layer

The internet’s fastest financial onboarding

Win more customers with an onboarding experience so fast, you need to see it to believe it.

Talk with our teamInstantly boost conversion

Get more customers to the finish line by instantly onboarding those who meet your company’s onboarding criteria.

Tailor to your onboarding

Build your own perfect customer profiles by only collecting data you need–whether it’s a bank account or a full financial profile.

Go faster, more securely

Offer the industry’s fastest user experience while optimizing for security with real-time authentication.

Just a phone number... aaand you’re done

Onboard customers in seconds

Convert up to 25% more customers

Lower onboarding time by 87%

How Layer works

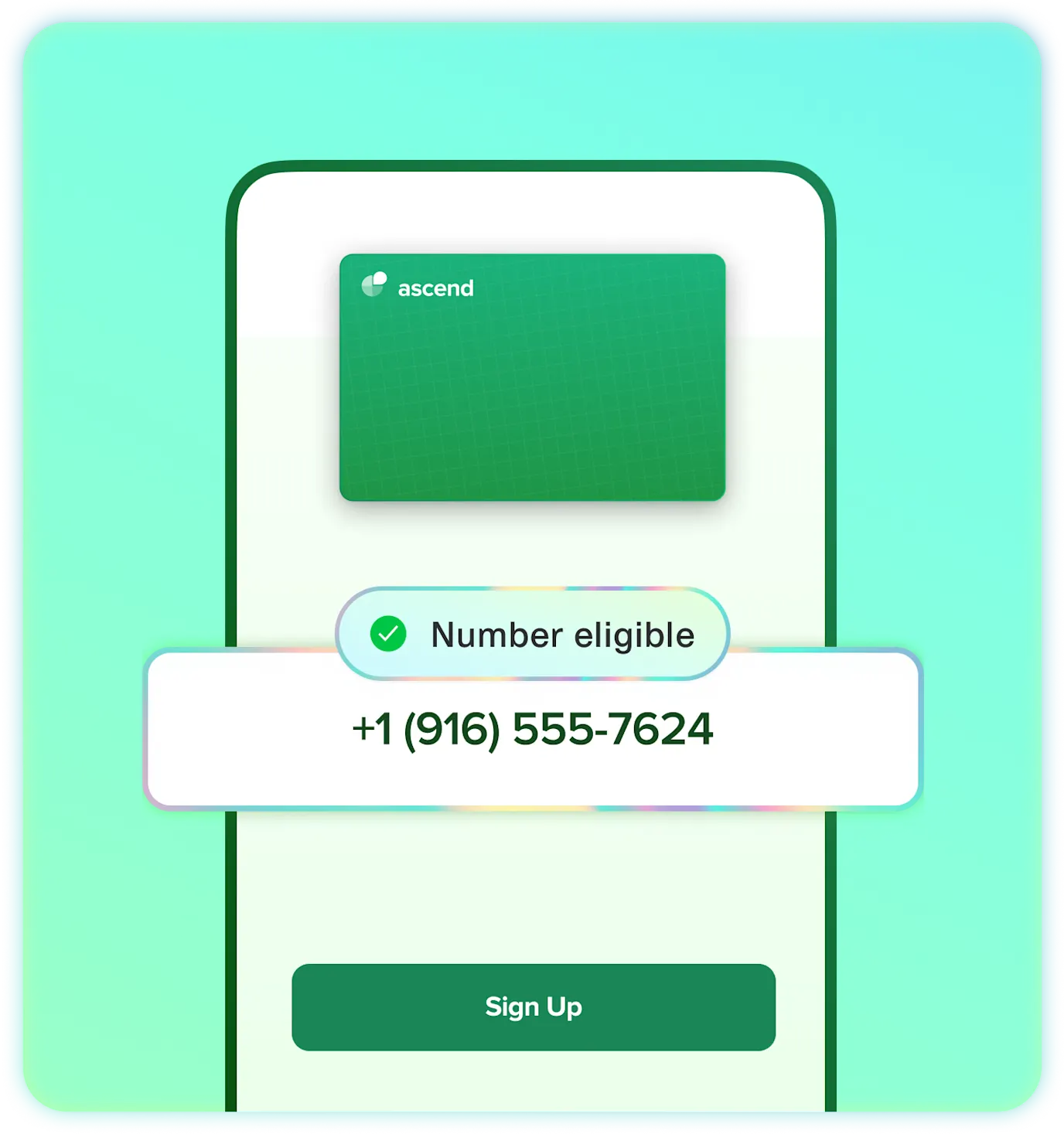

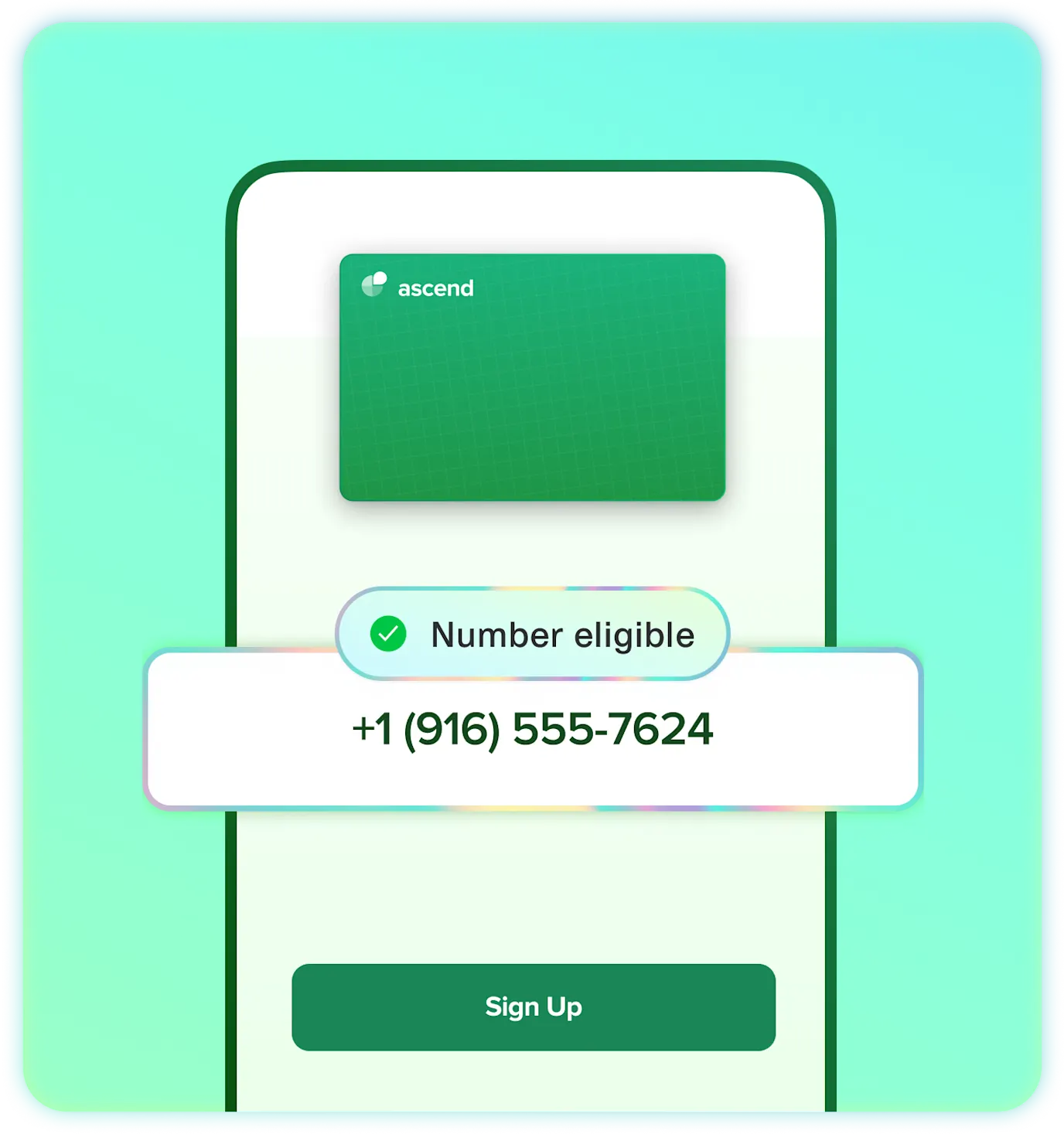

Check eligibility

All you need is a phone number. From there, we can find out if that person is on the Plaid Network and if they meet your onboarding requirements.

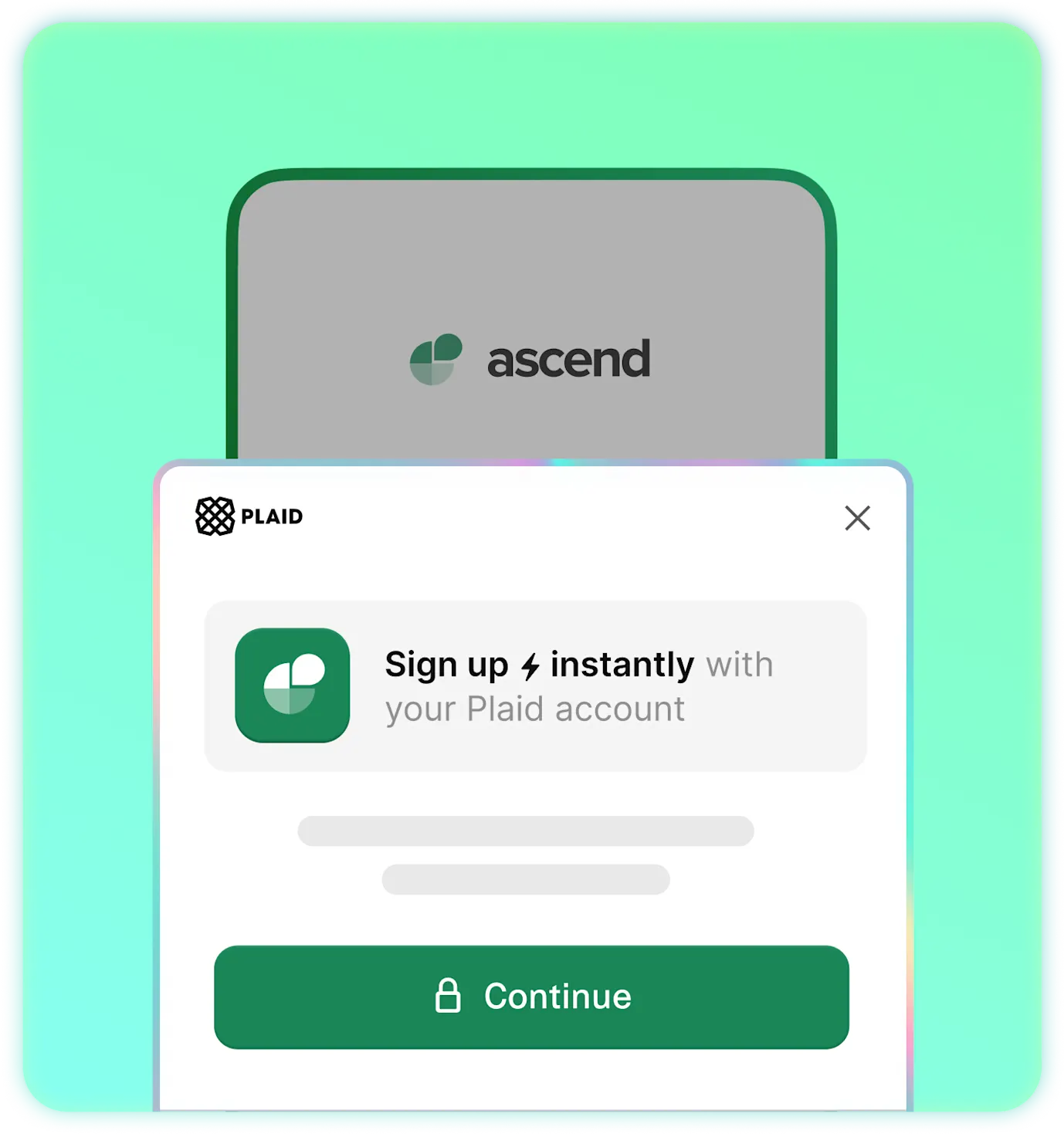

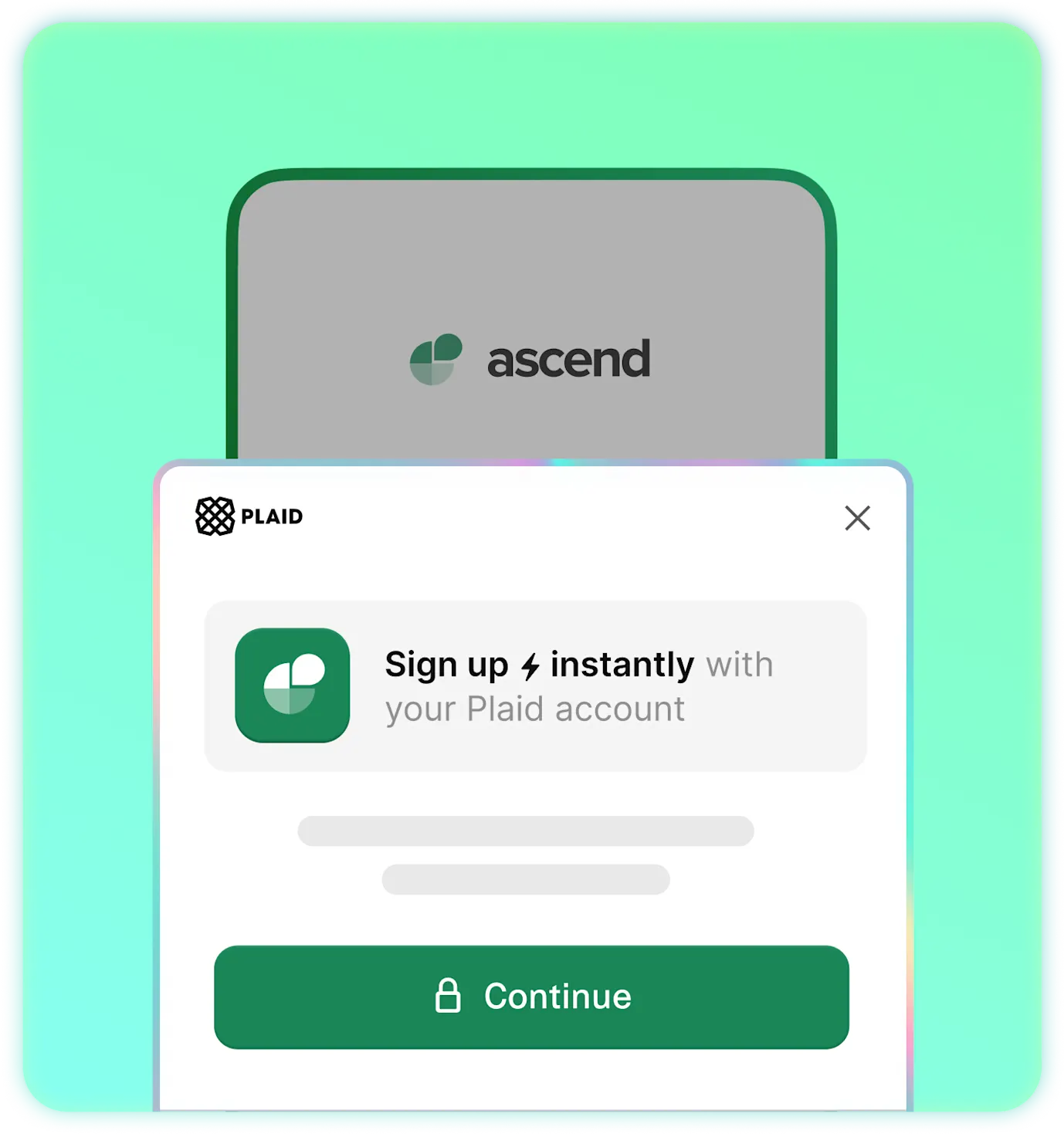

Introduce Layer

If their saved information meets your own onboarding criteria, we give them the option to sign up instantly with Layer.

Still need more information? We’ll send them through your existing sign-up flow.

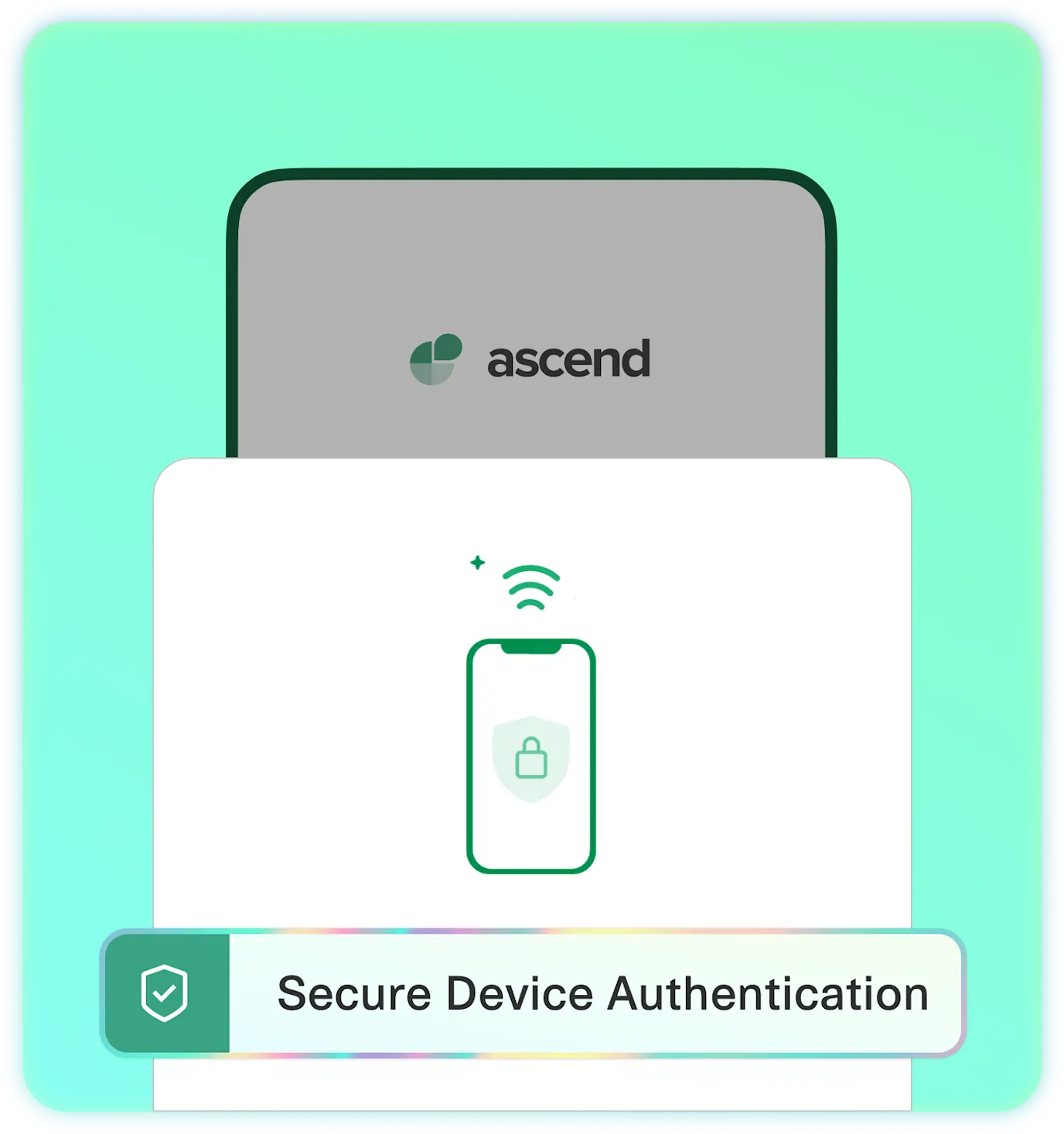

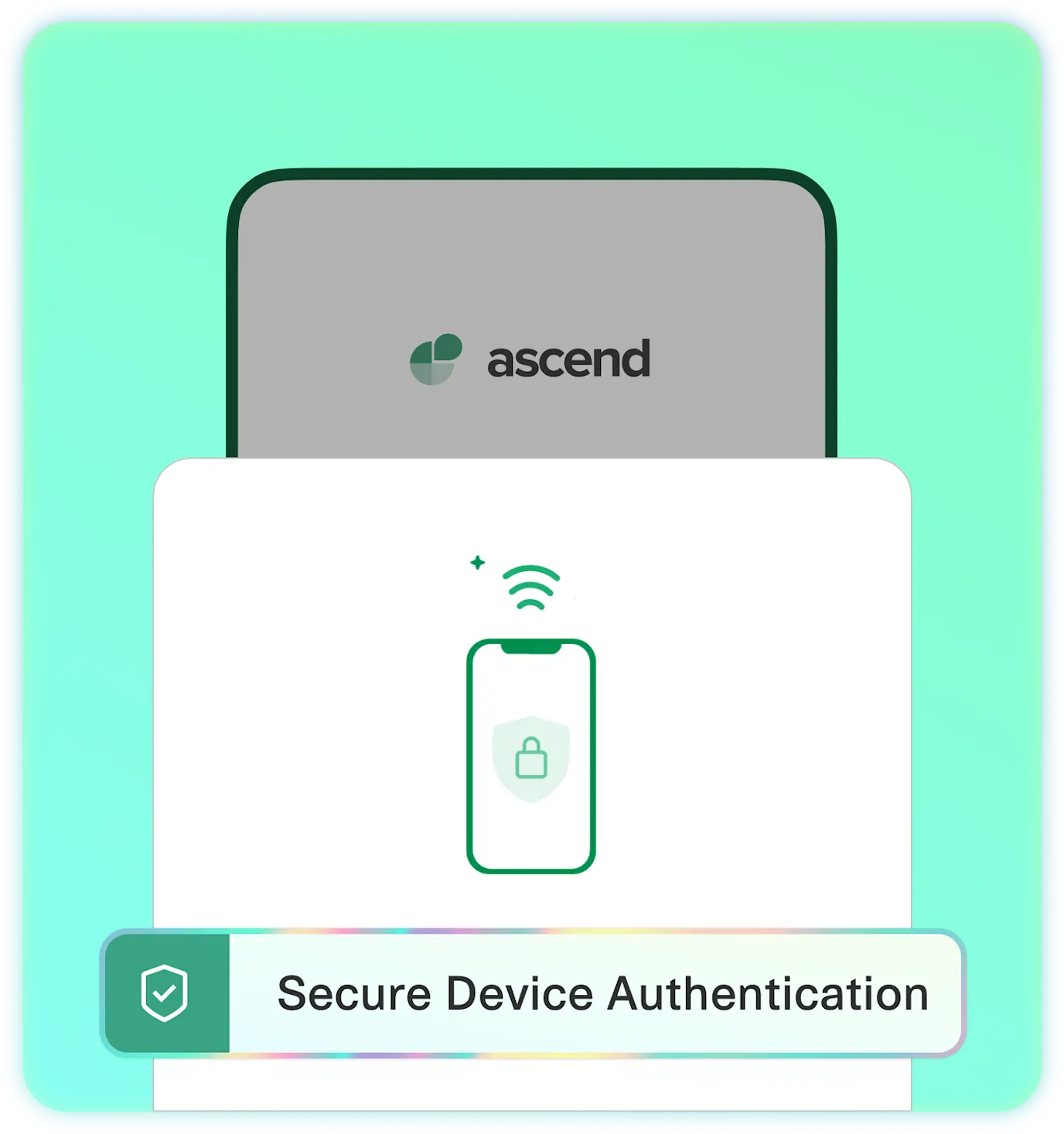

Authenticate and assess risk

Next, we authenticate the device and use real-time risk analysis to securely deliver the fastest user experience.

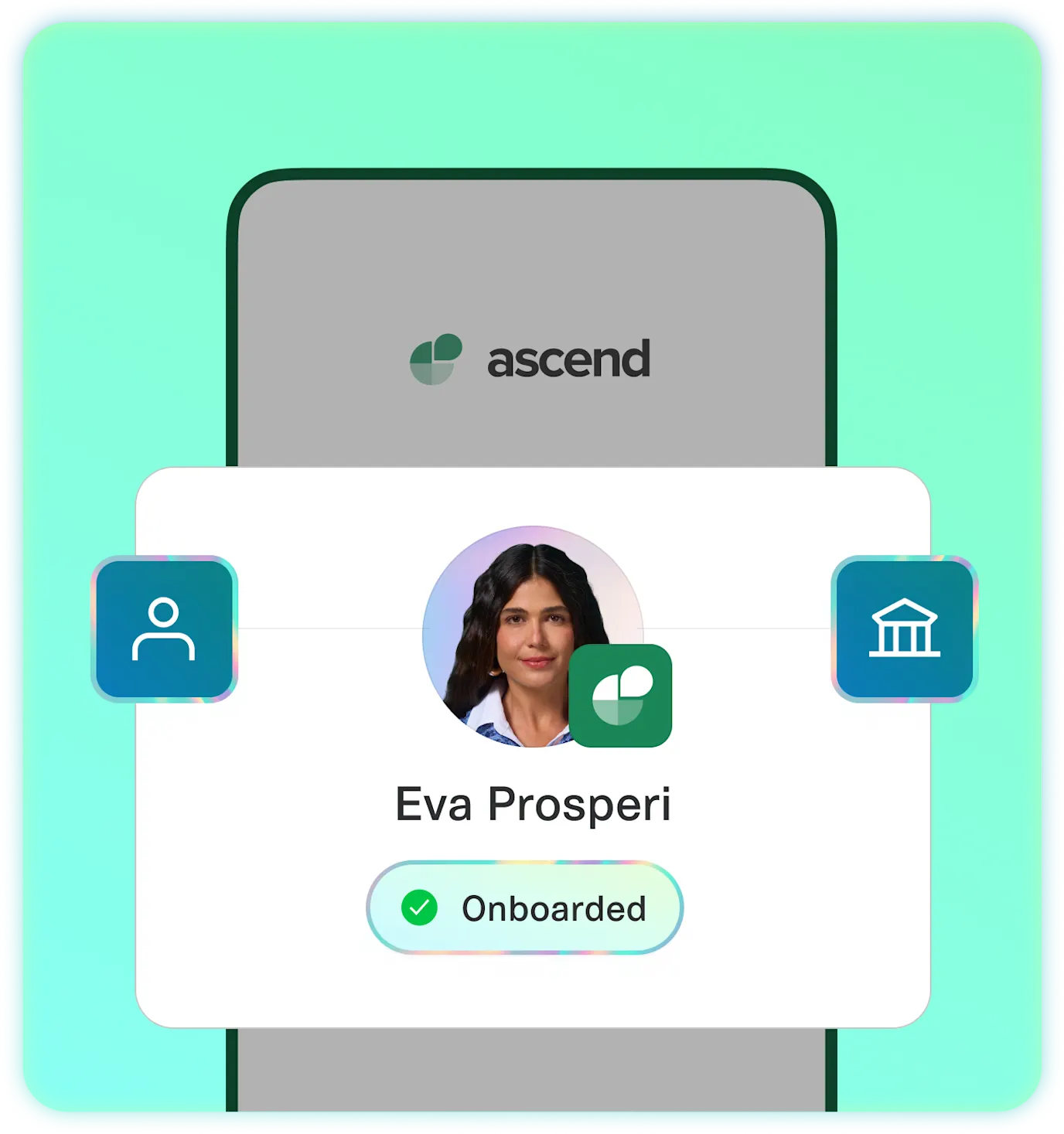

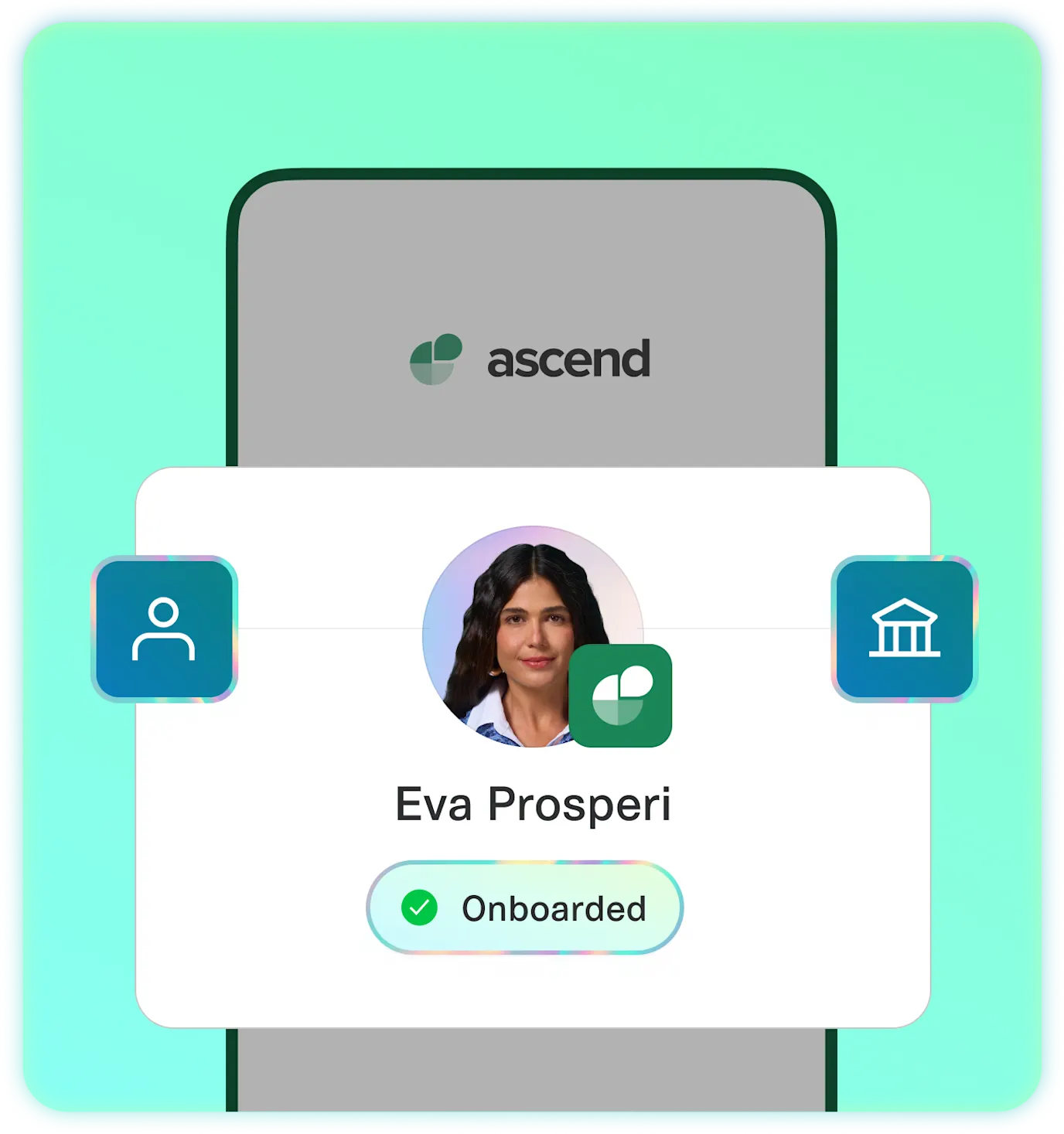

Update details

Once they confirm their details and choose which financial account to share, you can verify their identity using your KYC provider and connect their accounts with Plaid.

Finish onboarding

Congrats! You just onboarded a customer simply by collecting a phone number. We told you it was fast!

why layer

Instantly onboard millions of people from the Plaid Network

Small on friction, big on security

Safeguard sensitive data while you verify more trusted customers with real-time authentication checks. How’s that for peace of mind?

Verify phone numbers and authenticate devices with silent network authentication, passkeys, or SMS one-time password

Evaluate a phone number’s reputation and get notified of SIM swaps, recent port outs, or disconnects

Adjust success criteria on the go with dynamic risk-based checks

Small on friction, big on security

Safeguard sensitive data while you verify more trusted customers with real-time authentication checks. How’s that for peace of mind?

Verify phone numbers and authenticate devices with silent network authentication, passkeys, or SMS one-time password

Evaluate a phone number’s reputation and get notified of SIM swaps, recent port outs, or disconnects

Adjust success criteria on the go with dynamic risk-based checks

Possible Finance reduced

application times by 37%

Integrate in as little as one day

Get access to an off-the-shelf interface that’s lightweight and optimized for conversion so you can get up and running in hours, not weeks. Start by integrating or upgrading to our latest SDKs.

View API docsIntegrate in as little as one day

Get access to an off-the-shelf interface that’s lightweight and optimized for conversion so you can get up and running in hours, not weeks. Start by integrating or upgrading to our latest SDKs.

View API docs