liabilities

Debt is stressful.

Loan data

shouldn’t be.

Our clean data helps you make sense of what your customers owe from mortgages to credit cards.

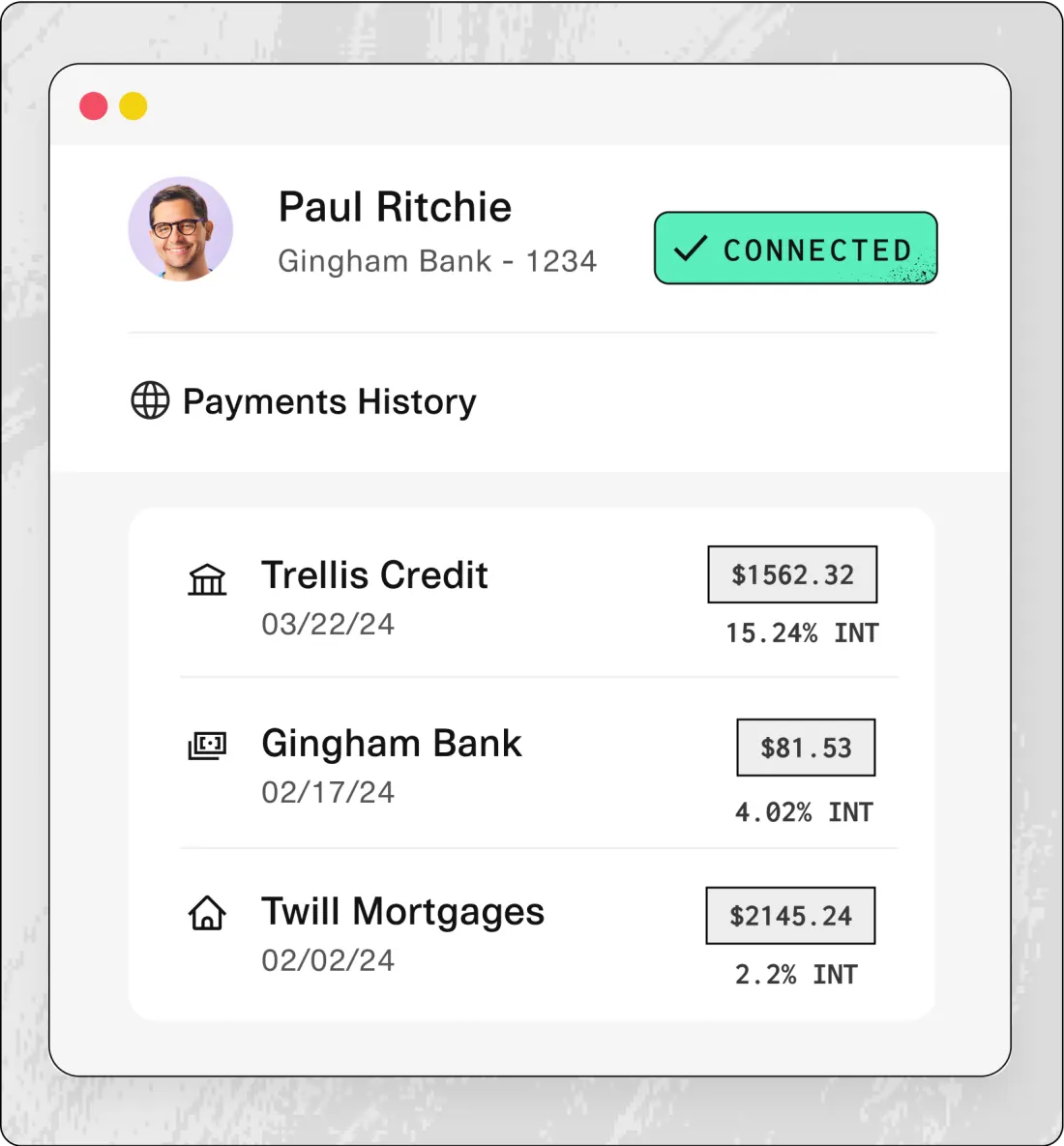

See the whole picture

Easily understand your customer's debt

APRs, due dates, and balances

used to be hard to track. Now,

they’re all in one place.

Easily access credit card and mortgage data from up to 98% of major institutions

See complete details including Annual Percentage Rates, terms, balances, payment history, and more

Keep up with interest-rate changes and new and existing loans with real-time updates

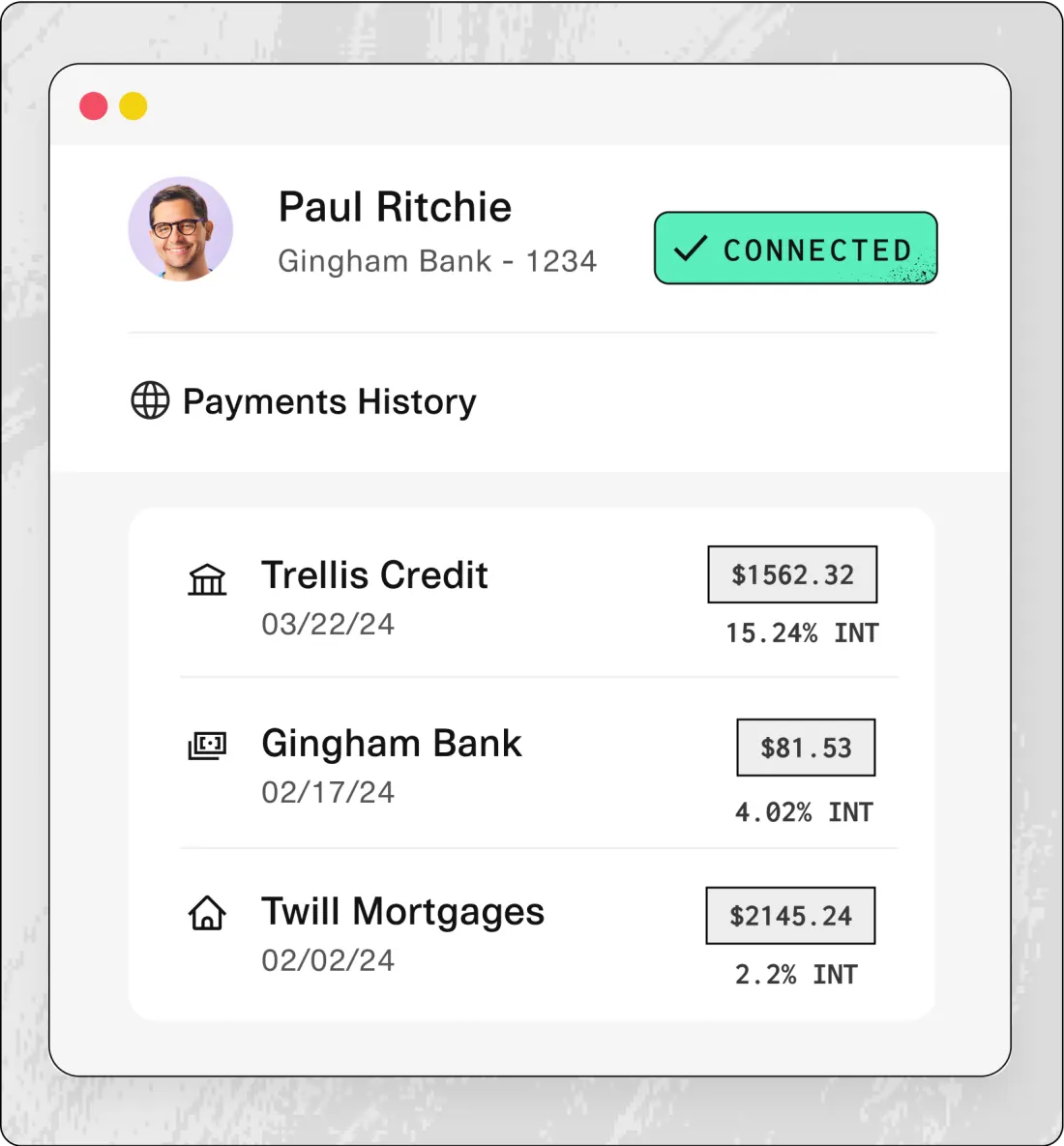

APRs, due dates, and balances

used to be hard to track. Now,

they’re all in one place.

Easily access credit card and mortgage data from up to 98% of major institutions

See complete details including Annual Percentage Rates, terms, balances, payment history, and more

Keep up with interest-rate changes and new and existing loans with real-time updates

One API to verify debt and loan data

Our easy-to-use tools, from the latest webhooks to versioned API changes, are engineered to help you ship quickly while avoiding all the upkeep.

View API docsCredit cards

Access credit card details including Annual Percentage Rates (APRs), credit limit, minimum payment amount, next payment due date, last statement issue date, and more.

Mortgages

Access mortgage details including loan number, original loan amount, interest rate, property address, escrow balance, last payment date, and more.

Designed to work better together

Meet all the products for building a personal finance solution

Transactions

Power better insights with up to 24 months of transaction data across 12,000+ financial institutions.

Learn moreInvestments

Build a holistic view of investments, including account balances, holdings, and transactions.

Learn more