Plaid for property management

Reliable residents.

Easy payments.

Your key to instant resident qualification and hassle-free rent collection.

Talk to our team

Fill vacancies faster

Speed up the lead-to-lease process for tenant screening with faster identity, income, and employment verification.

Reduce bad debt

Stay clear of unpaid rent and bad debt with verified financial data that can’t be forged.

Get paid on time

Automate bank payments for online rent collection without the hassle of data entry errors, manual processing, and fraud.

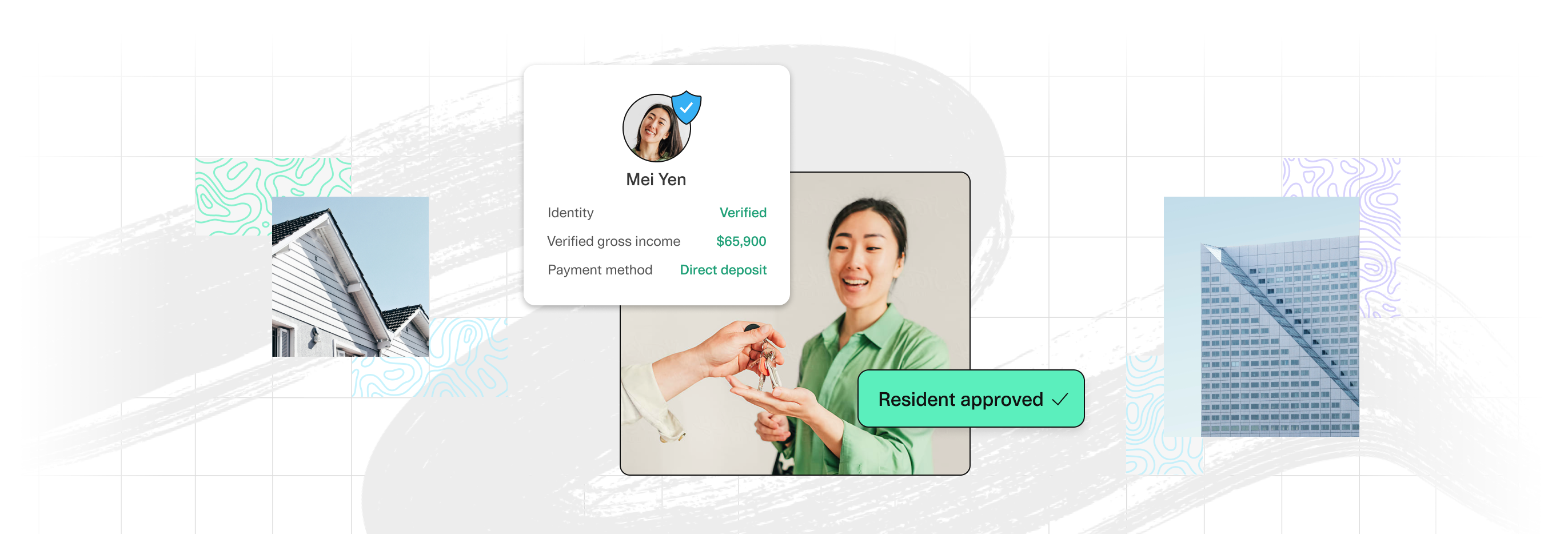

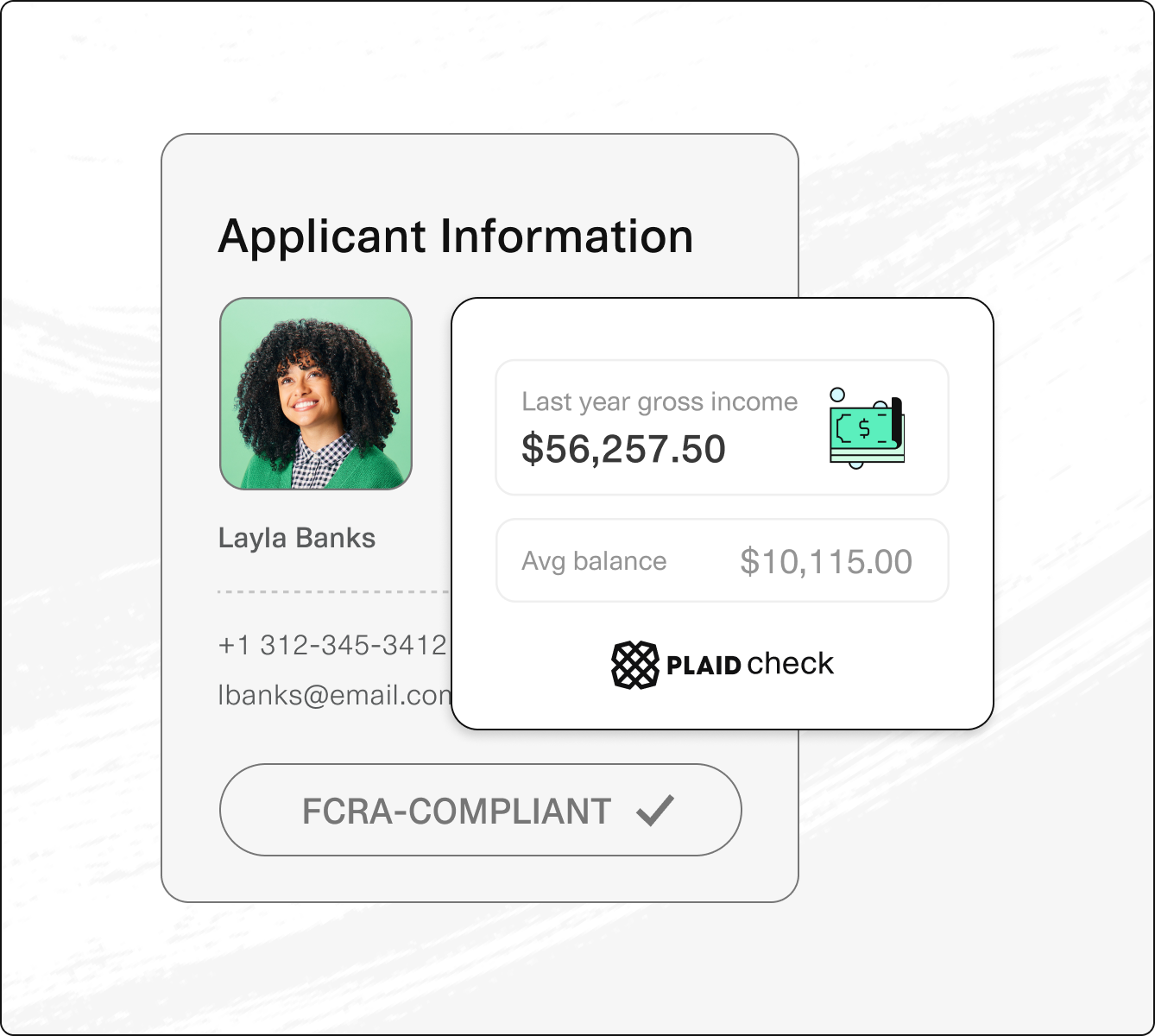

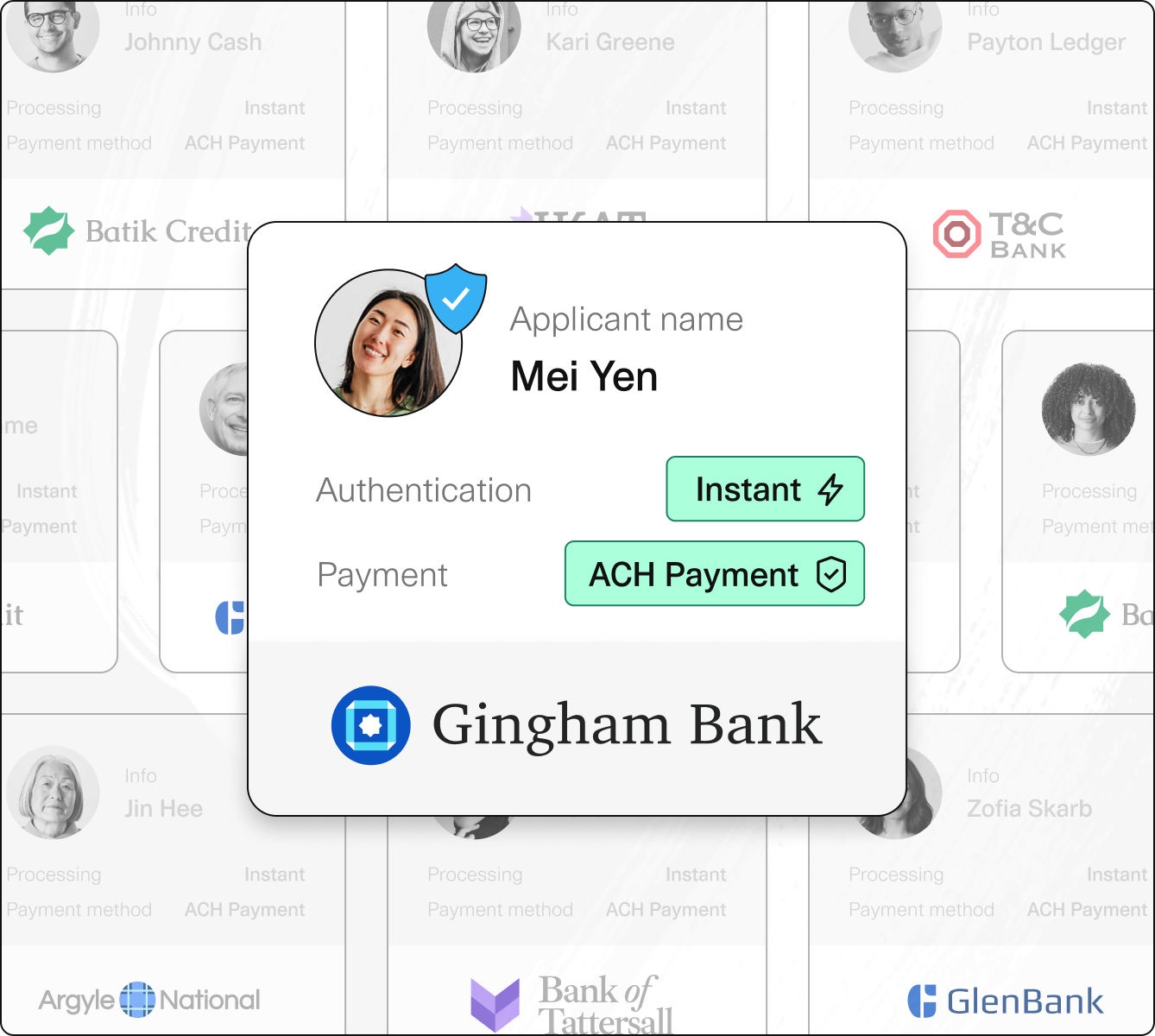

Onboard residents with confidence

Don’t take days to approve an applicant. With Plaid, you get accurate, real-time data to screen, approve, and onboard the most qualified residents in just hours.

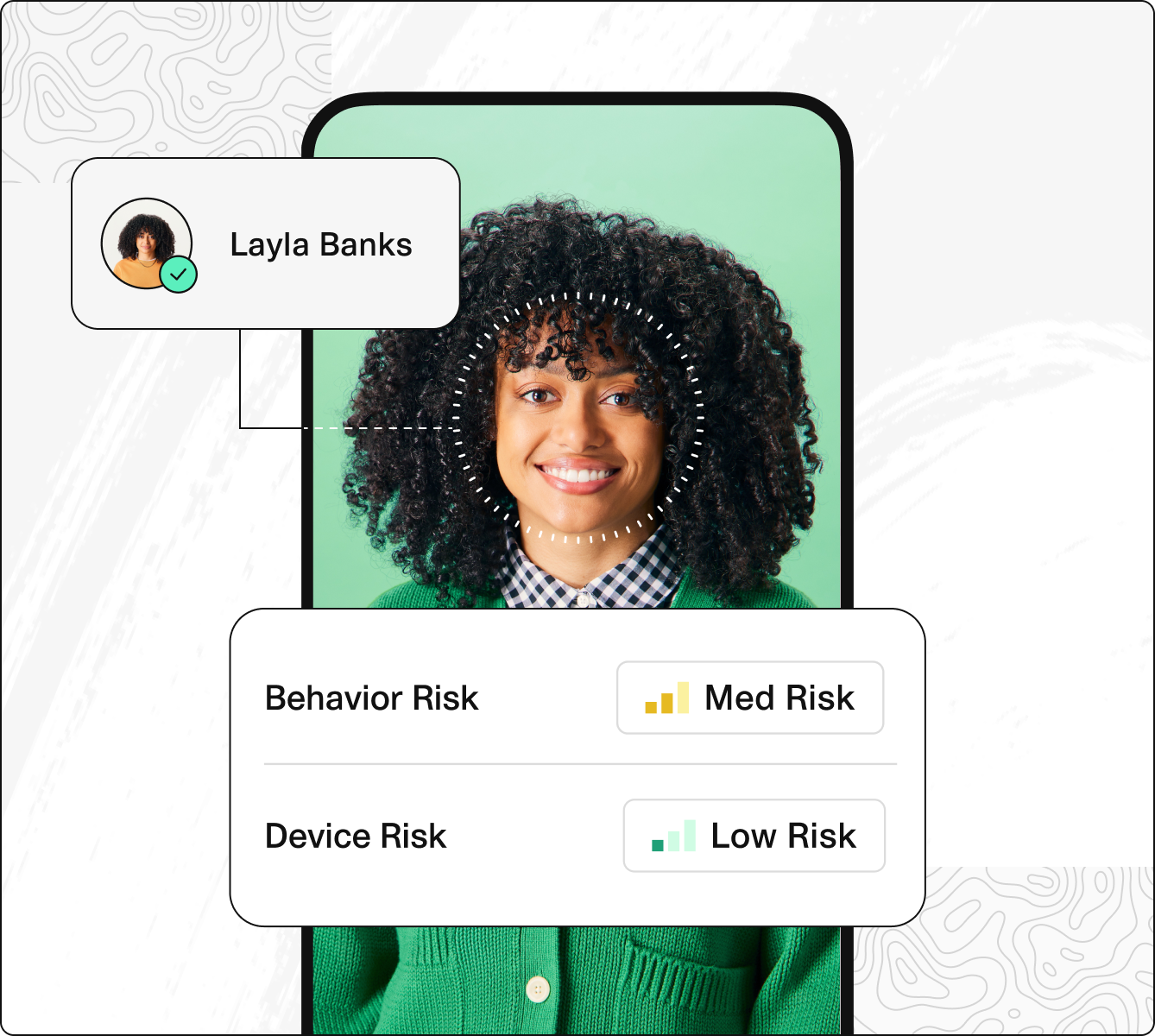

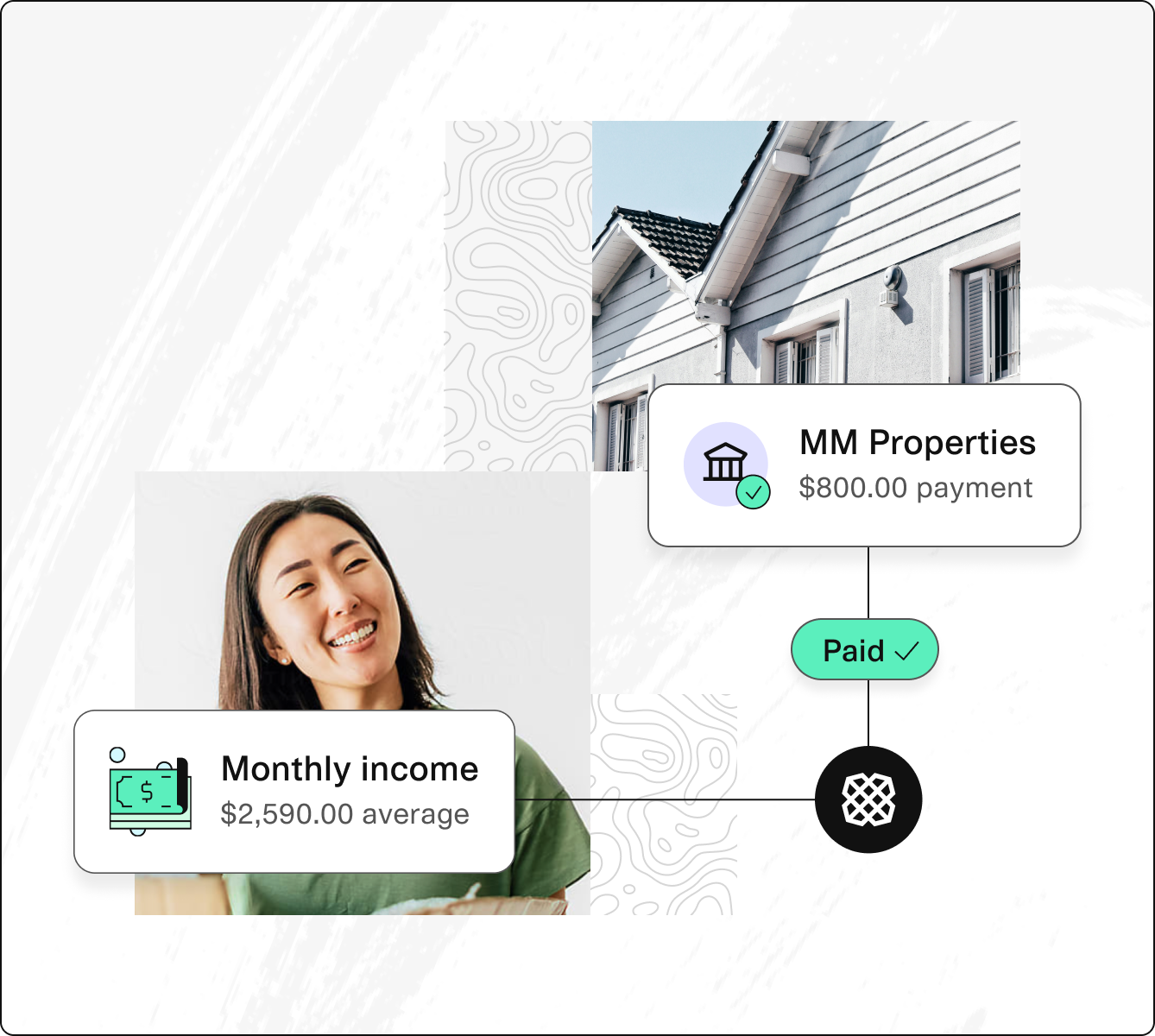

Identify reliable residents, faster

Plaid covers 100% of the U.S. workforce across banks, documents, and payroll so you can instantly verify tenant income and employment.

Verify income in seconds

Say “yes” to more qualified applicants with verified gross and net income insights powered by Plaid Check’s Consumer Report.

Prevent rental fraud

Reduce the risk of synthetic identity theft and streamline Anti-Money Laundering (AML) compliance with instant identity verification.

Plaid’s advanced tools help us ensure applicants are who they say they are with a balance of speed and reliability, aligning with our company's commitment to innovation and excellence.

Senior leader, Invitation Homes

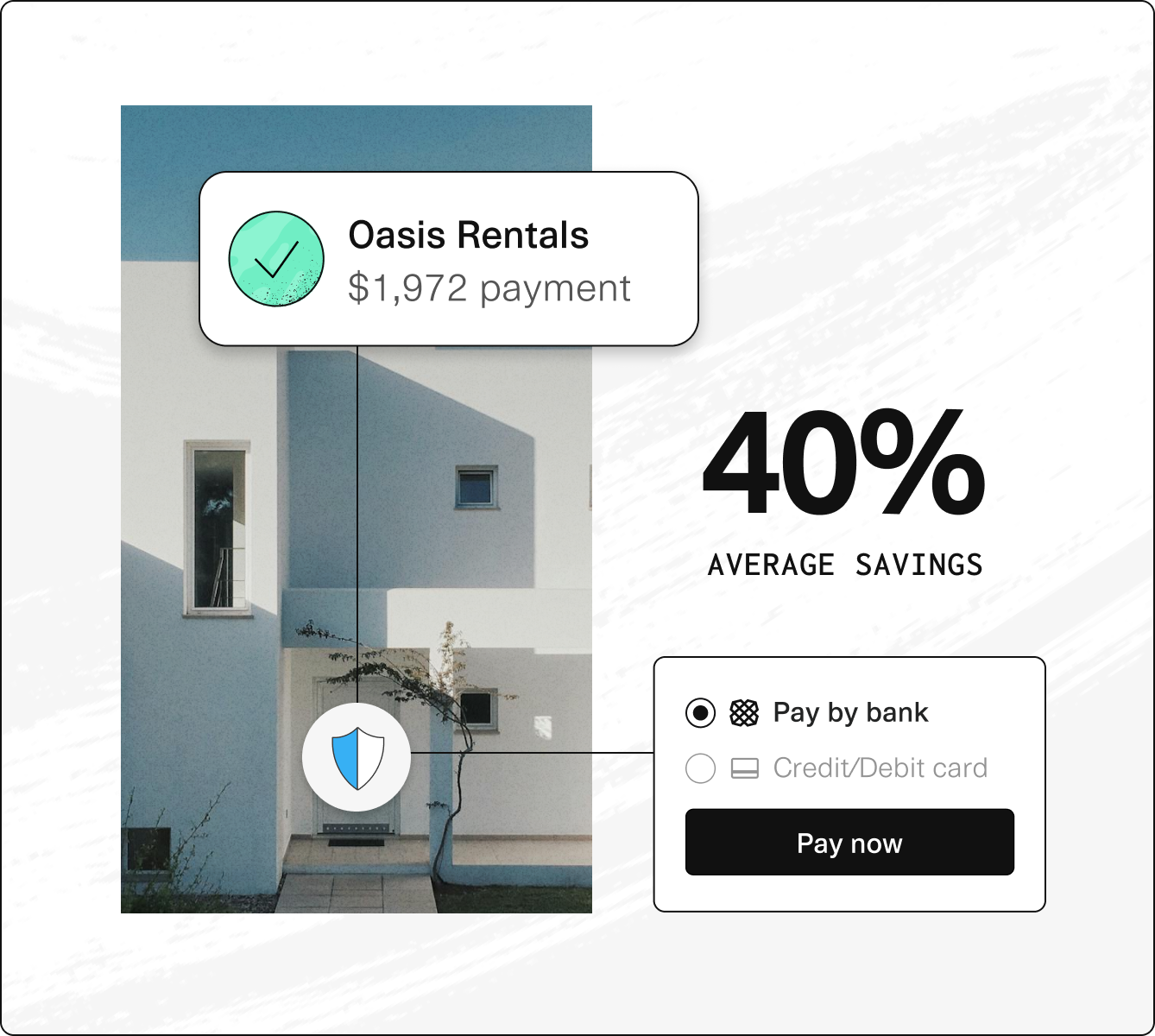

Get paid online and on time

Make rental payments easier for everyone. Save hours chasing payments, cut costs, and reduce fraud with easy-to-set-up bank payment options for one-time or recurring transactions.

Authenticate any account

During onboarding, instantly verify account ownership and account information from over 12,000 financial institutions globally.

Prevent missed rental payments

Proactively monitor a resident’s ongoing financial health and get ahead of missed payments by recommending alternative solutions.

Lower payment costs

Save an average of 40% on processing fees and avoid the delays, paperwork, and NSF fees that come with other payment methods.

10 seconds

Verify identities in as little as 10 seconds

100% coverage

Cover the U.S. workforce across bank, document, and payroll

+14

hoursSave a monthly average of 14 hours with bank payments

CUSTOMER STORIES

See why leading property

managers choose Plaid