August 22, 2023

Scaling an Open Finance future with Plaid’s Data Partner Dashboard

Chandni Chopra

Financial Access, Plaid

Chandni builds open finance products that ensure API connectivity across institutions of all sizes, so that consumers have access to the data they need via Plaid powered apps.

With more than 8 in 10 Americans using digital finance, institutions of all sizes are looking at how to meet their consumer’s demands for data connectivity across these apps, services and experiences. Data connectivity has become so embedded into our everyday lives that nearly 70% of Americans say they would consider switching banks if their primary bank couldn’t connect to the apps and services they use. As the momentum for API-based data sharing continues to build, providing consumers with real-time connectivity is now top of mind for both small and large financial organizations.

Plaid is excited to support data partners of all sizes, from the industry’s largest financial institutions and regional banks to fintechs, neobanks and digital banking platforms. That’s why we launched Core Exchange last year, an easy-to-implement Open Finance solution that aligns with the Financial Data Exchange (FDX) and meets consumers' expectations for data connectivity. Since then we’ve developed a dedicated Data Partner Dashboard that helps data partners onboard and launch API connectivity with Plaid even faster. Today, more than 3,200 organizations have access to API connectivity with Plaid to ensure their customers have the best possible digital experience.

A dashboard that delivers high-quality API integrations

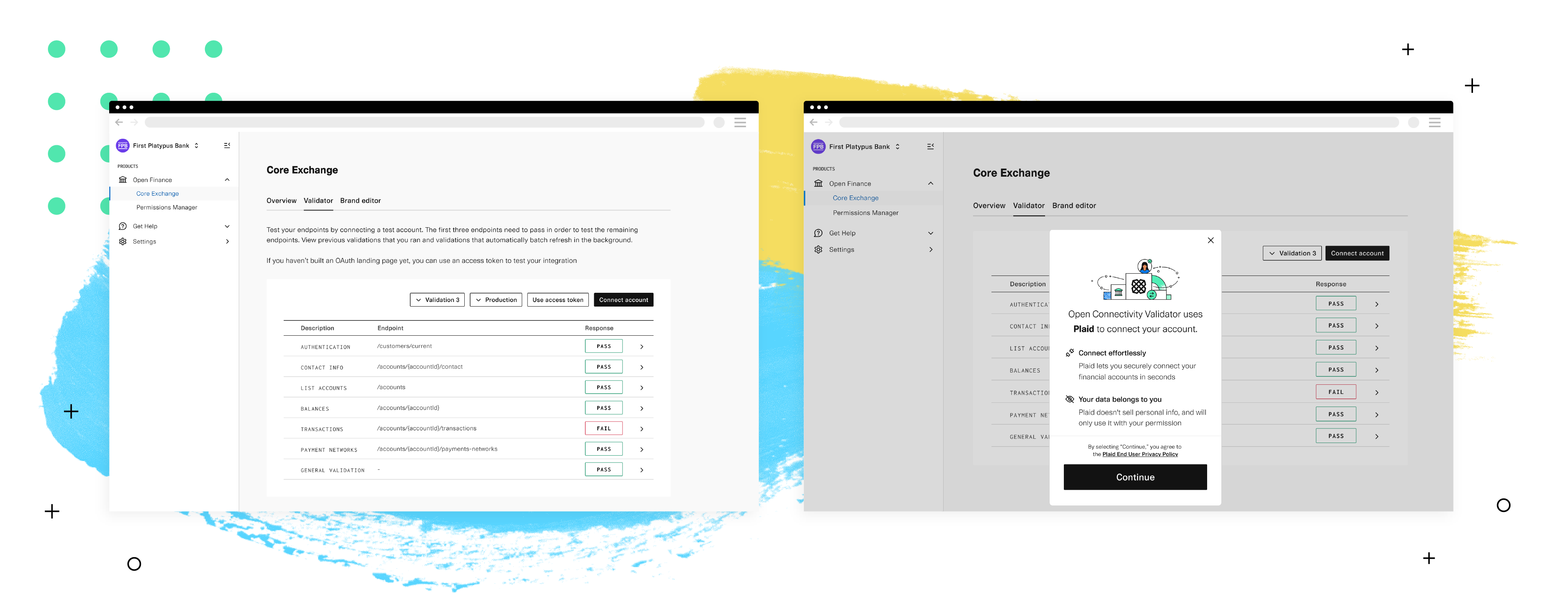

The Data Partner Dashboard enables data partners to build high-quality integrations by providing them with comprehensive documentation and dedicated tooling to build, test, and launch their integration. A key tool enabled via the Data Partner Dashboard is the Validator, which provides partners with the flexibility to test as they build their FDX integration. A partner can either start by testing OAuth or bypassing it until it’s ready - starting with their built endpoints instead. Once the OAuth build is completed, they can test the end-to-end account linking experience with Plaid Link.

Beyond seeing successes and failures for each endpoint, the Validator provides a view of how the data will look to Plaid Customers once it’s been normalized through Plaid’s systems into our core products of Authentication, Identity, Balances, and Transactions. If any errors occur, they are flagged immediately so that developers can quickly remedy them before launch. And with no limit on the number of validations they can run and a rolling two week history stored for each response, it’s easy to go back later and troubleshoot issues.

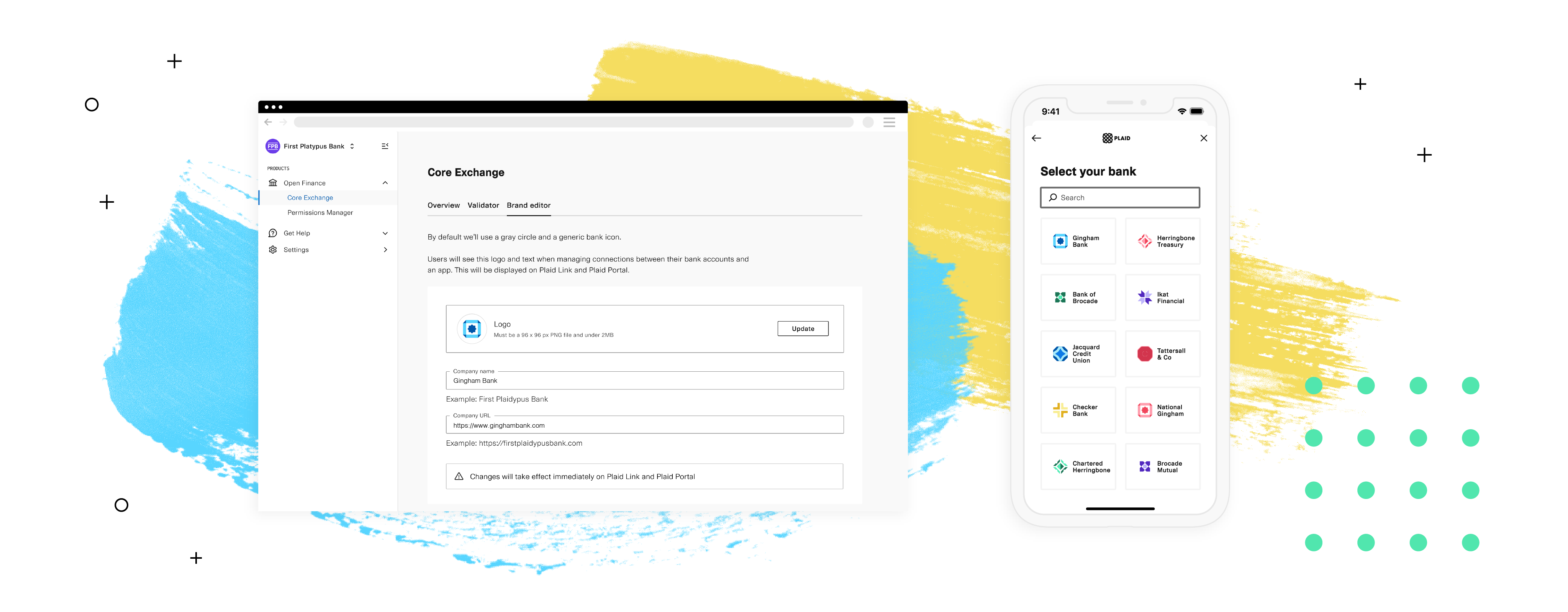

Once their validation is successful for all endpoints (shown above with the PASS responses), data partners can upload their Logo in the Brand Editor so that consumers can easily find and select their institution as a supported institution in Plaid Link. What they upload in the Brand Editor will show up in the Plaid Link flow during each consumer touchpoint across Plaid’s network of over 8,000 fintech apps.

Enabling data access for all through Plaid’s network

Solutions like the Data Partner Dashboard make it possible for Plaid’s data partners to complete implementation and onboarding in six to eight weeks on average and in some cases, in a matter of days. These no-cost solutions help data partners save time and resources, leveling the playing field for organizations of all sizes by giving consumers the financial data connectivity they expect, all with API integrations.

We’ve seen how data partners of all sizes can leverage the Data Partner Dashboard to scale their API integration with the Plaid Network. With more partners joining each day, we look forward to unlocking exponential value for consumers as they move their financial lives online. As open finance matures, Plaid is committed to helping institutions access and leverage the benefits of open finance, such as expanding the Data Partner Dashboard to include more functionality to support data partners on their journey.

If you have feedback, requests for new functionality, or want to be involved in early access testing for the Data Partner Dashboard, please contact your account manager.

Ready to get started with your open finance journey?