Payments

Low-cost, secure payments in an instant

Verify accounts, secure transactions, and manage a multi-rail payment offering for faster, safer money movement.

Quickly and reliably connect accounts, secure transactions, and move money

Connect

accounts

7 out of 10 customers abandon the authentication process. But with Plaid, you can sign customers up in seconds with instant authentication and account verification.

Boost conversion by up to23%

Move

money

Reach more customers by accepting multiple payment methods. You can build a custom multi-rail solution that gives every customer more flexibility.

Power a fast and secure payment experience with Transfer

How payments work with Plaid

Speed and flexibility are how we create a better customer journey. See their painless payments experience for yourself.

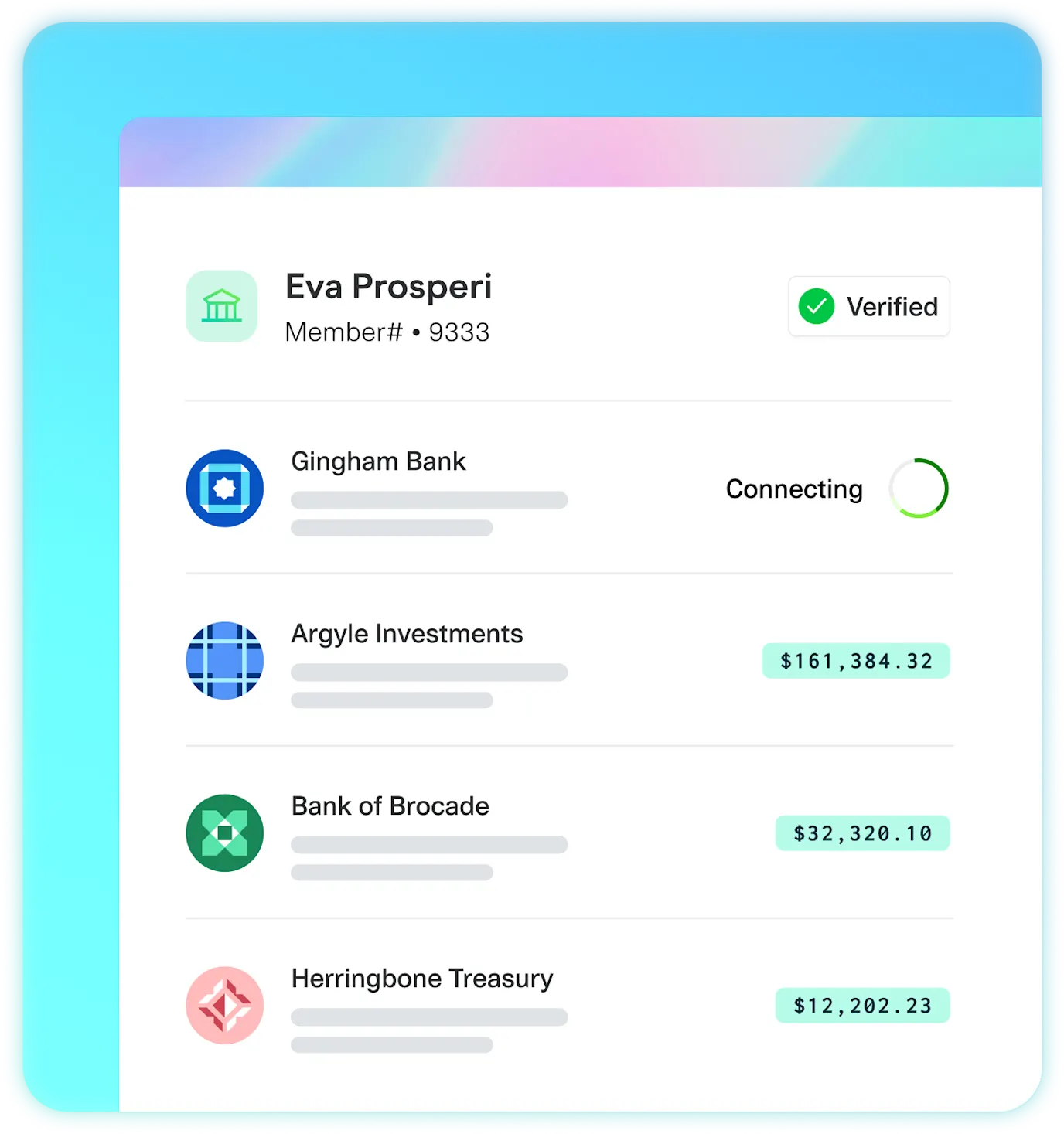

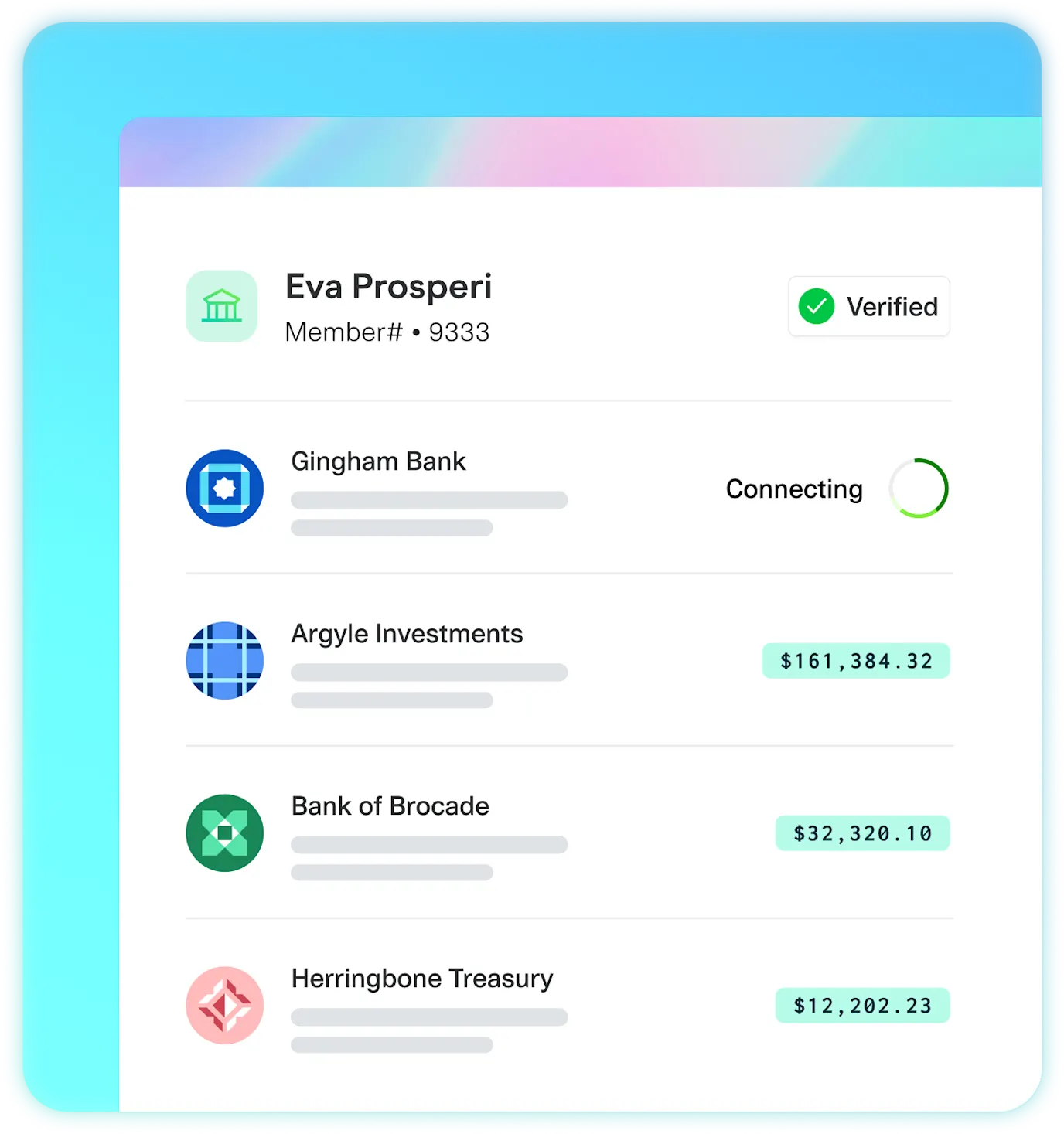

Step 1: Connect a new account

Auth lets customers connect their checking or savings accounts in seconds.

Step 2: Secure transactions

Signal offers flexible solutions, from assessing return risk to making informed risk decisions, based on your customizations.

Step 3: Move money safely, securely

Transfer lets you immediately move money on the rail of your choice. Even if you have your own payment processor.