Consumer Lending

Approve more loans with predictive risk insights

Make smarter decisions across the loan lifecycle with real-time cash flow data and risk analytics.

One-click experiences for higher conversion

Convert up to 25% more potential borrowers. Trusted by 1 in 2 U.S. bank account holders, our user experience streamlines the lending process.

Scores and attributes for easy risk assessment

Better predict ability to pay with insights into cash flow, income patterns, and account connection activity.

Streamline everything from verification to disbursement

Get to know and verify borrowers

Access real-time cash flow data, meet global KYC requirements, and reduce fraud losses with our powerful anti-fraud engine.

Instant onboarding

Borrowers can share key identity information and link financial accounts in seconds, straight from your application. All it takes is a phone number.

Seamless identity verification

Stay ahead of compliance and risk. Easily verify borrowers’ identities for global KYC with ID document checks, liveness detection, risk analysis, and anti-money laundering watchlist screening.

When users connect via Plaid, they convert faster, more frequently, more reliably, and with a better user experience.

Herman Man

Chief Product OfficerRead more

Smarter risk analytics for modern lending

Get up to 24 months of FCRA-compliant cash flow data alongside income insights, attributes, and risk scores—so you can assess affordability faster and more confidently.

Instant income verification

Reduce fraud and speed up approvals with real-time visibility into applicants' income streams, past and forecasted earnings, and employment.

Underwrite with more confidence

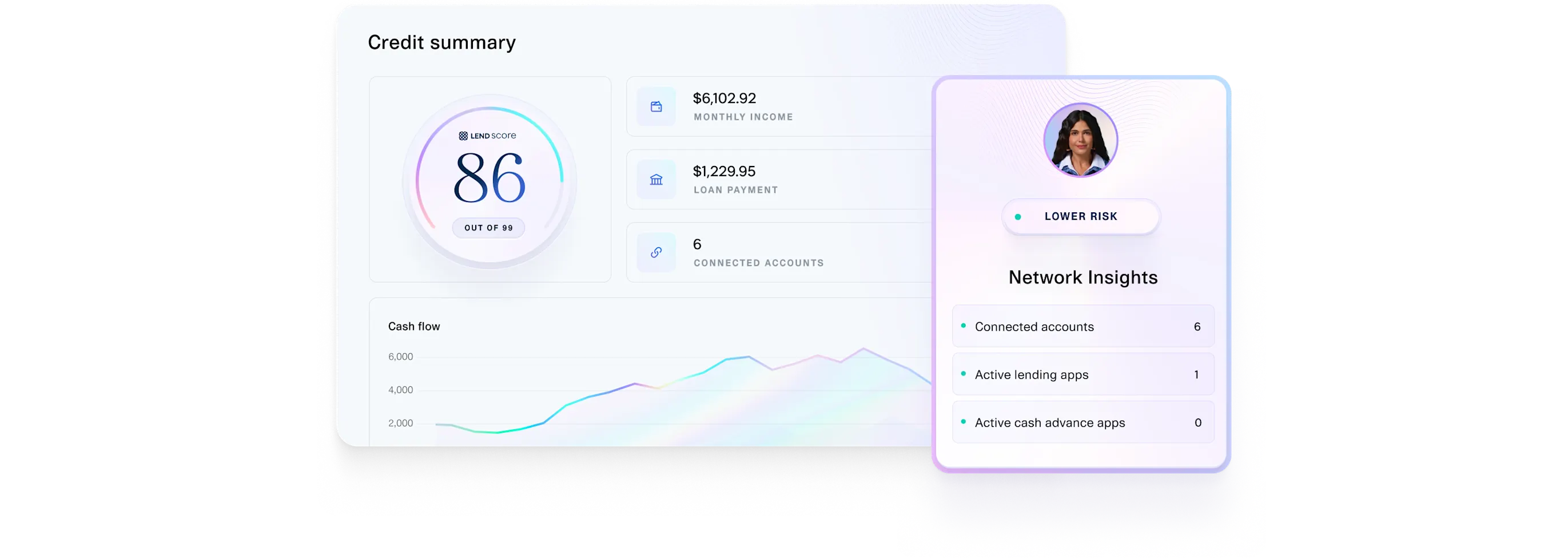

A powerful analytics suite with cash flow attributes, account activity insights, and risk scoring—designed to help you approve more qualified borrowers and reduce losses.

Decision faster with ready-made risk scores

Sharpen your risk assessment with the Plaid LendScore—built on real-time data and account connection activity that reflects a borrower’s up-to-date financial health.

Verify assets for mortgage lending

Use GSE-compatible reports with up to 24 months of transactions and account balances to verify assets—reducing the need for paper statements and manual reviews.

Ten years ago, there weren't structures for cash flow data. This new ecosystem of tools, like Plaid's CRA, gives lenders and financial institutions more reason to use cash flow data to meet their goals.

Tim Hong

Chief Product OfficerRead more

Instantly disburse

low-risk loans

Speed up loan payouts and simplify repayment with Plaid’s money movement solution. Send funds instantly with FedNow and Real-Time Payments, and enable auto-pay to reduce return risk.

Instantly disburse

low-risk loans

Speed up loan payouts and simplify repayment with Plaid’s money movement solution. Send funds instantly with FedNow and Real-Time Payments, and enable auto-pay to reduce return risk.

Unlock real-time cash flow data in as little as 10 seconds

Cover the U.S. workforce with bank account, payroll, and document data

Up to 80% conversion for account linking in lending applications