consumer report

Lend smarter

with cash flow

insights

Get seamless access to risk insights and cash flow data with Plaid Check, a Consumer Reporting Agency.

Credit reports don’t give the full picture

Plaid Check’s Consumer Report fills in the gaps with cash flow insights so you can decision with confidence.

Qualify more applicants

Accurately assess ability to pay for applicants, including millions with thin or no credit history.

Improve risk management

Identify risk factors and positive indicators before they show up in credit bureau reports.

Support your borrowers

Know when to raise credit limits or get ahead of repayment challenges with real-time data.

Cash flow data, without the hassle

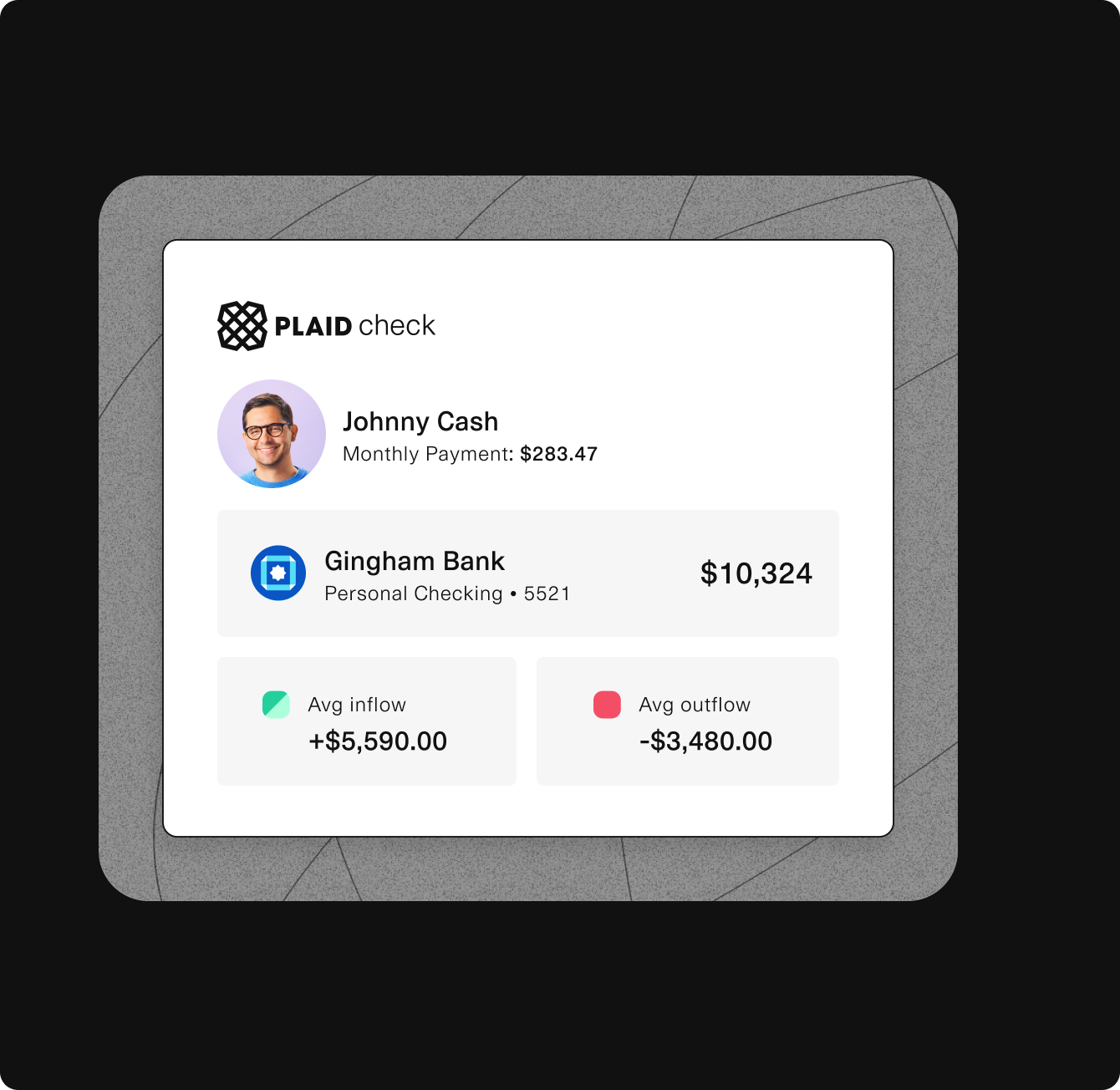

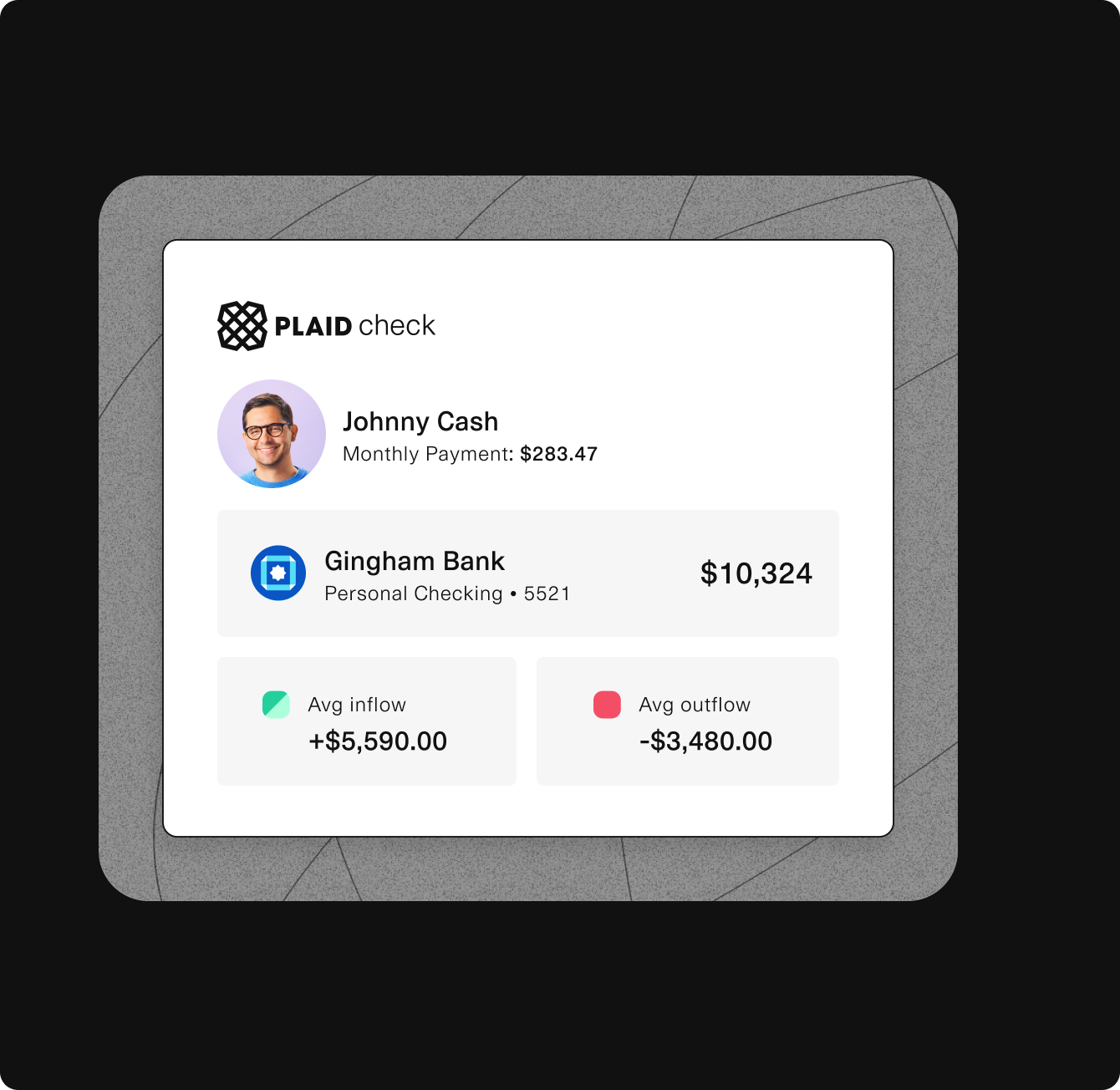

Just a few taps and applicants can give you access to up to 24-months of cash flow data. Layer makes data sharing quick and easy, so you can get the most complete financial picture at a glance.

View current, available, and historical balances

Review the applicant’s primary bank account

Access account ownership information

Cash flow data, without the hassle

Just a few taps and applicants can give you access to up to 24-months of cash flow data. Layer makes data sharing quick and easy, so you can get the most complete financial picture at a glance.

View current, available, and historical balances

Review the applicant’s primary bank account

Access account ownership information

Be the smartest lender in the room

Safely say “yes” to qualified borrowers with off-the-shelf insights. Gain a better understanding of an applicant’s credit risk, cash flow data, and financial stability so you can lend with confidence.

Instantly verify income and predict ability-to-pay

Access cash flow and Plaid Network attributes

Get actionable scores from our partner ecosystem

Be the smartest lender in the room

Safely say “yes” to qualified borrowers with off-the-shelf insights. Gain a better understanding of an applicant’s credit risk, cash flow data, and financial stability so you can lend with confidence.

Instantly verify income and predict ability-to-pay

Access cash flow and Plaid Network attributes

Get actionable scores from our partner ecosystem

Go live in days, not months

Simply text or email applicants to connect their bank accounts, then quickly process the application with our no-code dashboard. So you can keep applicants moving, whether they’re in line or online.

Get up and running without the technical workload

Invite applicants to link their bank account via text or email

Instantly visualize cash flow data and insights

Go live in days, not months

Simply text or email applicants to connect their bank accounts, then quickly process the application with our no-code dashboard. So you can keep applicants moving, whether they’re in line or online.

Get up and running without the technical workload

Invite applicants to link their bank account via text or email

Instantly visualize cash flow data and insights

Introducing Plaid Check

A new era calls for a new

consumer reporting agency

Connecting lenders to real-time cash flow insights for a faster, safer, and easier lending experience

Plaid Check is the only consumer reporting agency that gives you access to off-the-shelf credit risk insights backed by the industry’s largest consumer-permissioned data network.

In-depth insights

Most lenders don’t have the time, money, or resources to turn cash flow data into actionable insights. With Plaid Check, you don’t have to.

Informed decisions

Plaid Check is built to support all of your FCRA-related needs, from capturing permissible purposes to ensuring data accuracy. So you can use cash flow data responsibly while staying compliant.

Consumer information

You can request to view your Plaid Check Consumer Report by filling out this this form. If there are any inaccuracies, please submit a dispute using the same form.