Customer Stories

You’ll be in good company

Solutions

Company stage

Industry

Solutions

Company stage

Industry

How Rocket is reimagining homeownership

Read storyReimagining big-ticket checkouts

Read story

Simplifying financial wellness for every American

Read story

Self is helping millions build (back) credit

Read storyA breakthrough in cash flow scoring

Read storyUnlocking smarter credit decisioning

Read storyProviding faster access to wages

Read story

Helping homeowners unlock equity

Read storyAutomating credit access for the underserved

Read storyRobinhood’s Michael Silver on building a purpose-driven career

Read storyWebull’s Damarizz Medina on fraud prevention as a catalyst for growth

Read story

Transforming the mortgage experience

Read story

A faster way to pre-approve loans

Read story

One Nevada Credit Union reduced online account opening fraud by 50%

Read story

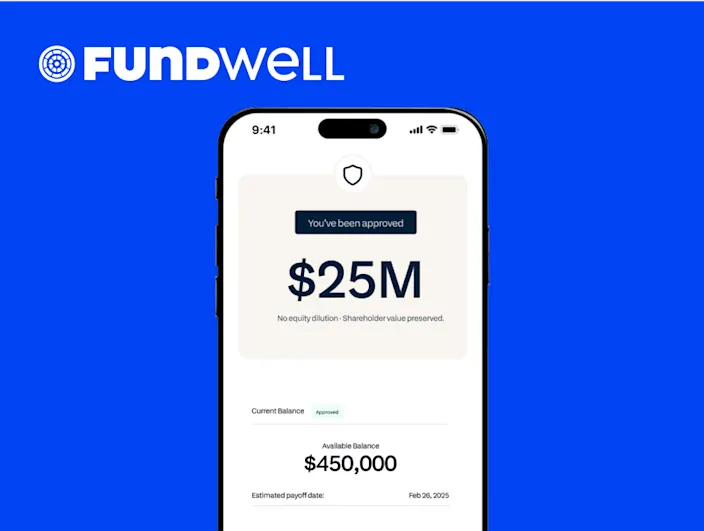

How Fundwell is redefining small business financing

Read story

Building a better billing experience

Read story

Why Forbright Bank is investing in the digital customer experience

Read story

Simplifying life insurance for the modern consumer

Read story

Certifying rent payments with confidence

Read story

Invitation Homes reduced lead-to-lease time by 60%

Read story

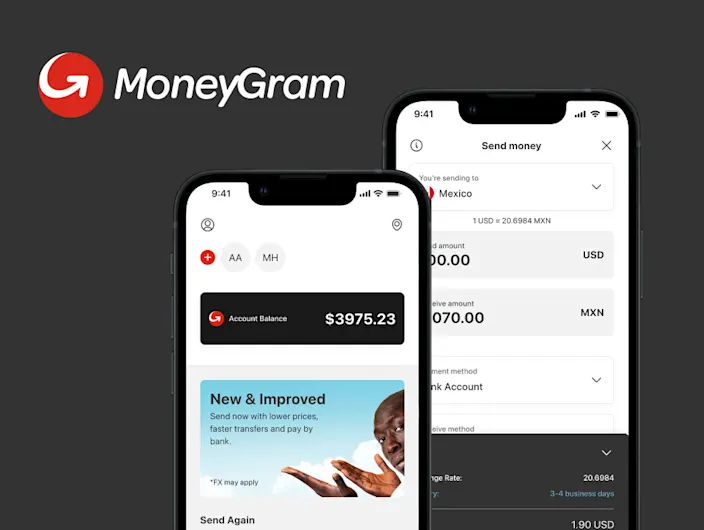

How MoneyGram is reshaping cross-border payments

Read story

Better data, better insights

Read story

Robinhood unlocked $100M in instant funds

Read storySmarter credit for startups to enterprises

Read story

Growing the world’s first sports stock market

Read story

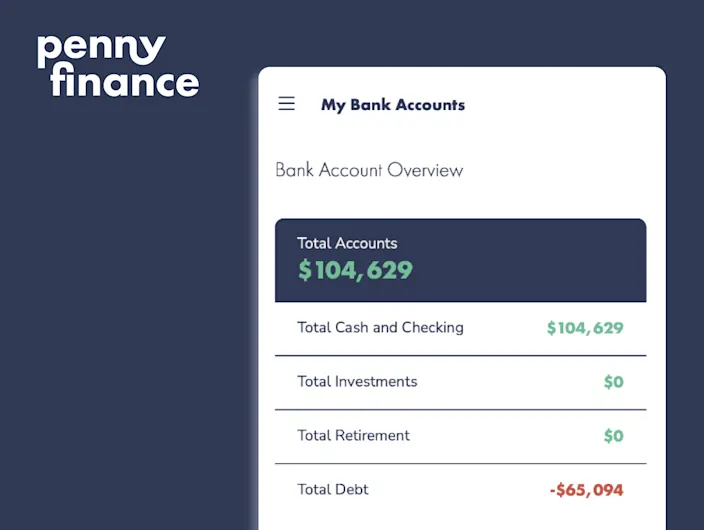

How Penny Finance is helping close the wealth gap

Read story

Rethinking the rental experience

Read storyReshaping lending with cash flow underwriting

Read storyMastering onboarding through speed, security, and scale

Read story

AI is rewriting the rules of accounting

Read story

A look at the future of crypto with Coinbase

Read story

Simplified Business Funding for UK SMEs

Read story

Revolutionizing rent payments with Livble

Read story

Breaking the debt cycle with small dollar lending

Read story

The rise of pay by bank with Adyen

Read story

Streamlining fiat-to-crypto onramps with Banxa

Read story

Expanding into mobile banking tech with H&R Block

Read story

How Veridian Credit Union fights fraud and lowers friction

Read story

How Affirm is creating the future of digital lending

Read story

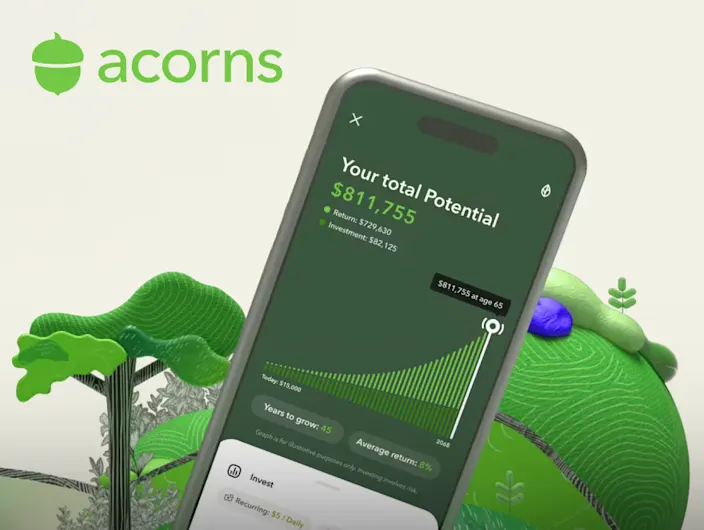

Engaging customers in digital investing

Read story

Unlocking lending opportunities

Read story

Varo Bank offered best-in-class connectivity

Read story

Copilot powered insights for 100K+ users

Read story

Chime boosted account funding by 300%

Read story

Growing and diversifying digital asset portfolios

Read story

Helping users increase their savings each year

Read story

Growing deposits while future-proofing for open banking

Read story

Enabling better data connectivity

Read story

Lowering portfolio risk with cash flow data

Read story

Saying "yes" to more qualified loan applicants

Read story

Opening doors with fast income verification

Read story

Giving millions fair access to credit

Read story

Powering more compassionate lending

Read story

Unlocking real-time access to spend data

Read story

Helping users take control of their money

Read story

Giving people access to affordable credit

Read story

Powering real-time data connectivity

Read story

Fighting against friction, fees, and fraud

Read story

Helping users improve their financial health

Read story

Simplifying budgeting with clean data

Read story

Boosting engagement while reducing risk

Read story

Building financial tools for the underserved

Read story

Making ACH payments as easy as cards

Read story

Boosting retention with embedded banking

Read storyMaking childcare payments easier with Wonderschool

Read storyAlleviating the top source of stress for employees with The Beans

Read storyStreamlining impact finance with Positive Finance

Read storyBuilding BNPL for global B2B payments with Slope

Read story

Making portfolio management simple

Read story

Redefining BNPL bill pay with Cushion

Read story

Growing engagement through better rewards

Read story

Building Stack lowered payment costs

Read story

Increasing Onboarding Conversion by 10%

Read story

Gemini provides a secure and regulated marketplace for cryptocurrency

Read story

LendingTree gives users a holistic view of their finances

Read story

Ellevest is leveling the financial playing field

Read story

Canopy verified renters in seconds

Read story

BlueVine makes 4x faster loan decisions

Read story

Improving data connectivity for millions

Read story

CU of Texas turned spending data into insights

Read story

Esusu helped renters effortlessly build credit

Read story

A pharmacy for the digital age

Read story

A fast, flexible payday solution

Read story

Klover is boosting engagement with better data

Read story

Making the markets work for everyone

Read story

Winning customers with easy onboarding

Read story

Approve Owl powers informed loan decisions

Read story

A safe, easy way to boost loan approval rates

Read story

Unboxing high-speed, low-fee payments

Read storyPowering more transactions with open banking

Read story

Building loyalty with easier money transfers

Read story

Powering faster, more secure payments

Read story

Easier loan approvals for SMEs

Read story

Leveling up payments for online gaming

Read story

Building trust with faster, safer payments

Read story

Making payroll easy for remote workers

Read story

Saving small businesses time and money

Read story

Qualifying more residents with fast onboarding

Read story

Giving clients a complete financial picture

Read story

Powering smarter investment decisions

Read story

The faster, easier way to fund more accounts

Read story

Accelerating growth with easier payments

Read story

Making happy campers with faster payouts

Read story

Growing savings with real-time financial insights

Read story

Expanding access to fair, flexible payments

Read story

Scaling your business quickly and affordably

Read story

The easy way to verify identities globally

Read story