November 16, 2023

The Fintech Effect 2023: Consumer insights reveal growth opportunities ahead

Kevin Young

Product Communications Lead

Kevin leads product communications, showcasing the transformative role of Plaid, our customers, and partners in reshaping financial services.

Discovering that nearly 2 in 3 Americans want more AI in financial services was just one of many revealing insights in our fourth-annual Fintech Effect report. The Fintech Effect 2023 is based on a broad consumer survey conducted by The Harris Poll and seeks to understand how consumers are using fintech in their daily lives, their perceptions and expectations of financial services, and how behaviors are changing over time.

When we began the report four years ago, fintech was still emerging. Adoption and use dramatically increased during and after the pandemic with nearly 9 out of 10 people using some type of fintech app, and the average person using 3 to 4 apps to manage their financial lives.

In a climate of inflation and economic uncertainty, this year's report delves into the shifting financial priorities, expectations, and behaviors of consumers. The report offers insights to help inform product priorities in the year ahead, including spotlights on financial access, payments, credit, artificial intelligence, and more.

Here are five highlights among many findings in this year’s report:

1. Fintech: A continued lifeline in an uncertain economy

The survey underlines the stress gripping consumers in a fluctuating economy. The vast majority of Americans (89%) expressed various degrees of financial stress, with 35% feeling a significant weight. However, more than half (56%) said they lean on digital financial tools to navigate these challenging times, and of those, 84% say they’re better off due to using those tools. These consumers say fintech helps them better understand their spending, make progress toward their personal financial goals, or feel less stress or anxiety about their finances. Notably, 55% rely on fintech apps like budgeting tools to help them weather challenges related to inflation.

2. The data dialogue: Rethinking credit scores

A striking 63% of consumers believe traditional credit scores fail to capture their complete financial narrative. Highlighting a shift in perspective, 60% feel sharing banking data could paint a more accurate financial portrait. This trend is amplified among Millennials, where 71% support the idea. The majority of consumers support supplementing credit scores with consumer-permissioned data. Consumers are very comfortable sharing primary income and transaction histories to aid in loan approval or securing better rates.

3. The rise of pay-by-bank: Americans are ready

Around the world, native, digital bank payments are emerging as a new way for people to pay for goods and services using funds from their bank account. In the U.S., we believe 2024 will mark the year when more pay-by-bank options surface in areas like bill pay, account-to-account transfers, payins and payouts, and even some ecommerce applications. According to this year’s report, Americans are ready: two-thirds (67%) of consumers are open to pay-by-bank, even when credit and debit cards are available—noticeably higher among fintech users (72%) and Millennials (74%). In fact, 51% said they used bank payments over cards in the last year—again higher among fintech users (56%) and Millennials (62%). The appeal lies in convenience, security, and fewer fees.

4. Trust in fintech continues to grow: A paradigm shift

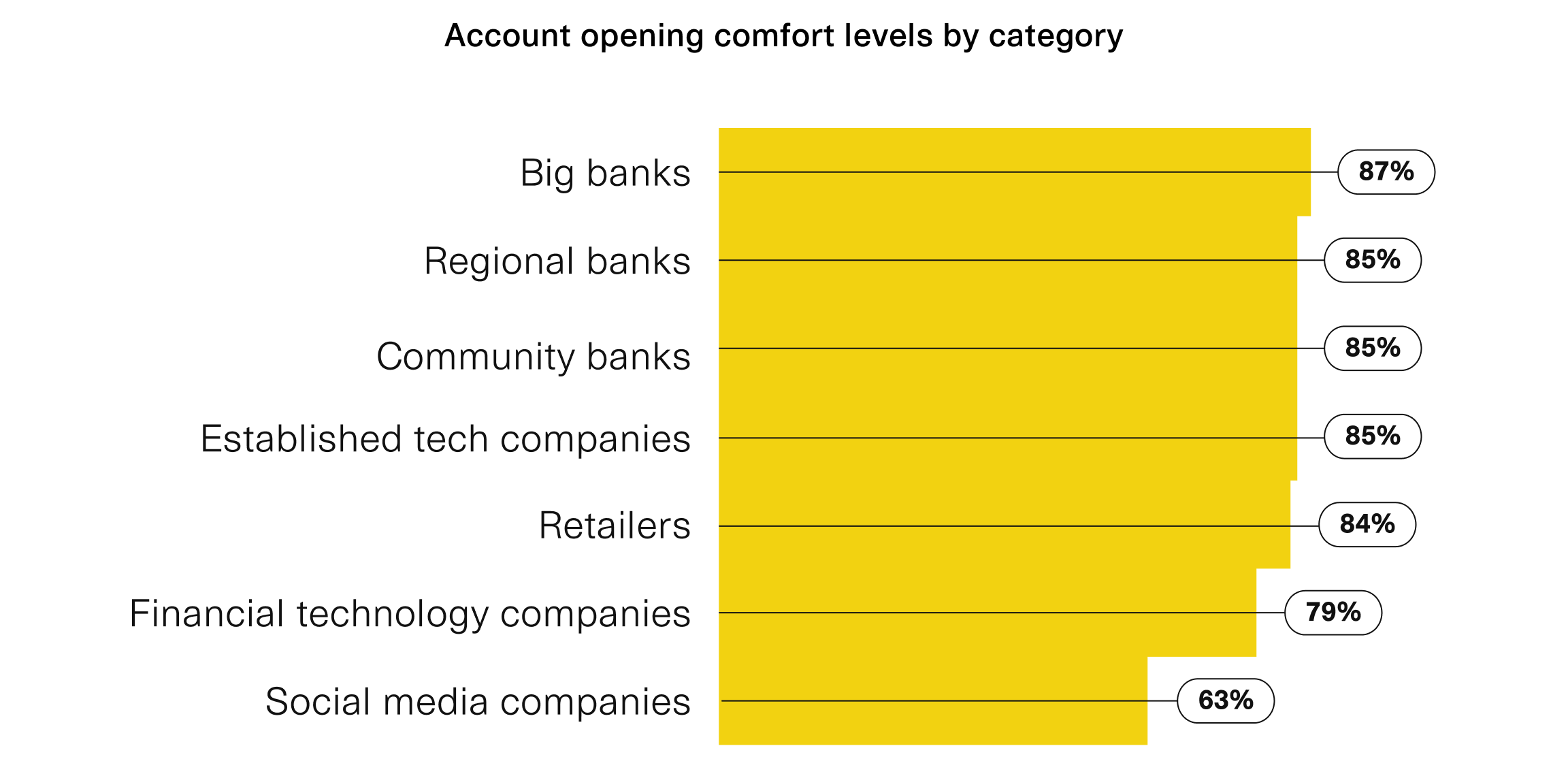

Consumer comfort in opening accounts is diversifying. While large, national banks hold a strong 87% comfort level, fintech companies now boast 79%, indicating a narrowing trust gap. The report highlights growing comfort in opening financial accounts with non-traditional providers, signaling a progressive shift in consumer perceptions as fintech becomes more ingrained in our daily financial lives—from familiar tech applications to brand name retailers and more.

5. Embracing AI: Consumers crave personalization and automation … with caveats

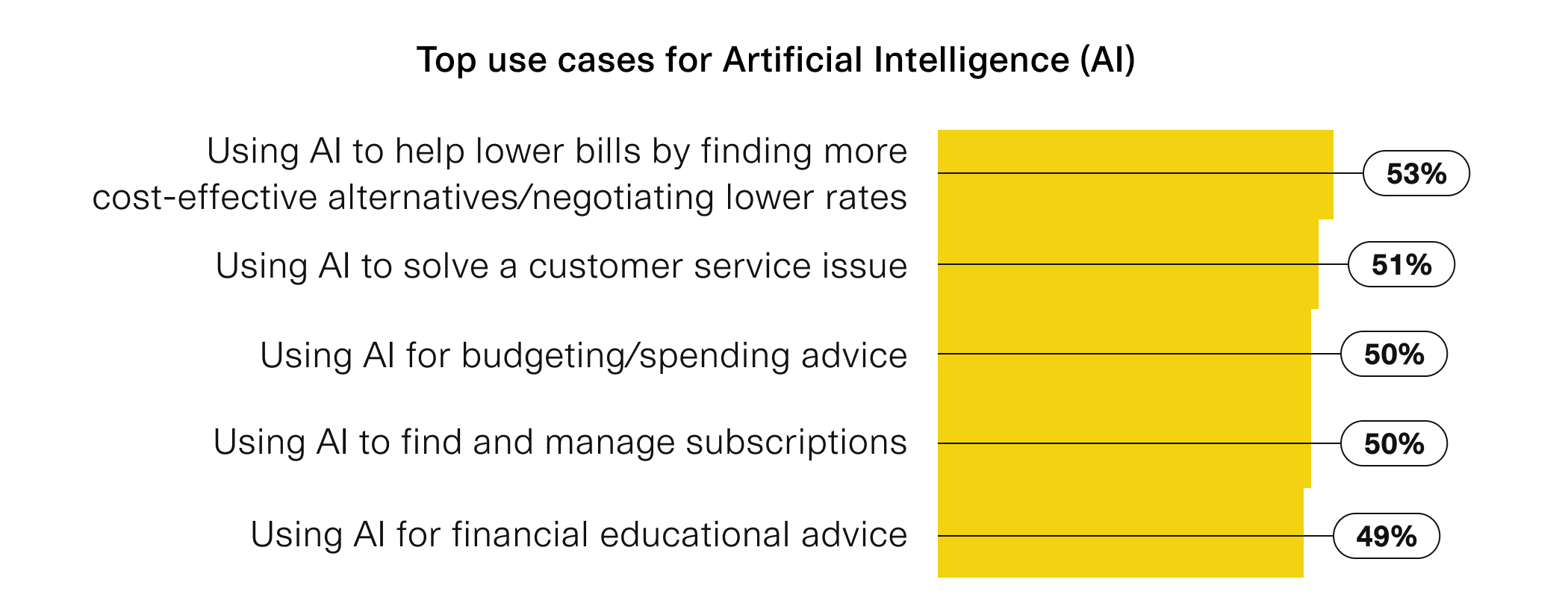

AI's potential to revolutionize financial services through personalization and automation has captured the imagination of Americans. In fact, 60% believe AI will revolutionize financial services within the next five years. Consumers see the biggest potential in lowering bills (53%), helping solve customer service issues (51%), providing budgeting advice (50%), managing subscriptions (50%), offering financial education (49%), and streamlining tax filings (36%). While 60% want fintech apps to use AI for a more personalized approach (such as providing real-time recommendations), most Americans are not ready for a fully automated future. In fact, 7 in 10 Americans would prefer to review AI's financial decisions before entrusting it to make decisions on their behalf.

Consumer interest in emerging areas like credit, payments and AI suggests there is significant room for growth ahead despite the current macro environment. These findings also just scratch the surface of what's on people's minds when it comes to digital finance. To explore these insights and more, download The Fintech Effect 2023.