Boost user engagement

Problem

Varo needed a way to migrate millions of customers to Varo Bank without requiring them to re-link their bank accounts and risk losing them to competitors

Solution

With Plaid, Varo enabled a seamless migration with custom account linking flows and industry leading Data Connectivity solutions

A bank for all of us

Year after year, consumers make it clear that they value being able to connect their bank account to the digital finance apps and services they rely on every day. According to a recent report by data analytics firm FICO, that’s one of the primary reasons why younger US consumers–specifically Gen X, Millennial, and Gen Z groups–are switching to digital-only “neobanks”.

At the forefront of that change is Varo Bank, the first consumer de novo bank to be granted a full national bank charter by the Office of the Comptroller of the Currency (OCC). Founded in 2015, Varo Bank has a bold mission to bring financial inclusion and opportunity to millions of Americans striving to reach their financial goals in a banking system where, historically, they have been overcharged and underserved.

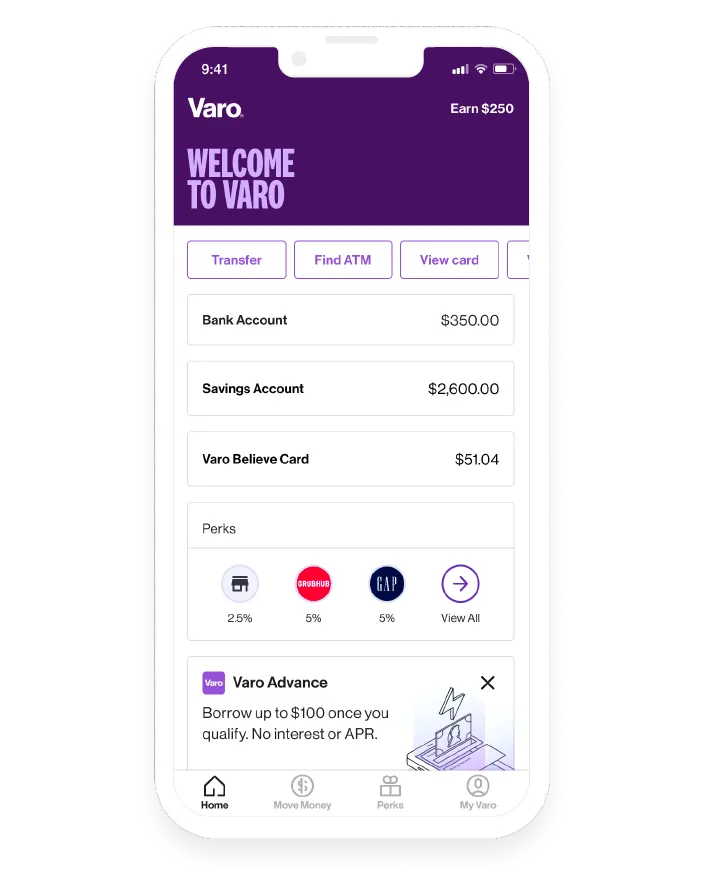

Through its mobile app and online banking channels, Varo Bank offers solutions to help customers stretch their paycheck, build credit, and start saving. Their products include bank accounts with no minimum balance requirement or monthly account fees, high-interest savings accounts, flexible short-term lending options and secured charge cards.

Once Varo Bank secured a bank charter, one of the challenges it faced was to migrate customers from one platform to another.

To ensure that customers were able to migrate quickly and securely, Varo Bank turned to Plaid.

By moving customers to Varo Bank, we were essentially asking customers to switch banks, which is why we needed to make the entire experience as frictionless as possible.

Anton Chakhmatov, Director of Product Management at Varo Bank

Users who link an account with Plaid are 60% more engaged than those who don't

Users made more than six million account connections to fintech apps since integration

Varo Bank reports a 50% decrease in fraudulent returns since implementing Plaid

Easy user migration

In order to open an account with Varo Bank, first-time customers are prompted to link their external bank accounts. Enabling this seamless account linking experience is what first prompted Varo Bank to partner with Plaid back in 2018, leading to a 15% jump in the success rate for linking customer bank accounts.

With the launch of Varo Bank, the challenge was no longer to onboard new customers. It was to migrate existing customers without requiring them to re-link their bank accounts.

“If we created too many steps for our customers then we risked losing them to our competitors. We didn’t want that to happen which is why we worked with Plaid to significantly reduce friction,” says Chakhmatov.

Plaid helped Varo by rewriting the account linking flows which enabled a seamless migration of users’ bank accounts over to Varo Bank.

“Plaid helped ensure that friction was minimal throughout the linking migration process which removed the need for customers to re-link their financial accounts,” explains Chakhmatov.

How it works

Leading data connectivity

The next step in the migration process was to achieve product parity between Varo’s existing platform and Varo Bank. By ensuring that the feature sets were equal across both applications, Varo wasn’t just able to power a seamless migration, they were able to do it without degrading the user experience.

One of the critical feature sets that made that possible was Plaid Exchange, a streamlined API and Digital Connectivity solution that allows Varo Bank’s customers to connect to a network of more than 7,000 fintech apps and services.

Since implementing Plaid Exchange, 6.4 million connections (and counting) have been established between Varo Bank customers and external fintech apps and services–helping Varo Bank further establish its role as a primary financial partner.

With a seamless linking experience and open finance integration, Varo Bank is now able to drive user engagement across the platform. In fact, Varo Bank has seen a 60% lift in card activations for customers who link their account via Plaid when compared to customers who don’t.

That boost in customer engagement helps generate more customer data which Varo Bank can use to power better customer experiences, resulting in higher profits and greater lifetime value of new and existing customers.

As a fully regulated bank, it was also critical for Varo Bank to stay compliant so that the millions of ACH payments that occur each year could happen smoothly and efficiently.

Plaid helps Varo Bank reduce unauthorized returns with account ownership checks. As a result, Varo Bank has seen more than a 50% decrease in fraudulent returns which helps it save money by preventing larger downstream return related costs.

“Because we’re a regulated bank, we have strict requirements around ACH processing. One of which is around our return rates. Plaid played a critical role in ensuring that we meet our regulatory obligations as it relates to NACHA."

Anton Chakhmatov, Director of Product Management at Varo Bank

A trusted partner

Today, banks of all sizes have the ability to become a trusted financial partner by offering a more seamless user experience and helping customers achieve their financial goals. Given the success of their recent migration, and being named Best Overall Savings Account on Forbes Advisor’s Best Online Savings Accounts of 2022 and Best Checking Accounts of 2022, Varo Bank is committed to rolling out new products to better serve future generations. That’s a mission Plaid can get behind.

“Plaid has always been there to guide through the proper solutions and that has translated to an improved product offering for our customers,” says Chakhmatov.