Win more customers

with more ways to pay

Boost revenue and simplify your workflow,

all in one place.

Launch in days

With Plaid’s powerful API, you can get up and running in days–not months.

Drive revenue

Increase the lifetime value of customers with a complete multi-rail solution.

Maximize performance

Reconcile payments in a flash through APIs or with our easy-to-use dashboard.

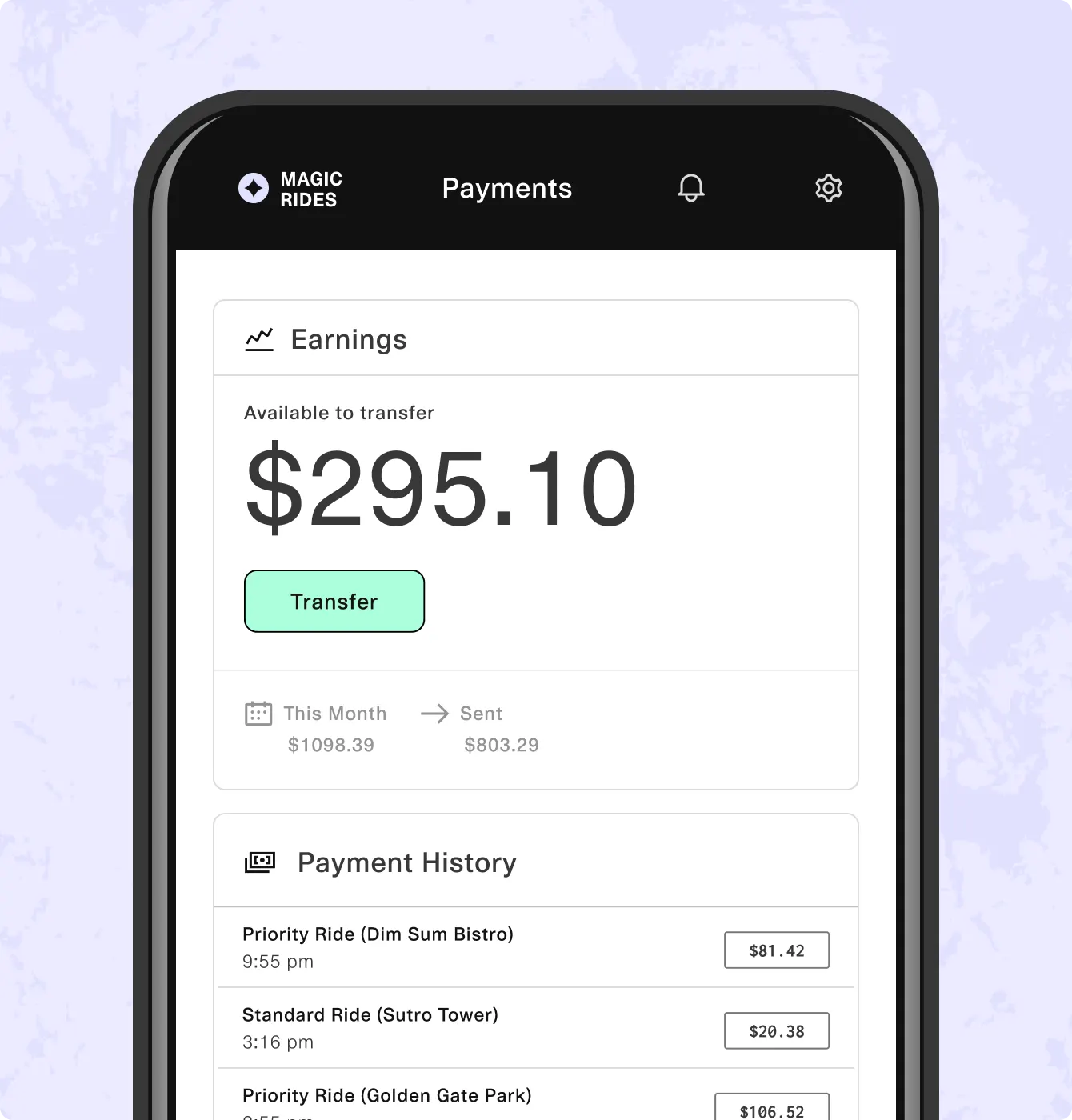

See Transfer in action

Watch demo

Make more with less

Say goodbye to pesky fees. With Plaid Transfer, you can optimize for revenue at every stage of the user journey. Plus, when compared to the nearest competitor, Plaid offers a 23% higher conversion rate.

Connect user accounts in seconds with Plaid Link

Verify account and routing numbers instantly

Reduce NSF and return risk with a built-in Risk Engine

Transfer money between accounts, safely and quickly

Make more with less

Say goodbye to pesky fees. With Plaid Transfer, you can optimize for revenue at every stage of the user journey. Plus, when compared to the nearest competitor, Plaid offers a 23% higher conversion rate.

Connect user accounts in seconds with Plaid Link

Verify account and routing numbers instantly

Reduce NSF and return risk with a built-in Risk Engine

Transfer money between accounts, safely and quickly

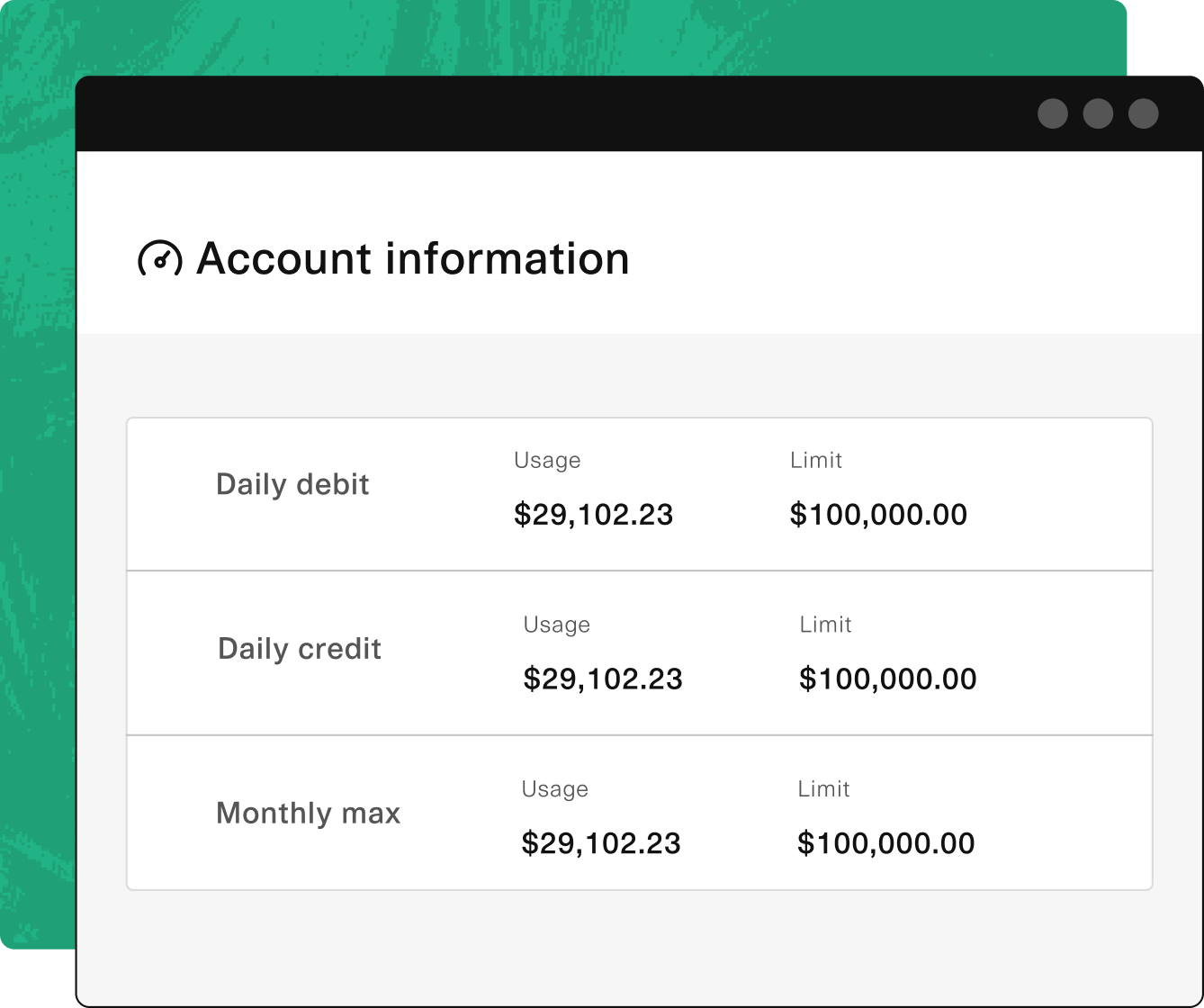

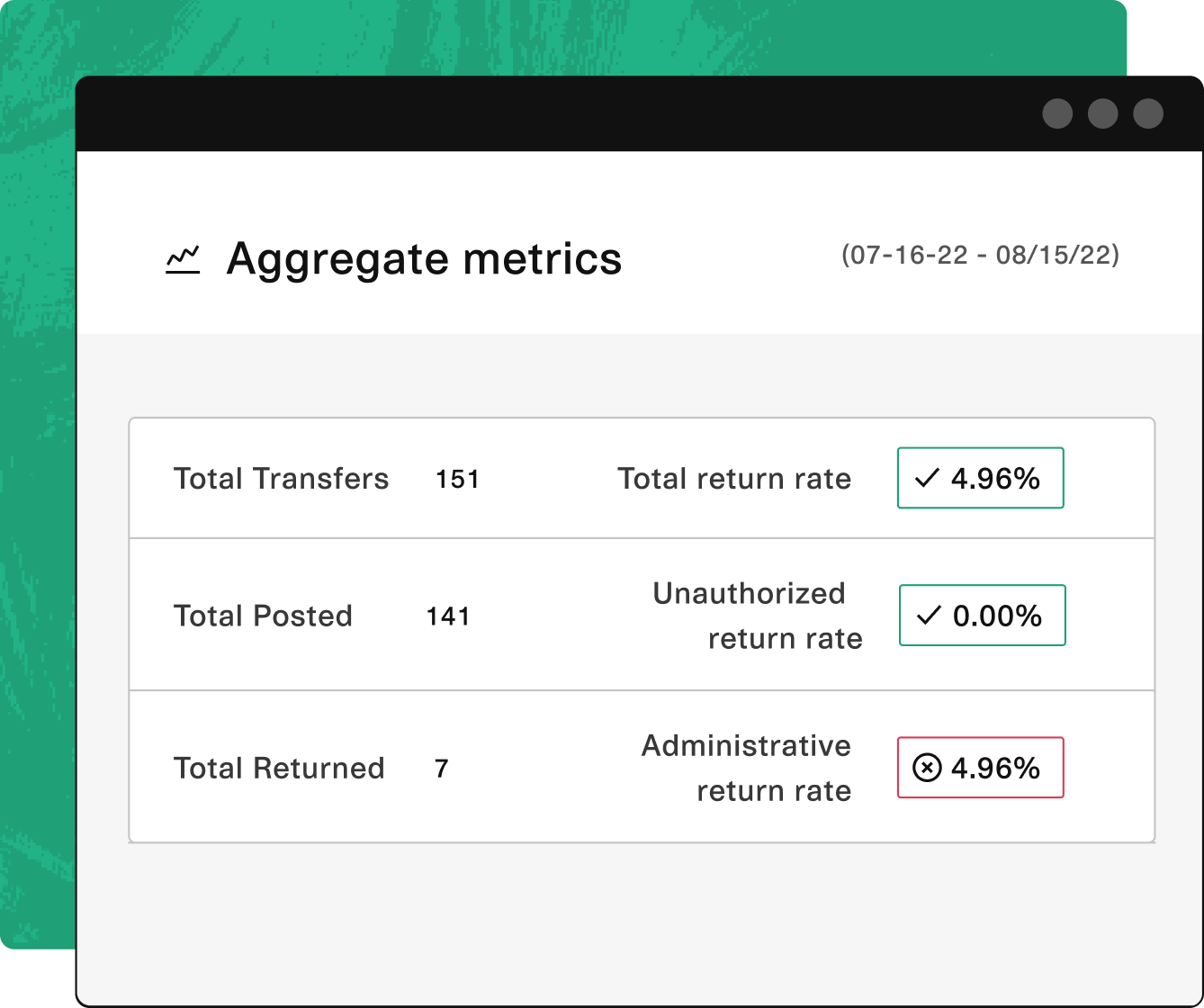

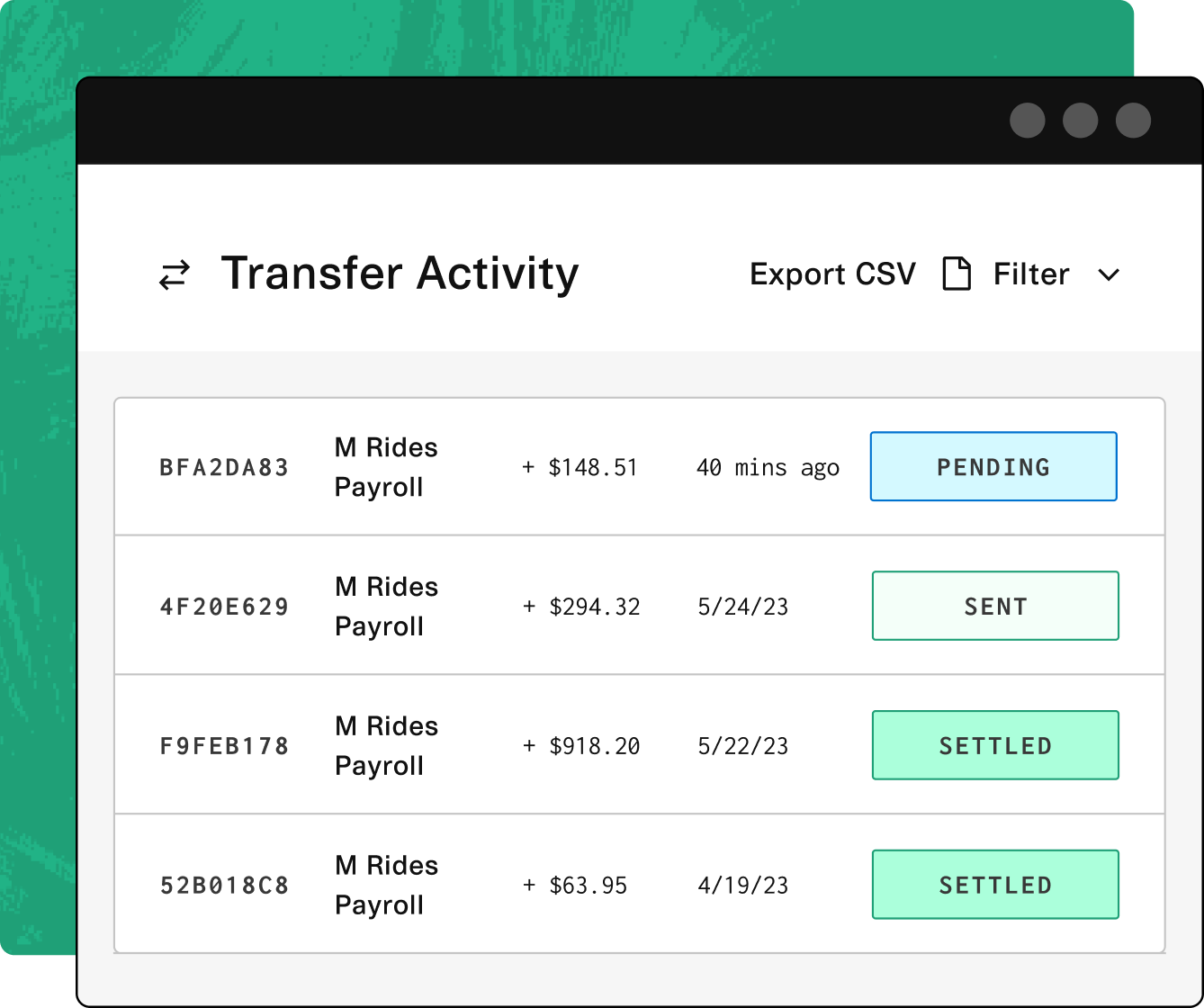

Get a 360° view of payments

Gain deeper insights into each payment with the latest reports, real-time analytics, and optimal support functionality. So you can optimize for performance and stay one step ahead of operations.

Account information

Manage industries, use cases, and SEC codes you're approved for.

Return Rate Management

Track your return rate to ensure uninterrupted access to ACH network.

Transaction Monitoring

Get full visibility into transaction stages, settlement locations, and returns.

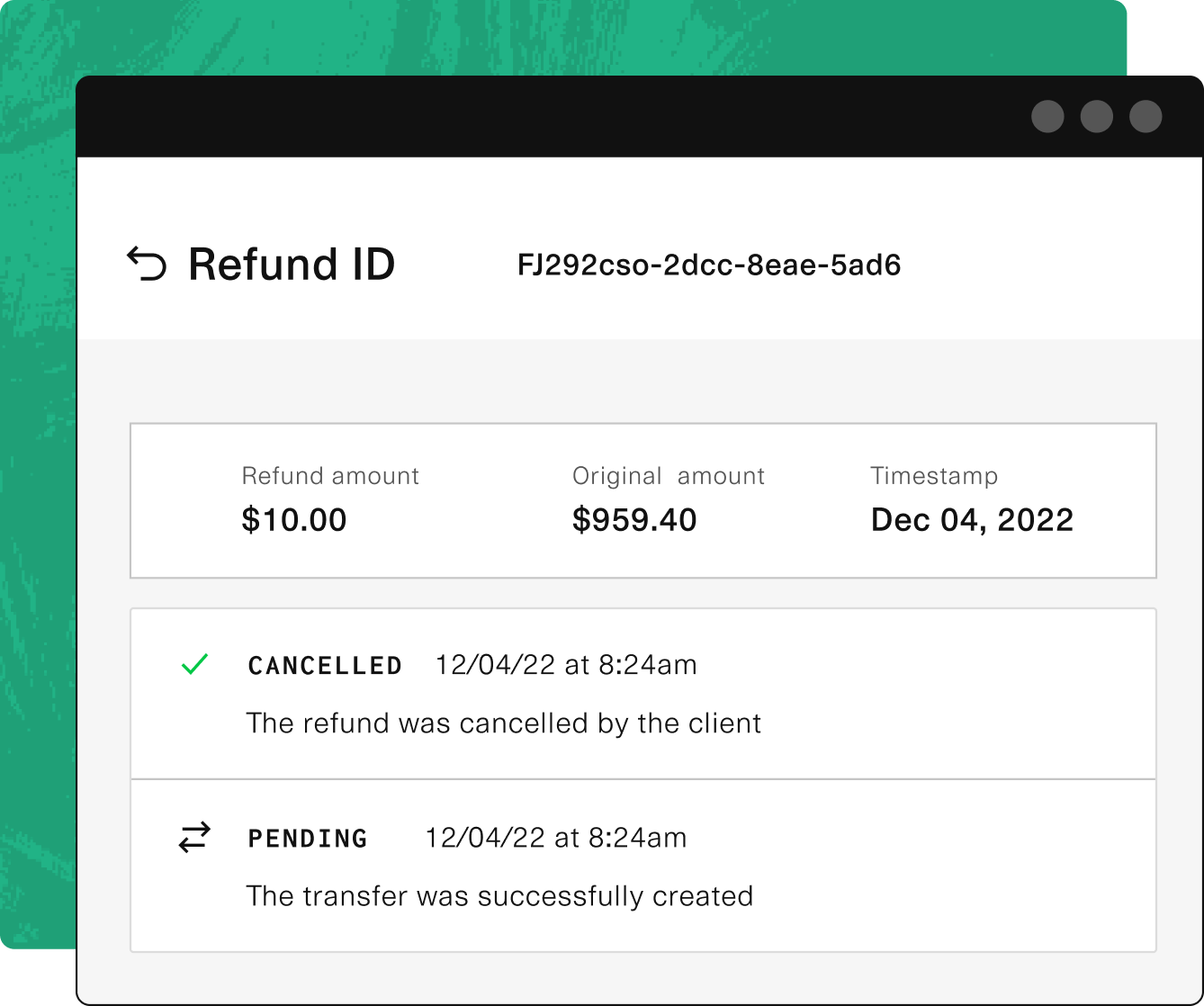

Refund Workflows

Issue and track full refunds to customers for goods or services.

Simple to configure.

Like really simple.

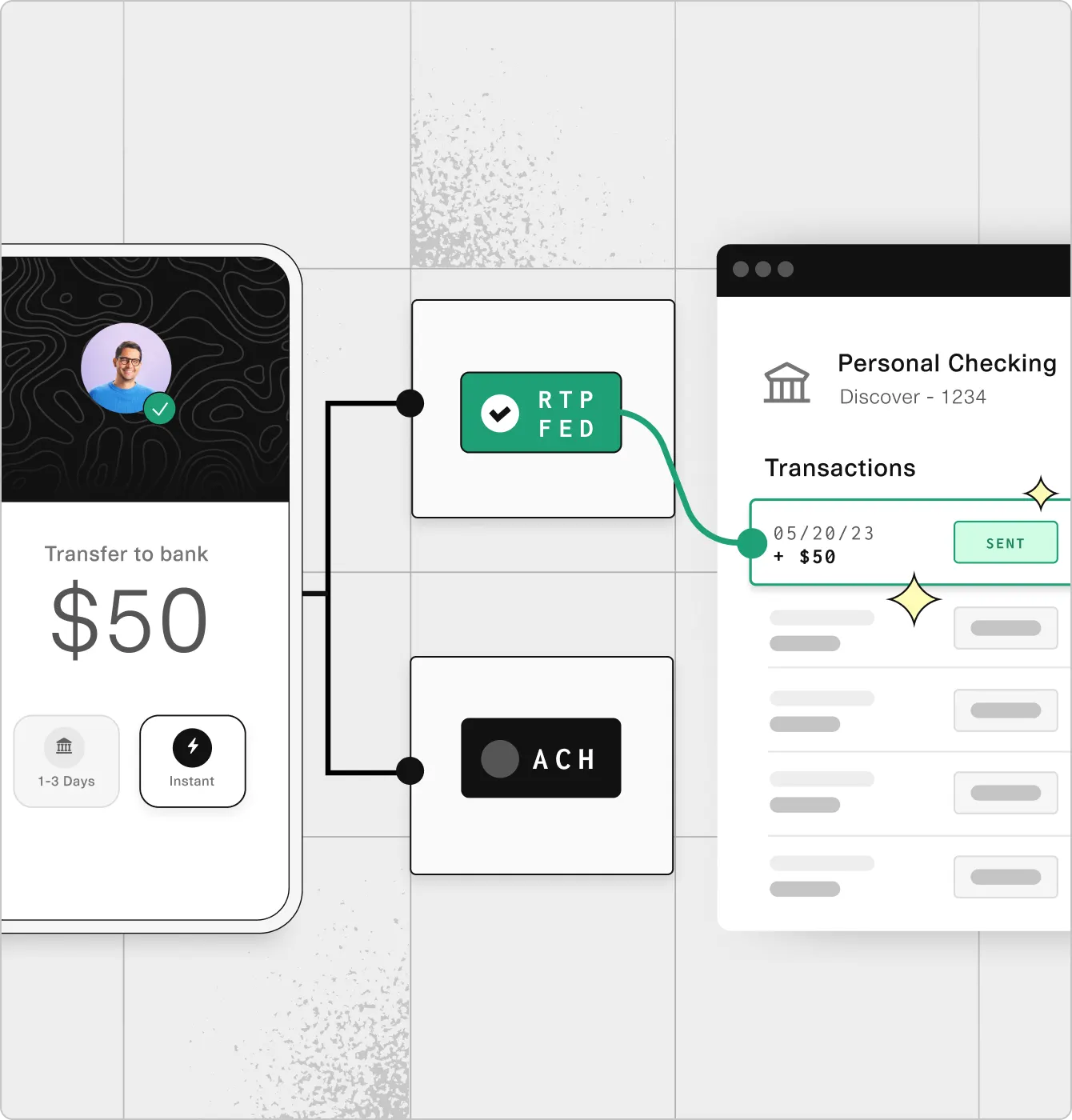

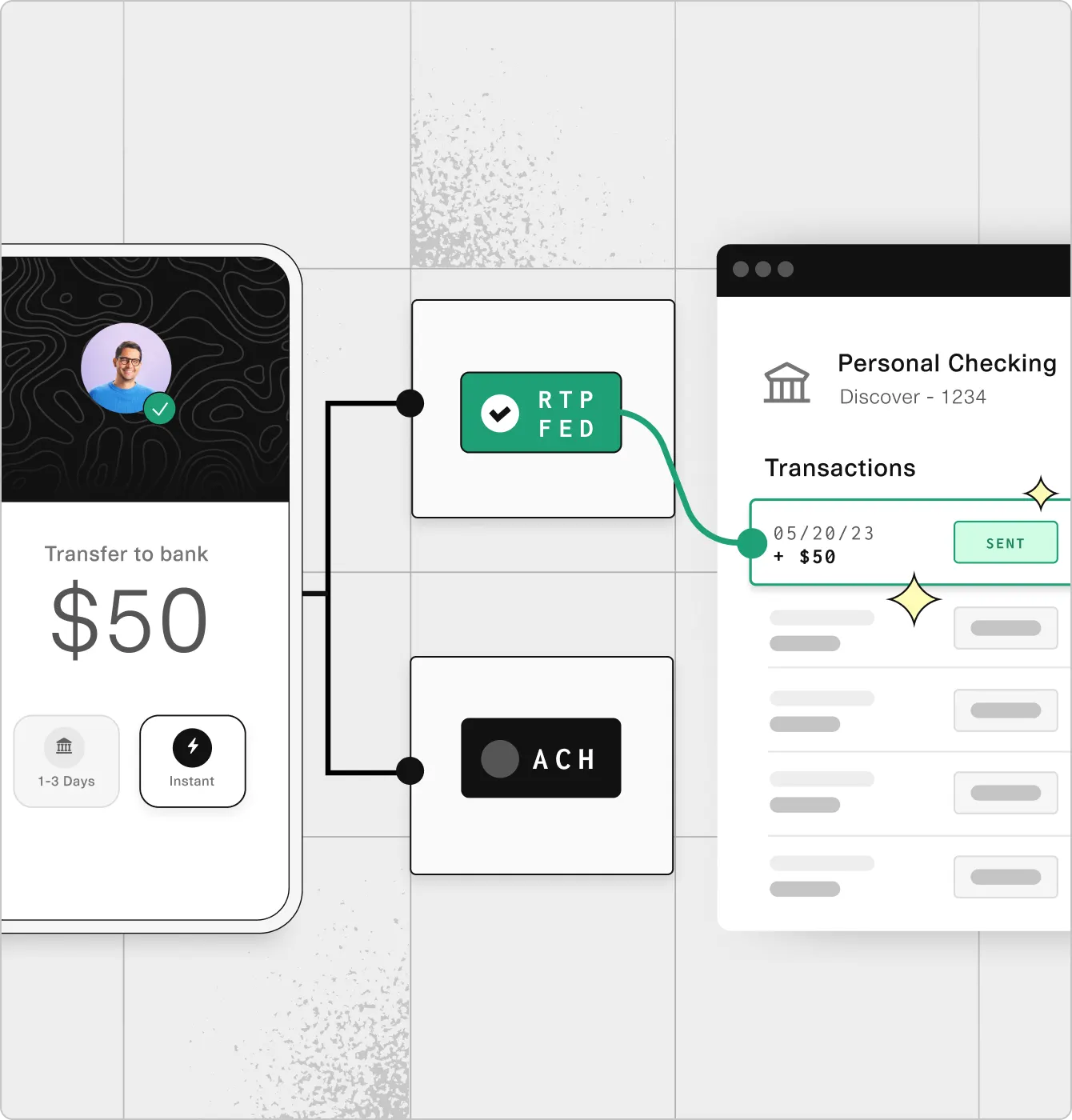

Supercharge your financial offering with a multi-rail solution that’s as flexible as it is powerful. From ACH to Real-Time Payments to FedNow, build the solution that’s right for you and reach more customers with the click of a button.

Simple to configure.

Like really simple.

Supercharge your financial offering with a multi-rail solution that’s as flexible as it is powerful. From ACH to Real-Time Payments to FedNow, build the solution that’s right for you and reach more customers with the click of a button.

Build fast with simple

and powerful APIs

Our easy-to-use tools, from the latest webhooks to versioned API changes, are engineered to help you ship more quickly. Without all the upkeep.

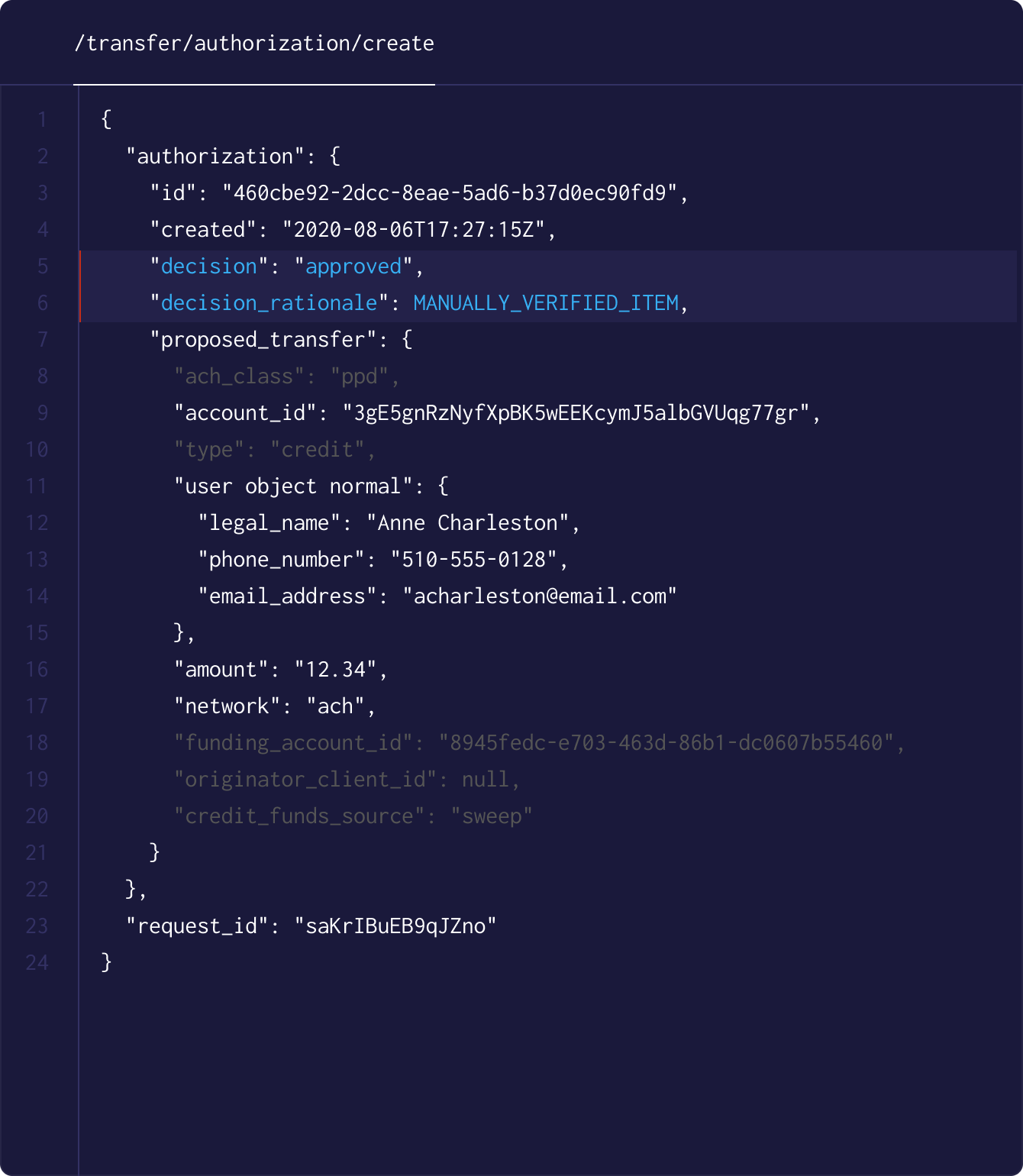

/transfer/authorization/create

This API helps assess failure risk of a transfer before submitting it.

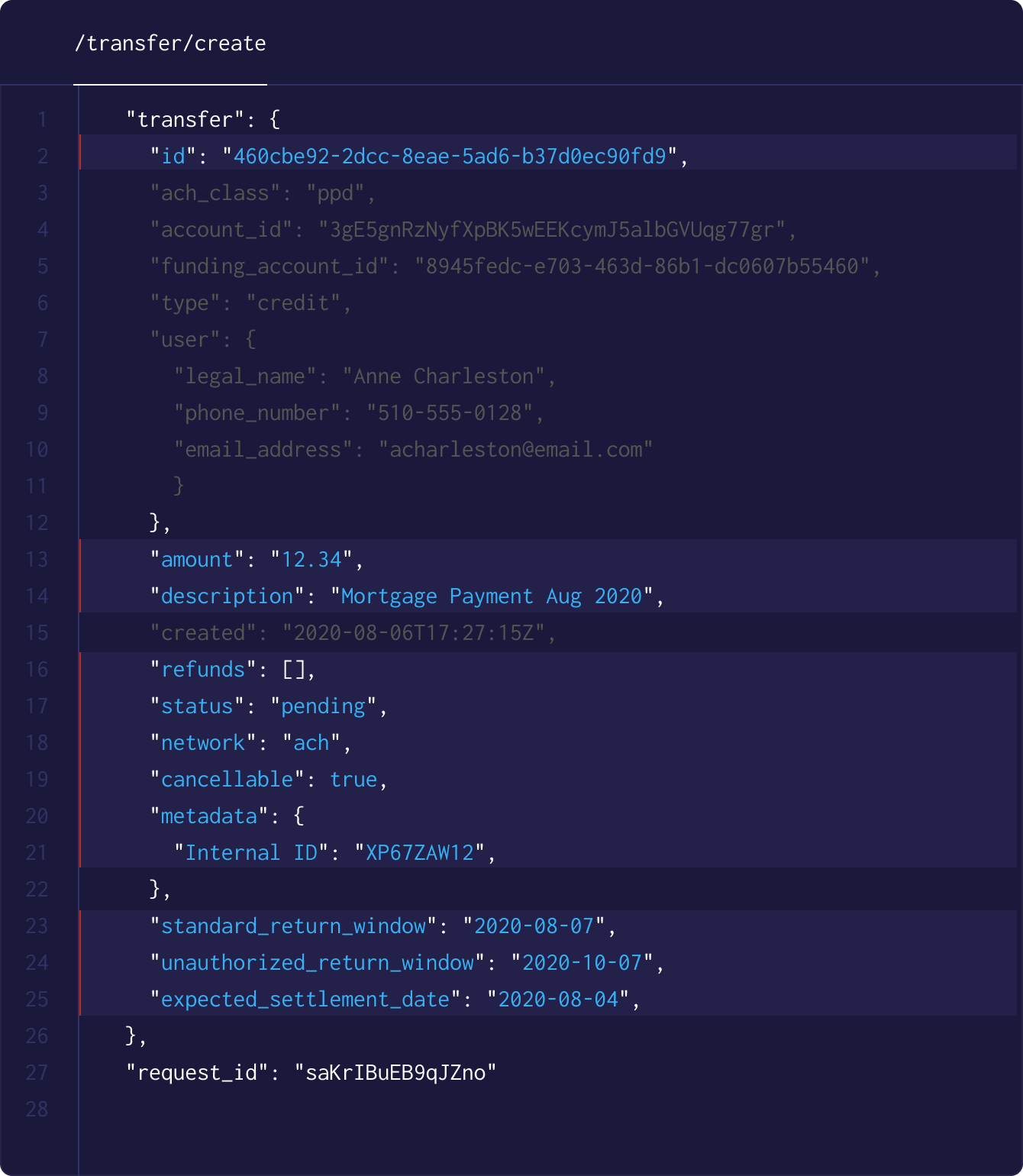

/transfer/create

This API submits a transfer for processing after getting approval from Plaid.

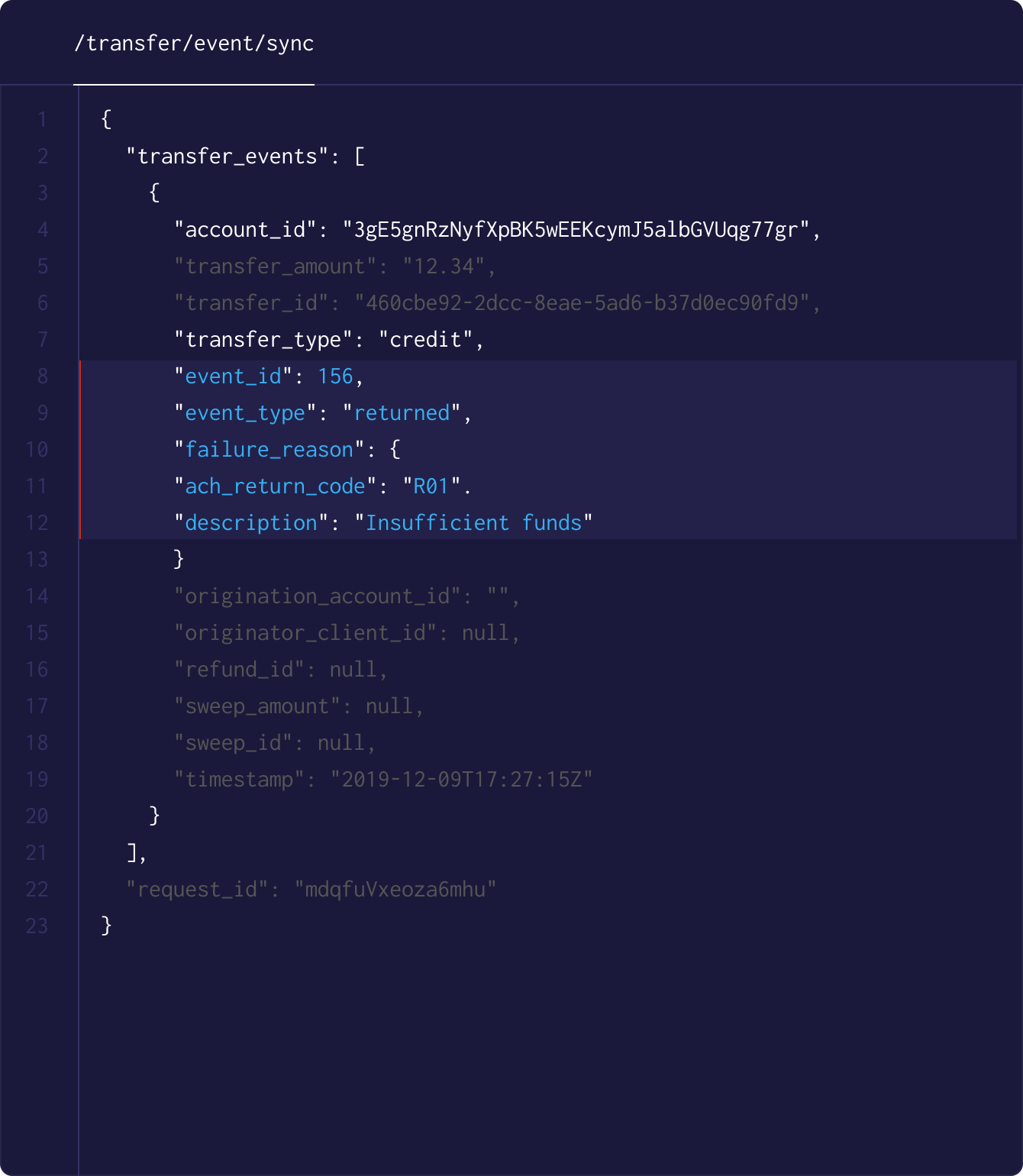

/transfer/event/sync

This API retrieves status updates for a transfer from Plaid after submission.

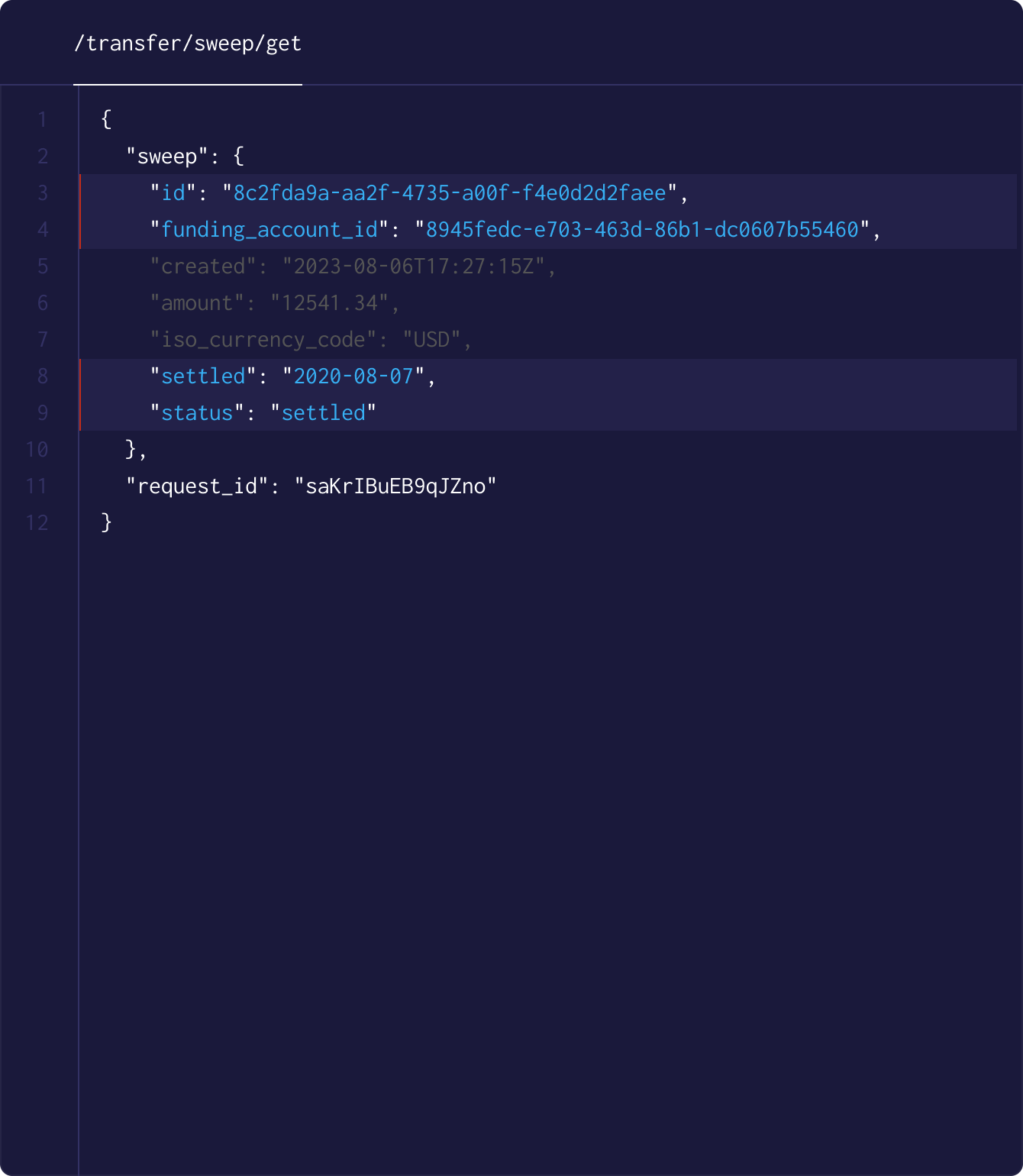

/transfer/sweep/get

This API retrieves information about payouts from Plaid to your business checking account.

Ready to get started?

Get the API keys and start building today or talk with an expert to find out what solution is right for you.