Pay By Bank

Paying too much for payments? We can fix that.

A better pay by bank experience is here—and it’s an average of 40% more cost effective than cards.

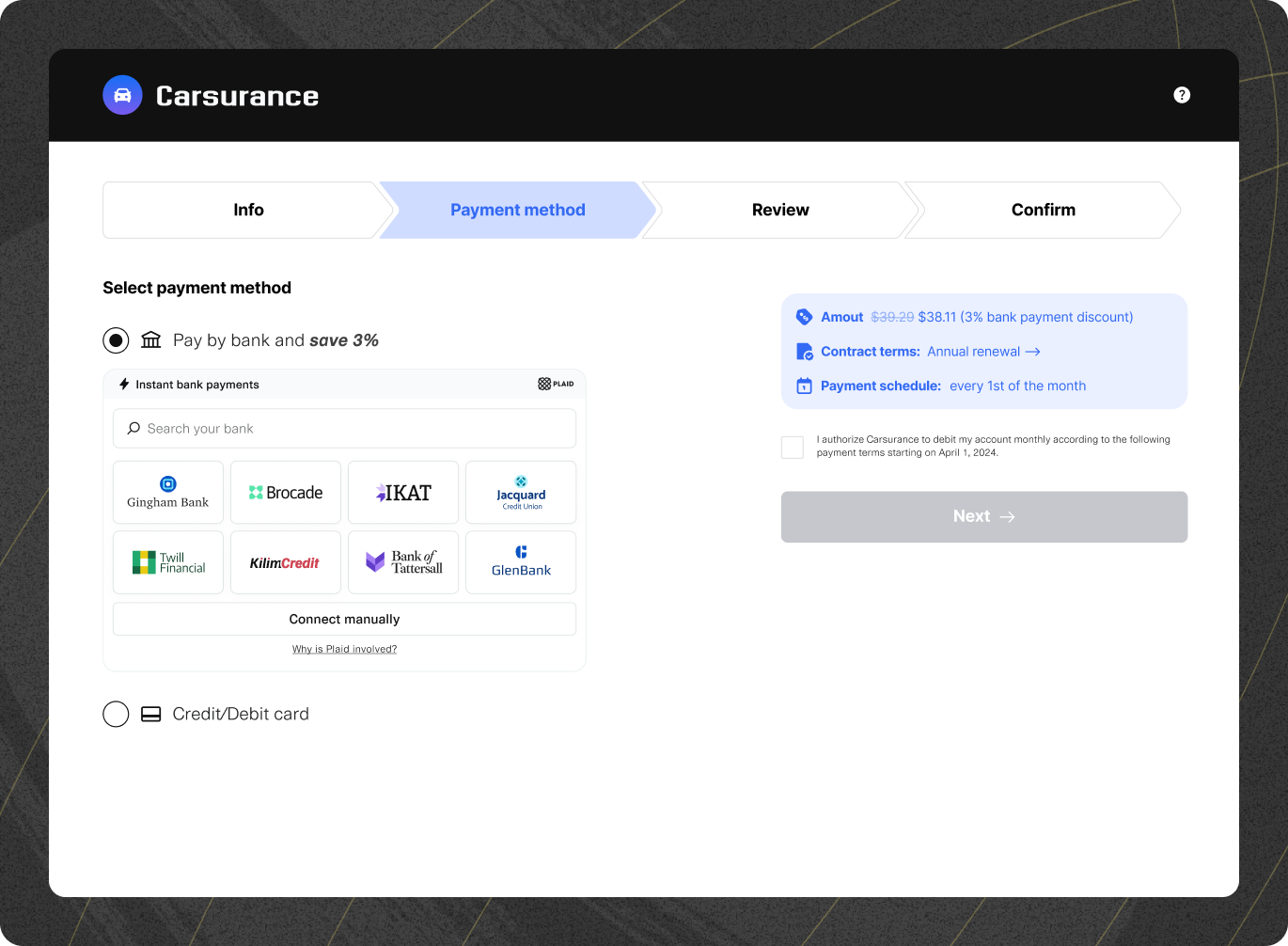

Easy as cards

Increase conversion with a 3-click payment experience powered by the Plaid Network.

Global coverage

Access global bank rails while preventing losses with real-time insights from Plaid’s risk engine.

Lower transaction fees

Reduce payment costs and lower your processing fees by an average of 40%.

Higher revenue, lower fees

Capture more revenue, offer easier payment experiences, and reduce fraudulent payments across every type of transaction with pay by bank.

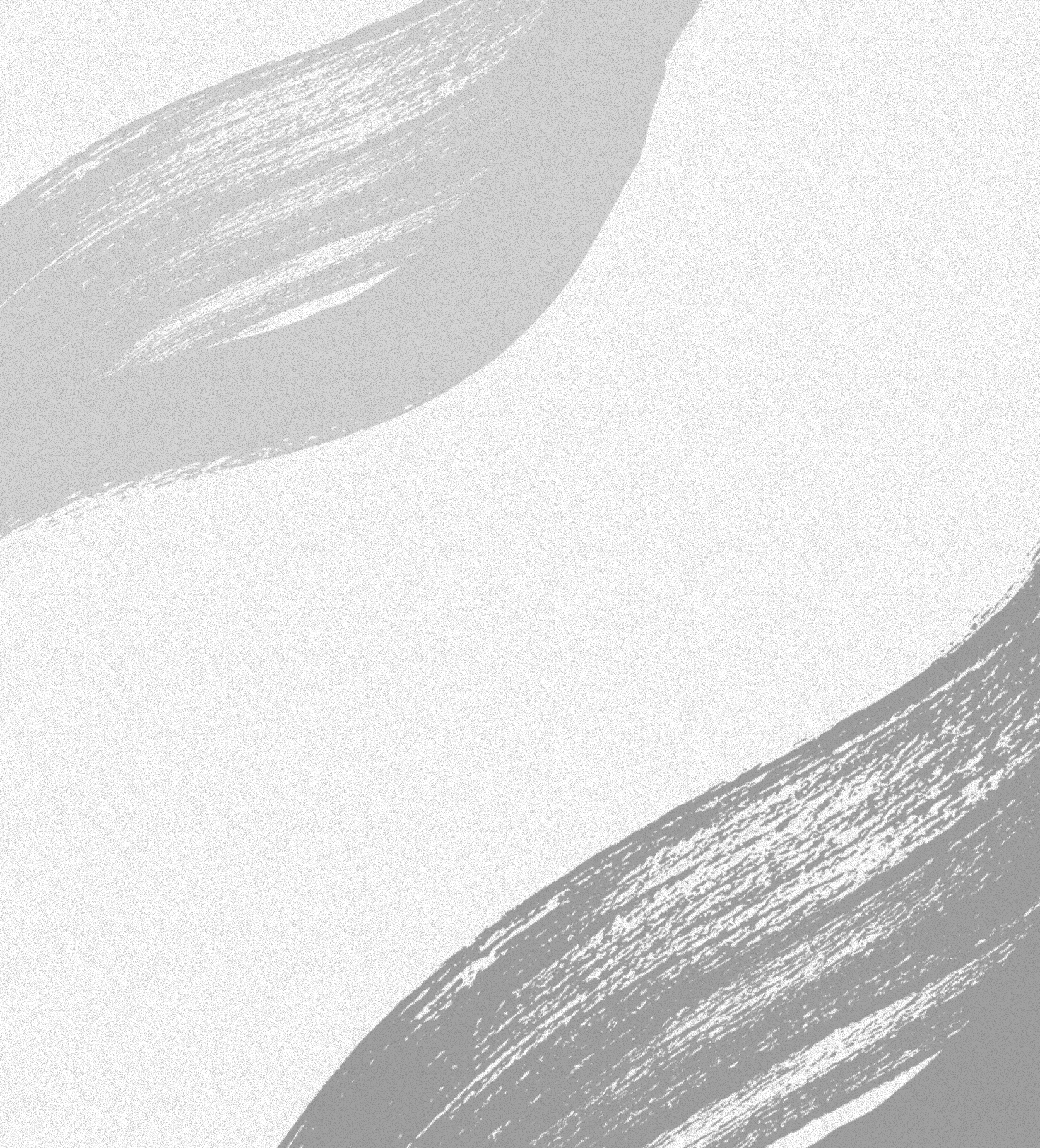

Bill pay

Increase ACH adoption and reduce returns by making it easy for customers to set up online payments from their bank account.

Digital subscriptions

Earn more with autopay. Pay by Bank lets you automate recurring low-fee payments so that you can collect and retain more revenue.

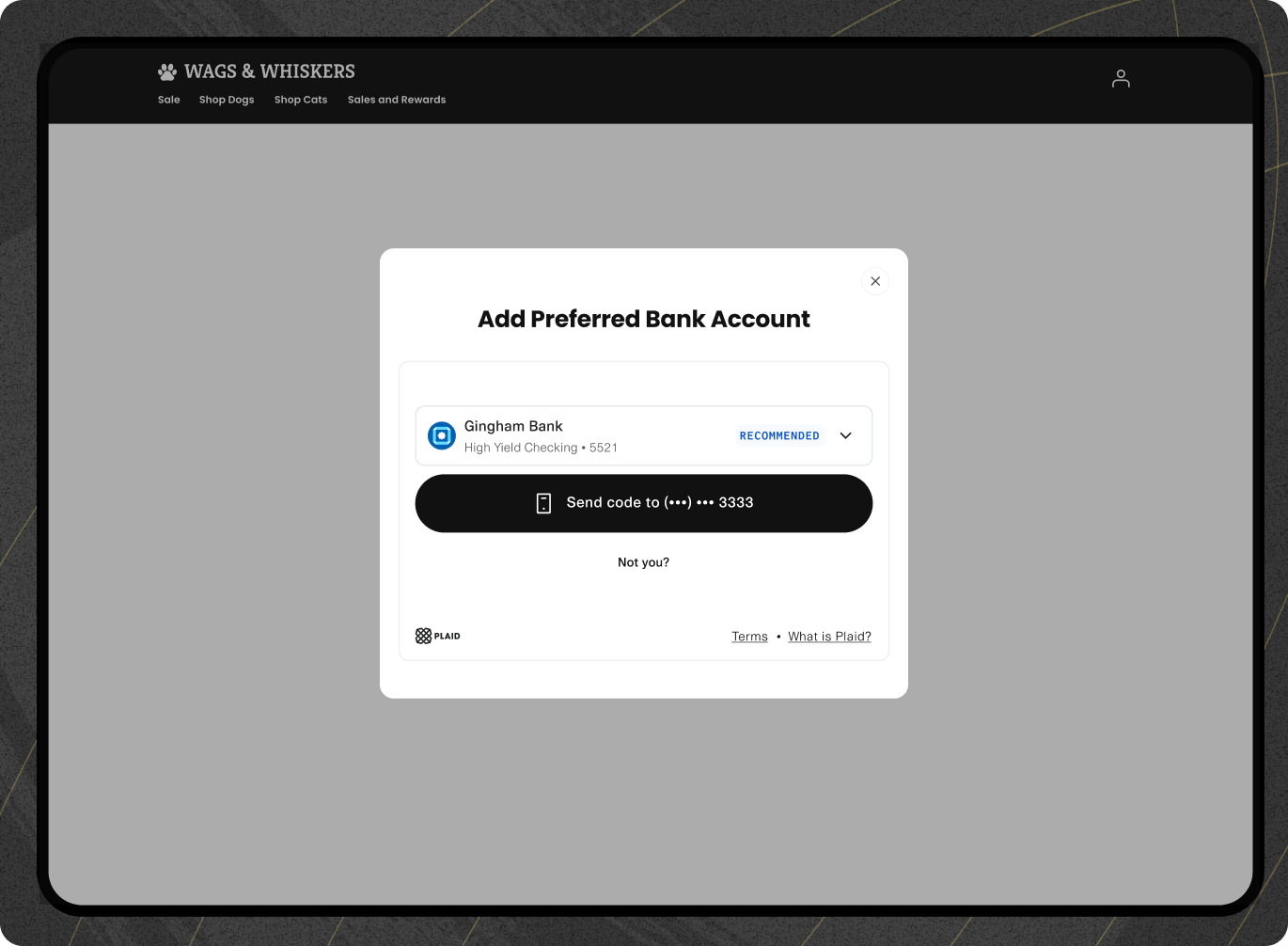

E-commerce

Lower fees, reduce the chances of chargebacks and fraud, and reach the next wave of shoppers that prefer to pay with their bank account.

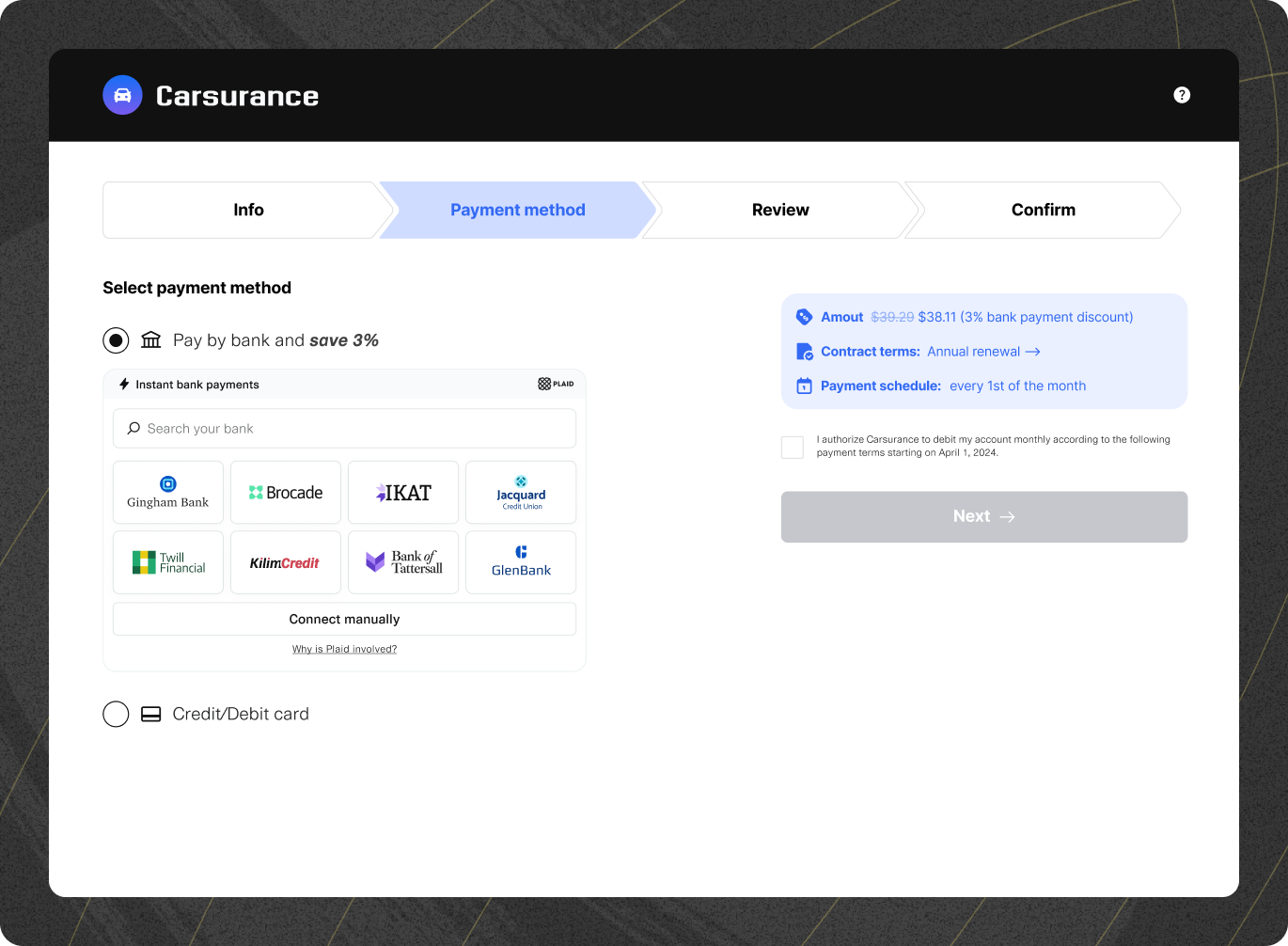

Easy one-click checkout

Make payments as quick as a click. Get access to the largest network of recognized pay by bank users so you can offer the fastest payment experience every time.

Easy one-click checkout

Make payments as quick as a click. Get access to the largest network of recognized pay by bank users so you can offer the fastest payment experience every time.

1 in 2

U.S. adults with a bank account has used Plaid to connect to an app or service

23%

higher onboarding conversion in a head-to-head test against leading competitors

See pay by bank in action

Watch demoMaximize ACH payment

success with bill pay

Our bill pay solution offers industry-leading conversion and return rate reduction, while enabling tens of billions in payments volume.

Maximize ACH payment

success with bill pay

Our bill pay solution offers industry-leading conversion and return rate reduction, while enabling tens of billions in payments volume.

Plaid’s innovative, industry-leading financial technology made this partnership a great fit. Our complementary offerings form an unparalleled pay by bank experience for businesses and end-consumers alike.

Davi Strazza

President of North America

get started

Customize your checkout experience

Process your payments with Plaid

Offer the easiest payment experience with Plaid’s end-to-end payment solution. No clunky redirects, lengthy forms, or unnecessary friction.

Learn moreIntegrate with your payment processor

Easily add pay by bank to your payment flow. Do it with a flexible user experience that fits your checkout and drives the highest conversion.

Learn more