Open Finance

Your open finance journey starts here

Join the thousands of data providers that use Plaid’s industry-aligned solution to grow and stay compliant.

Enable, instantly view, and manage connections to thousands of apps

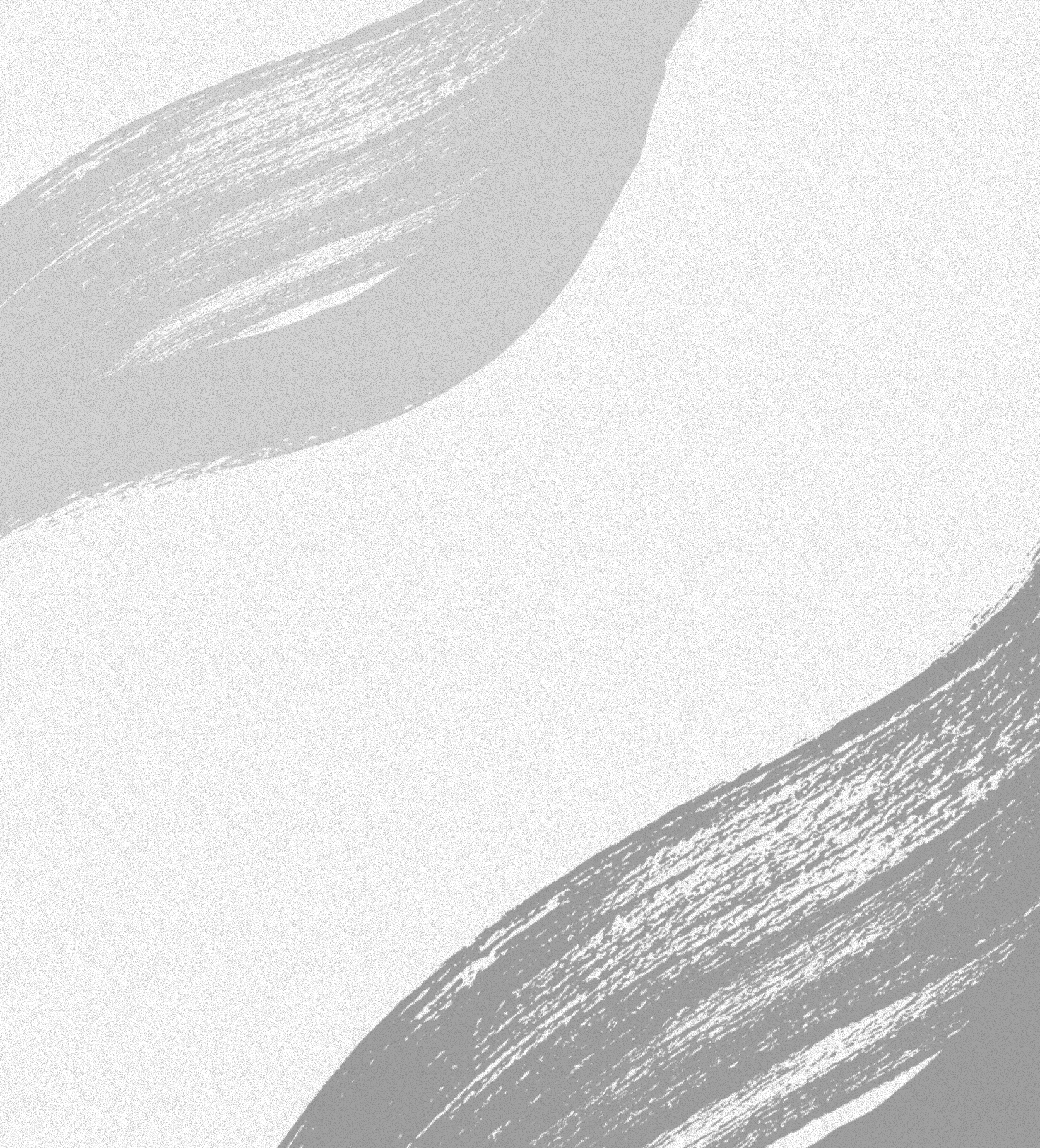

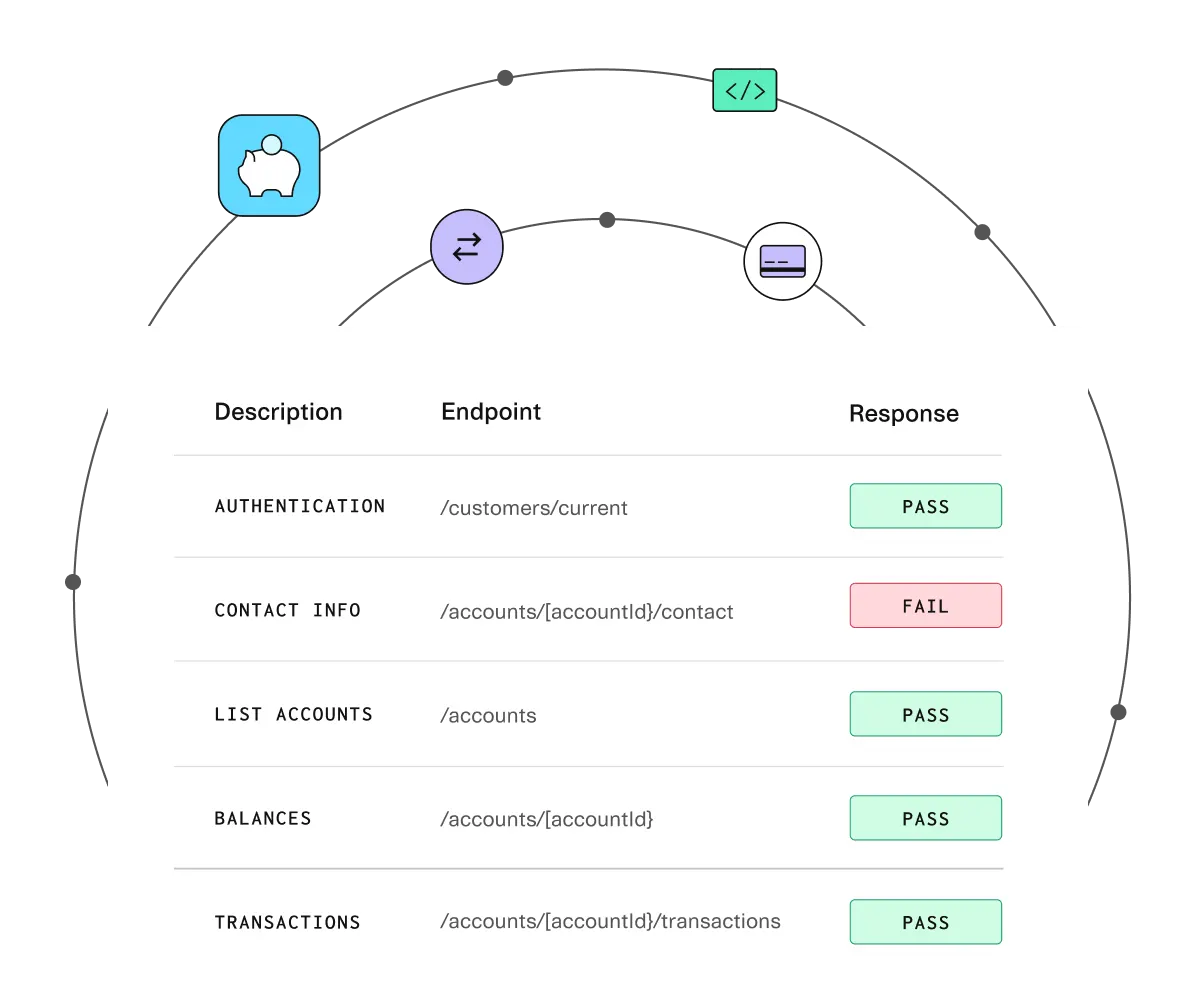

Enable DATA CONNECTIVITY

Leading financial apps are on the Plaid Network. We’ll help you build an FDX-aligned API that connects your customers to all of them with Core Exchange.

Learn more“Core Exchange is the best solution out there. Its APIs help us deliver solutions in no time.”

Nick Craven

SVP Commercial & Consumer

Banking, TAB Bank

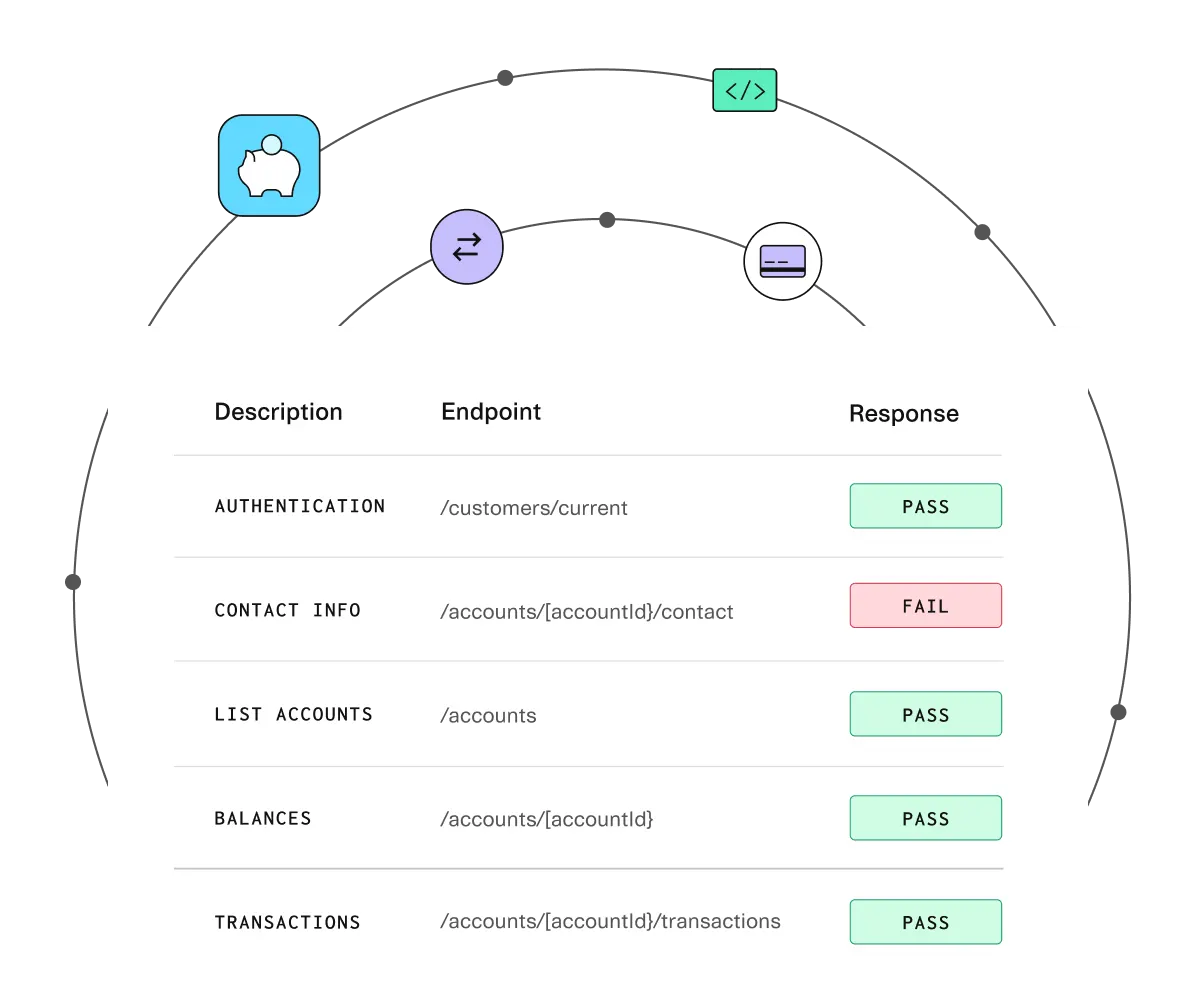

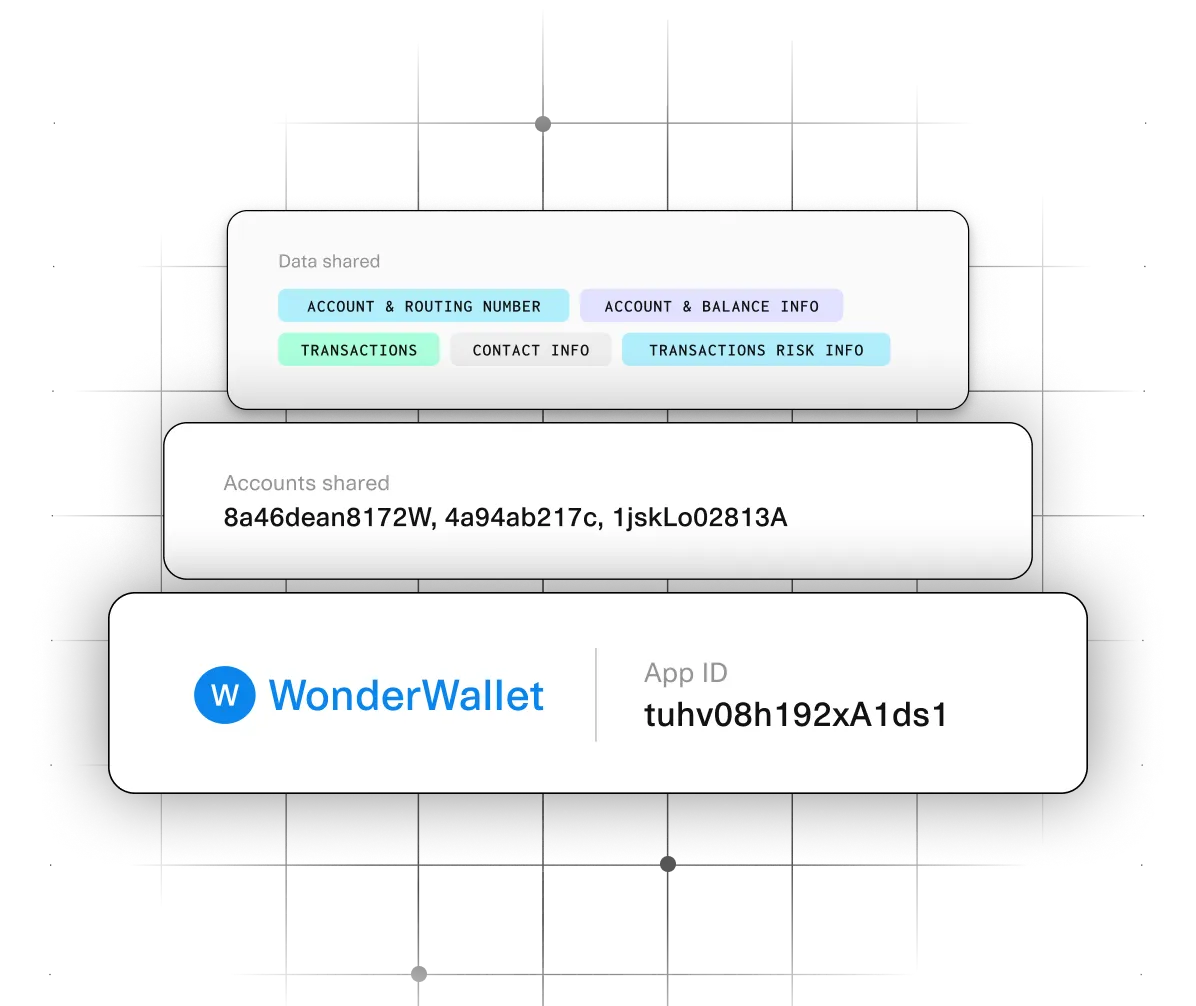

View customer connections

Stay connected at a glance. Permissions Manager lets you see every customer connection, receive real-time notifications, track authorizations, and more.

Learn more“Permissions Manager gives us a holistic view of our members’ connections via Plaid.”

Chelsea Potter

AVP of Digital Design & Support,

MSU Federal Credit Union

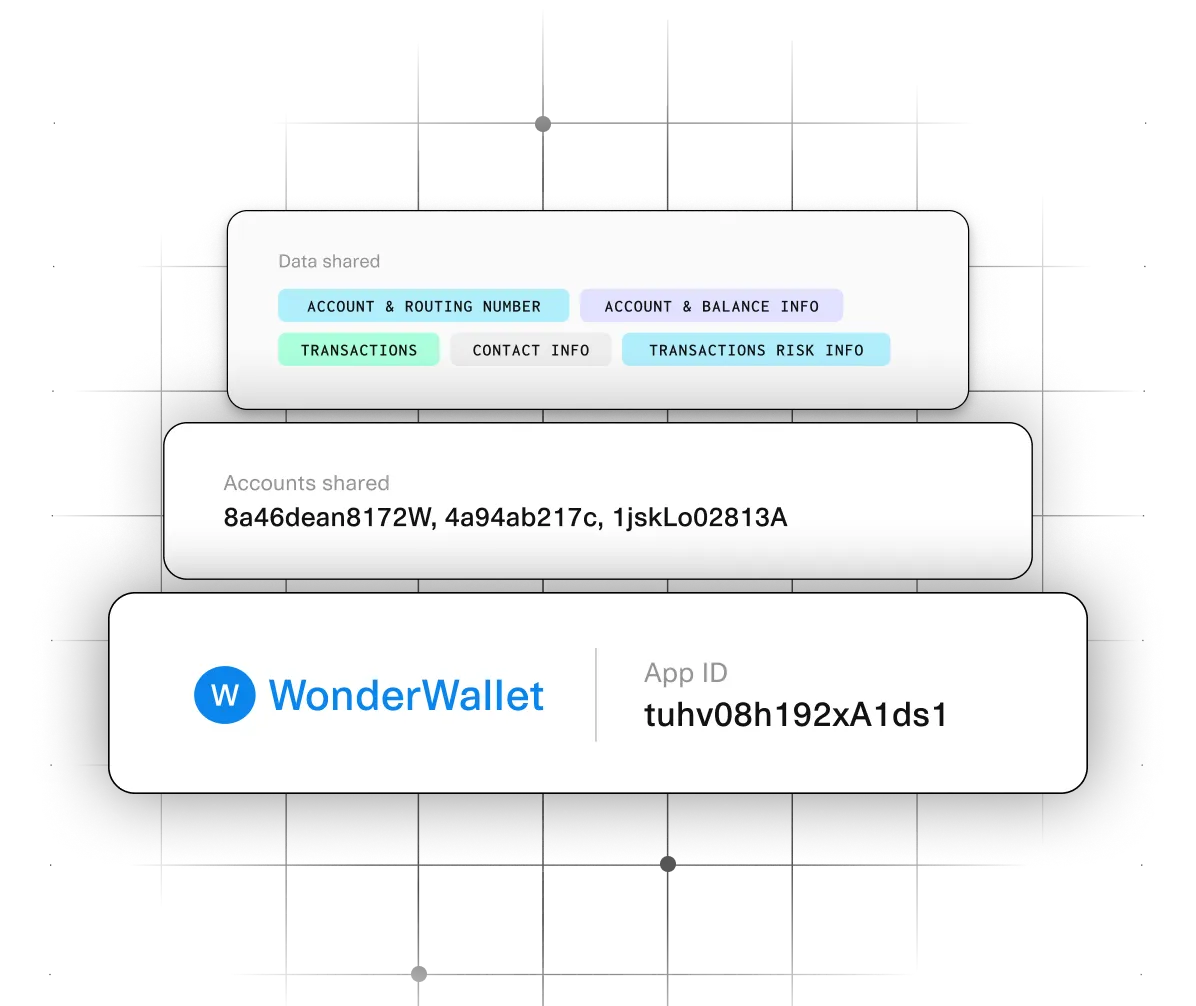

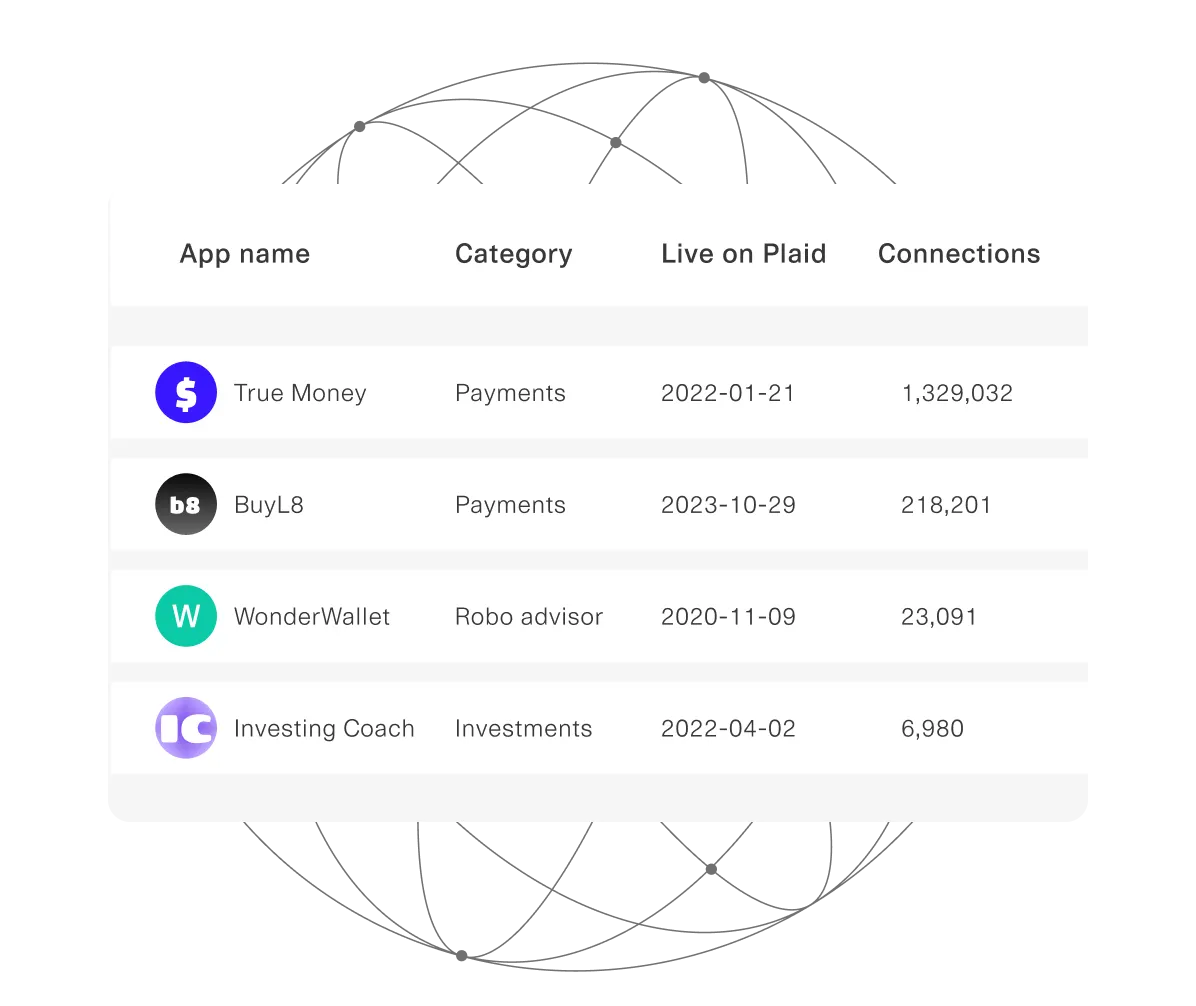

manage risk & app onboarding

Feel good about the apps your customers use. With App Directory, you can see thousands of screened apps across the Plaid Network with a no-code dashboard.

Learn more“We use the app-level insights in the dashboard to equip our teams with better data to manage risk and compliance.”

Liran Zelkha,

Co-founder, Lili

Grow faster and stay compliant on the industry’s most trusted platform

12,000+

global financial institutions are on the Plaid Network

1 in 3

adults in the U.S. have connected to an app or service with Plaid

80%

of Plaid’s traffic is already using or committed to using APIs

resources

Learn about open finance,

Section 1033, and more

Section 1033 & open banking: 3 solutions for data providers

How MSUFCU connects their members to thousands of apps

What is Section 1033? Get to know the latest CFPB rulemaking

Tech Talk: Navigating the final 1033 rule

Open finance: Unlocking a connected financial world

How Wise enables customers to view and manage connections

How Plaid customers can prepare for open banking regulation

What data providers need to know about Section 1033