banks & credit unions

More deposits.

More loans.

Less risk.

Deliver a seamless digital experience with Plaid. Connect accounts fast, offer personalized insights, and automate income checks for smarter lending.

Dependable, low-friction user experience

Used by half of U.S. adults, Plaid helps banks grow deposits and convert more customers with a seamless, familiar experience.

Real-time fraud and risk management

Our network-powered fraud prevention helps you reduce account takeovers, cut ACH returns, and streamline account openings.

Smarter data for better lending decisions

Verify income and employment digitally, from the source, to speed up lending, cut paperwork, and improve the borrower experience.

Open more accounts. Speed up funding.

Make account opening fast and secure for trusted customers

Avoid delays from traditional authentication methods. Verify accounts and identities digitally—all on one platform.

Digital identity verification

Strengthen identity verification with layered checks—like data source, ID document, and liveness verification. Block account takeovers and malicious sign-ups with device and network fraud checks.

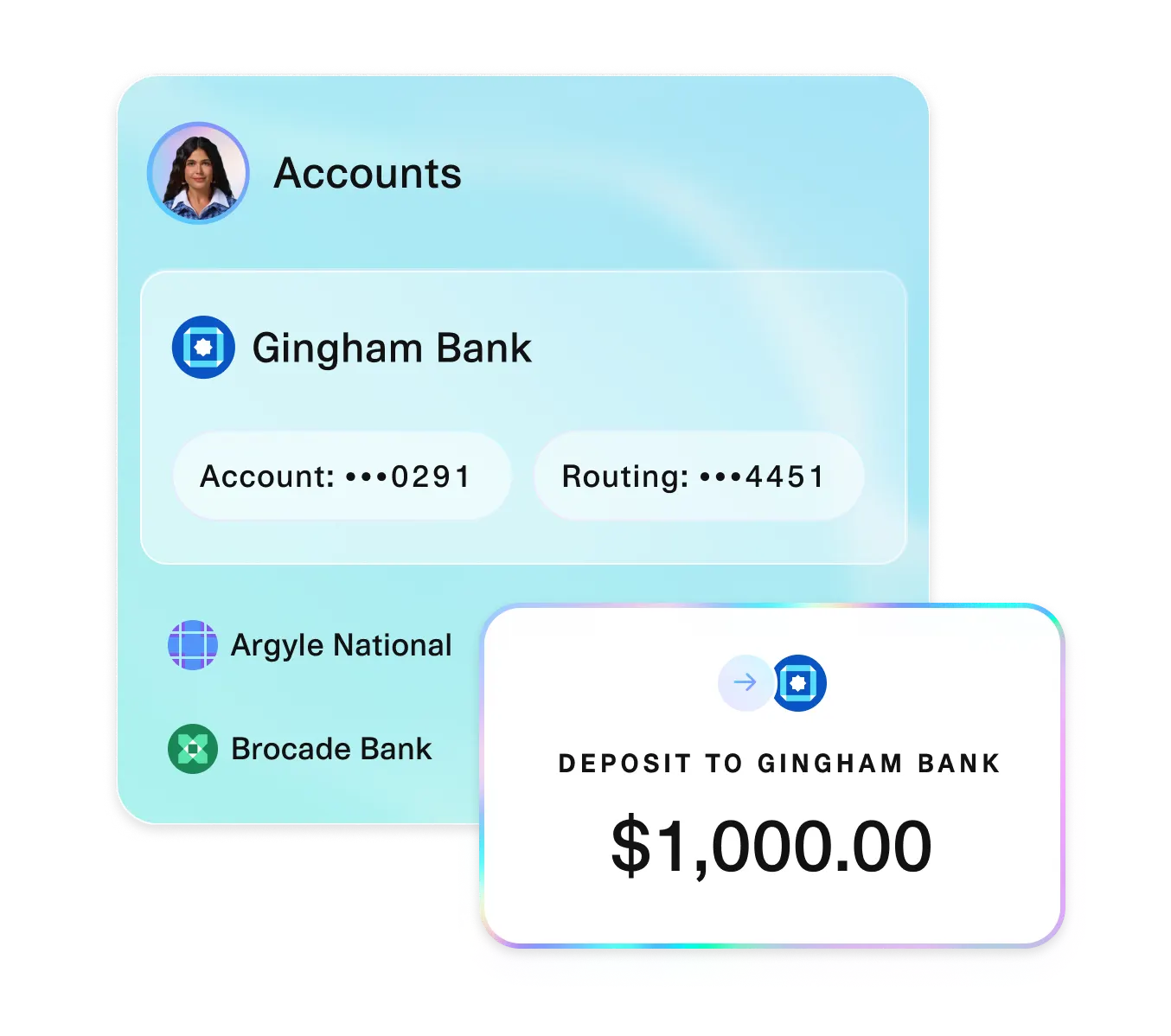

Instant account verification

Verify linked account information directly from the source with alerts on closures—minimizing errors from manual data entry and outdated sources.

Secure, reliable account funding

Give customers a seamless funding experience backed by real-time account verification, balance checks, and ACH risk insights.

How First Tech Federal Credit Union streamlined account funding

Launch quickly with top financial platforms

Plaid works with the online banking, account opening, and loan onboarding tools you already use—so you can deliver an experience customers want without the heavy lift.

Launch quickly with top financial platforms

Plaid works with the online banking, account opening, and loan onboarding tools you already use—so you can deliver an experience customers want without the heavy lift.

Become their primary bank with smarter, more connected experiences

Offer frictionless money movement

Help your customers move money when they want to, while keeping fraud at bay.

Verify account balances—protecting your customers from overdraft and NSF fees, and empowering you to move money easily and securely

Get real-time fraud protection through verified account ownership, high-risk account detection, and predictive insights to evaluate the risk of ACH returns

Offer frictionless money movement

Help your customers move money when they want to, while keeping fraud at bay.

Verify account balances—protecting your customers from overdraft and NSF fees, and empowering you to move money easily and securely

Get real-time fraud protection through verified account ownership, high-risk account detection, and predictive insights to evaluate the risk of ACH returns

reduction in fraud losses reported by customers

or more reduction in ACH returns seen across implementations

of U.S. accounts covered for verification

Provide tailored financial insights

Use real-time data to deliver personalized insights that build trust, deepen relationships, and drive cross-sell opportunities.

Turn data into insights and tailored offers; with up to 24 months of categorized data, help customers understand their habits and offer the right services, right on time

Increase engagement and reduce churn by delivering customized financial experiences powered by real-time financial and transaction data

Provide tailored financial insights

Use real-time data to deliver personalized insights that build trust, deepen relationships, and drive cross-sell opportunities.

Turn data into insights and tailored offers; with up to 24 months of categorized data, help customers understand their habits and offer the right services, right on time

Increase engagement and reduce churn by delivering customized financial experiences powered by real-time financial and transaction data

Accelerate credit decisions with real-time data

Get the full scope of your customer’s financial health

See your customers’ cash flow across accounts in real time—including income, assets, and employment data.

Reduce paperwork and manual reviews by verifying income and assets digitally from the source

Improve engagement and personalization by accessing up-to-date insights into income, expenses, and balances

With real-time cash flow data, you can offer better loans—with less risk and more confidence

Get the full scope of your customer’s financial health

See your customers’ cash flow across accounts in real time—including income, assets, and employment data.

Reduce paperwork and manual reviews by verifying income and assets digitally from the source

Improve engagement and personalization by accessing up-to-date insights into income, expenses, and balances

With real-time cash flow data, you can offer better loans—with less risk and more confidence

global financial institutions are on the Plaid Network

U.S. adults with a bank account have connected to an app or service using Plaid

financial apps and services built on Plaid