BEACON

The anti-fraud network

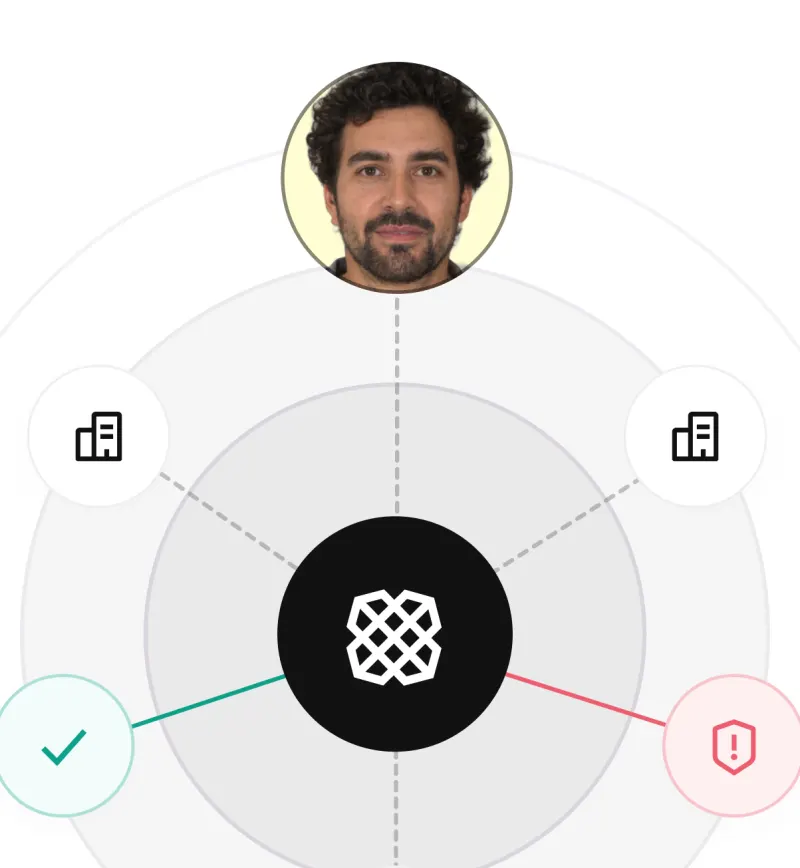

Stop the chain reaction and prevent fraud from proliferating across apps

Break the chain reaction

Alone, it’s impossible to stop a stolen identity from being used over and over, from platform to platform

Strengthen fraud defenses

Understand the fraud risk of your Plaid-linked bank accounts

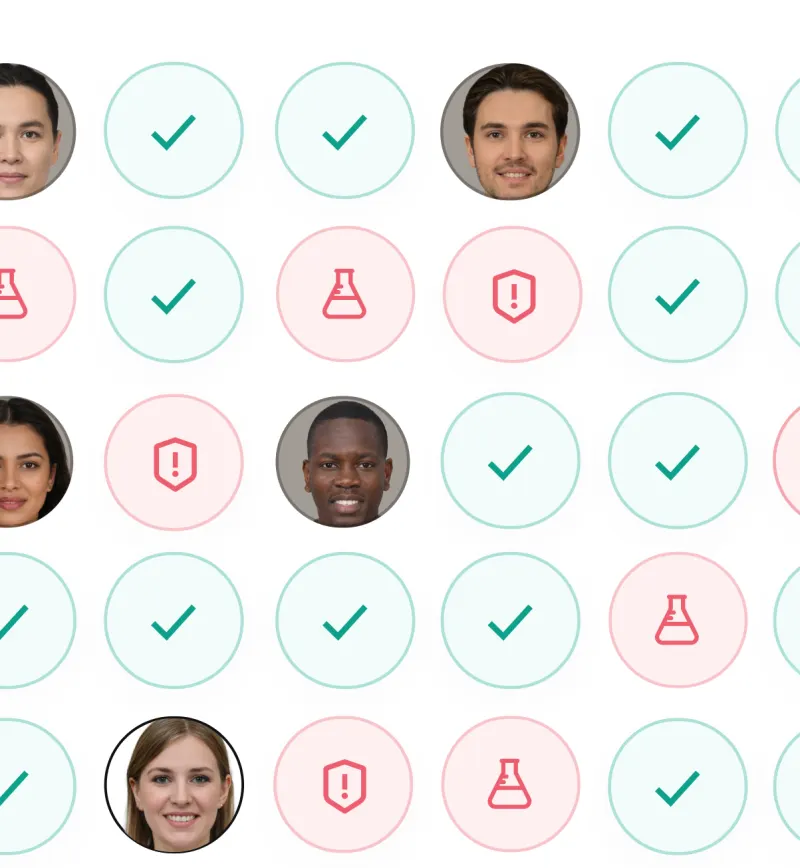

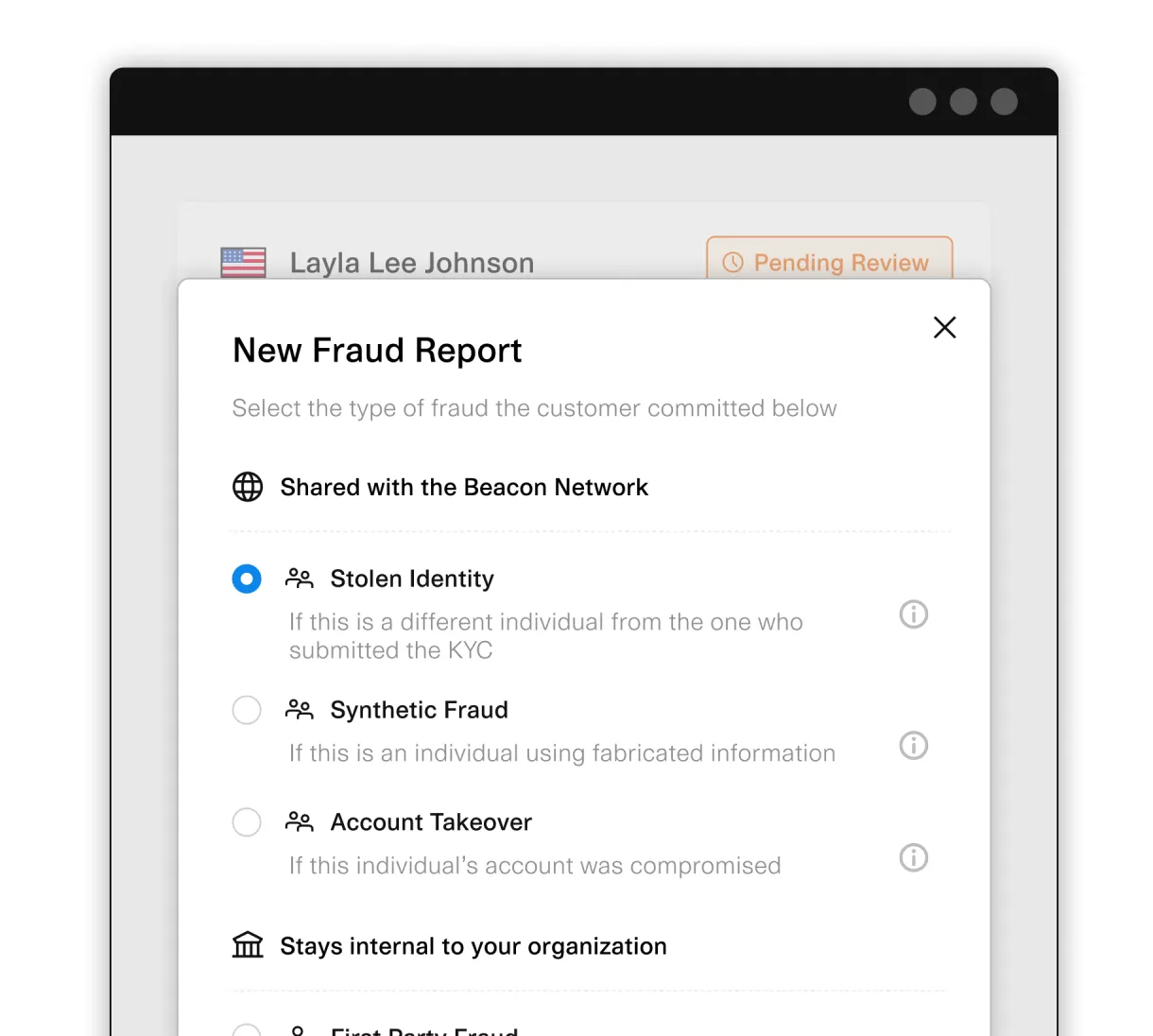

Report fraud, stop fraud

Report fraud and query against other reports made to Beacon to stop repeat fraud.

Defraud, meet defense

Plaid brings necessary network scale and expertise to help you safeguard against stolen and synthetic identities and account takeover threats. Inform Plaid Beacon of fraudulent actors, and query Beacon as to whether the identity data is associated with fraud elsewhere. Tap into insights from the Plaid network to analyze your Plaid-linked bank accounts for unique fraud indicators and help prevent fraud before it happens. Beacon is now available for the thousands of Plaid powered fintech apps and services to opt-in to.

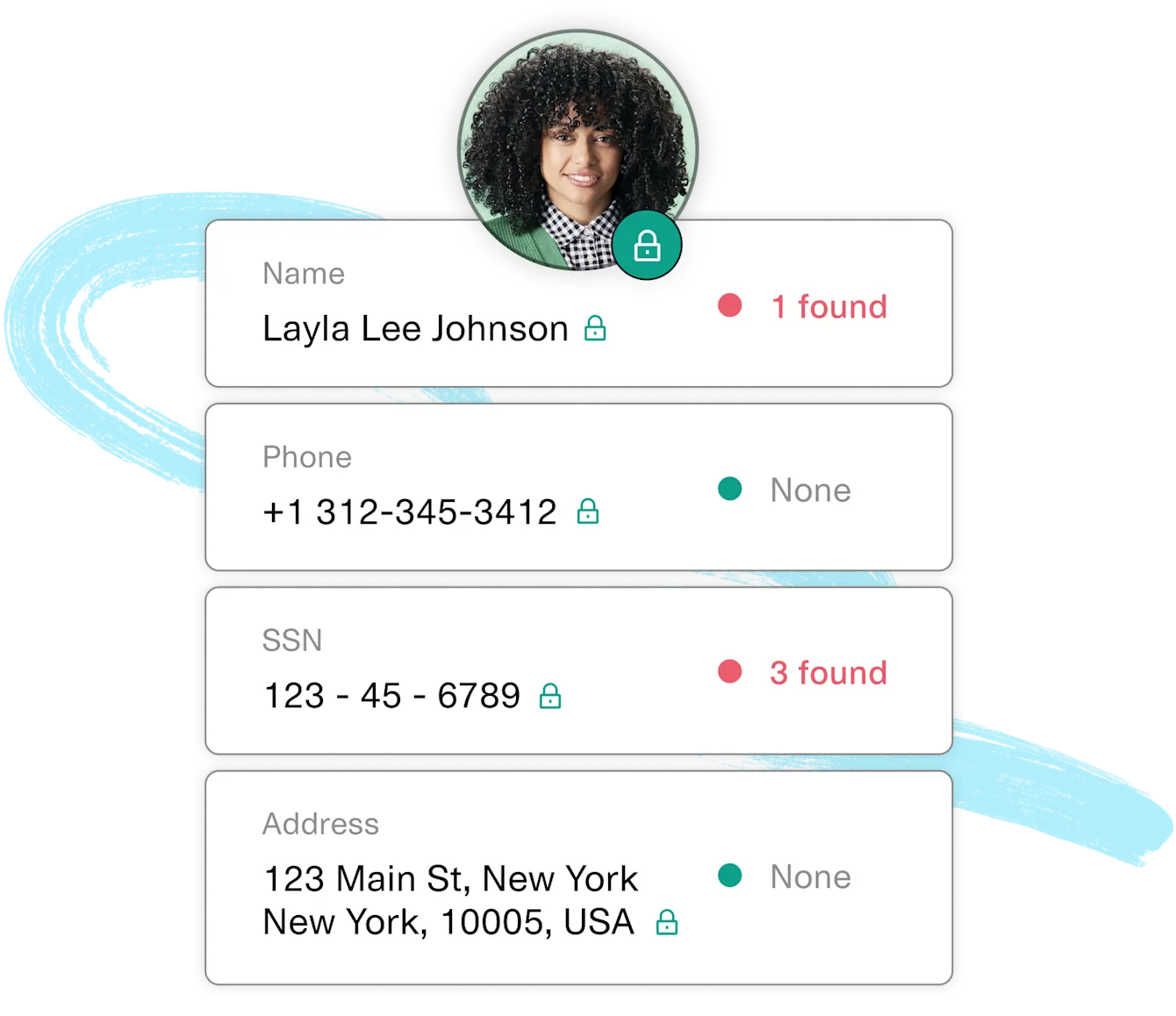

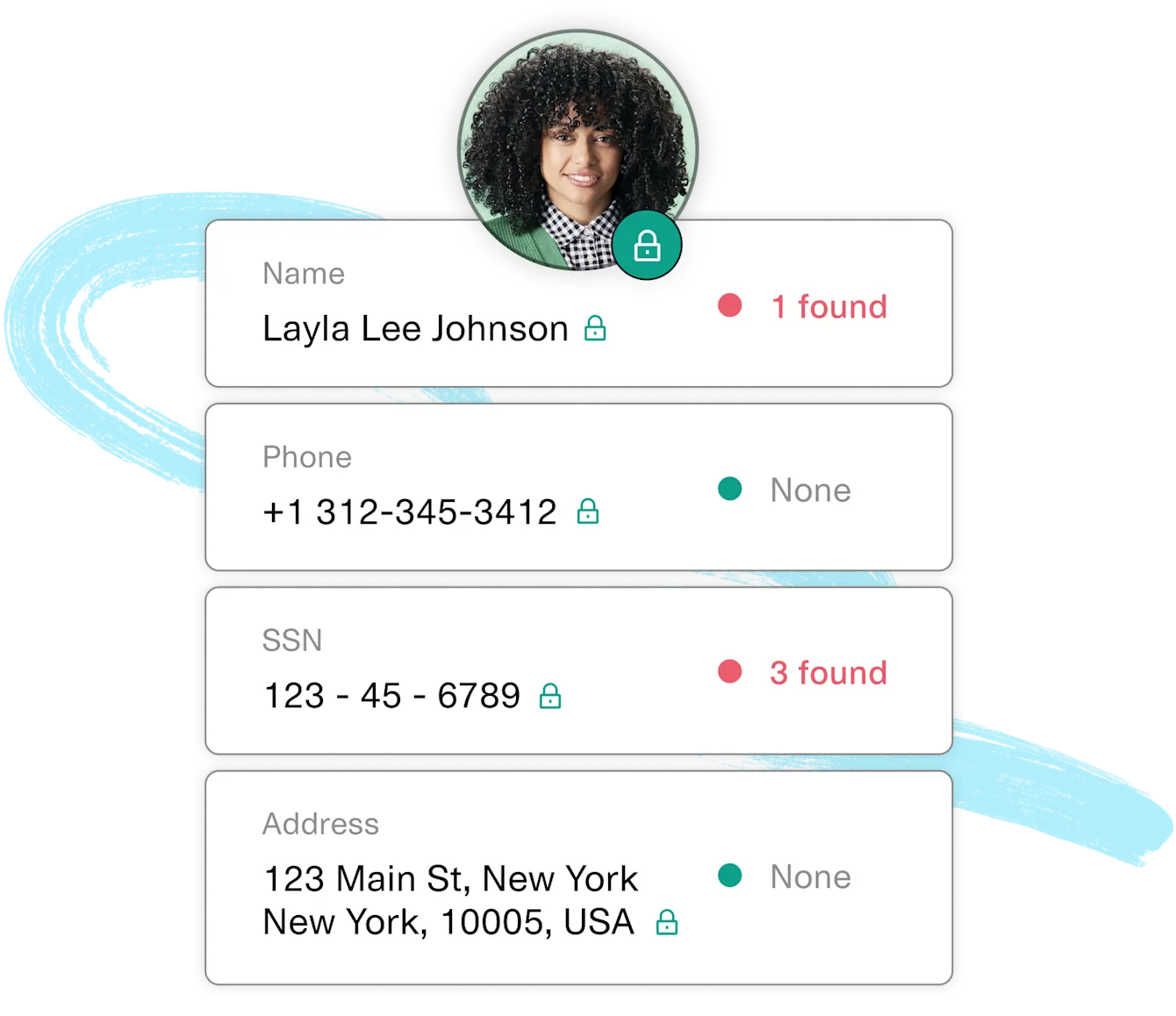

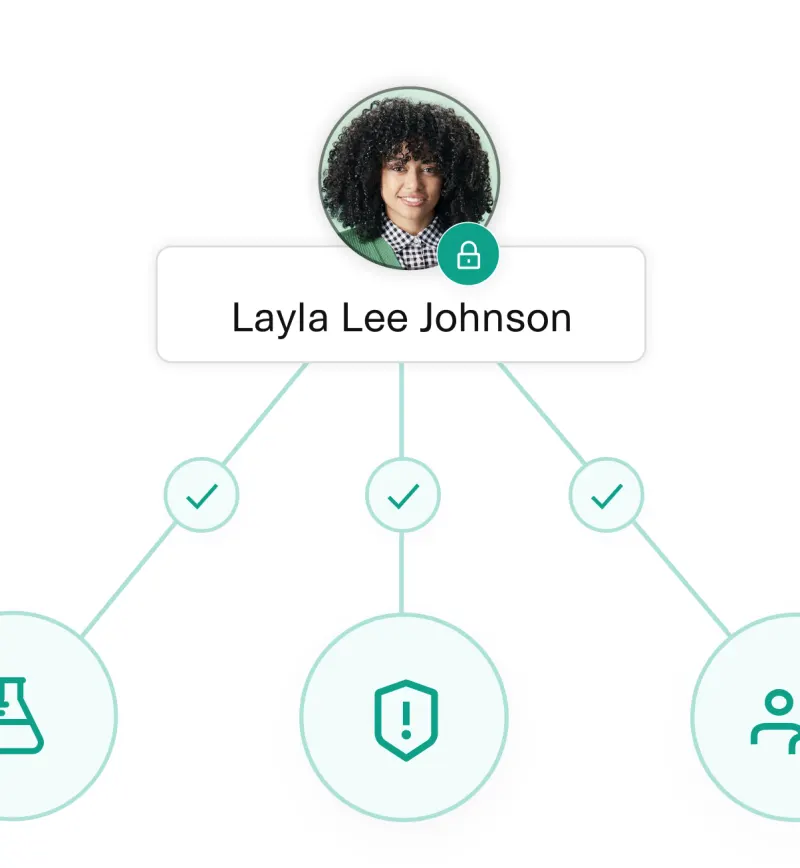

Reported as fraudulent

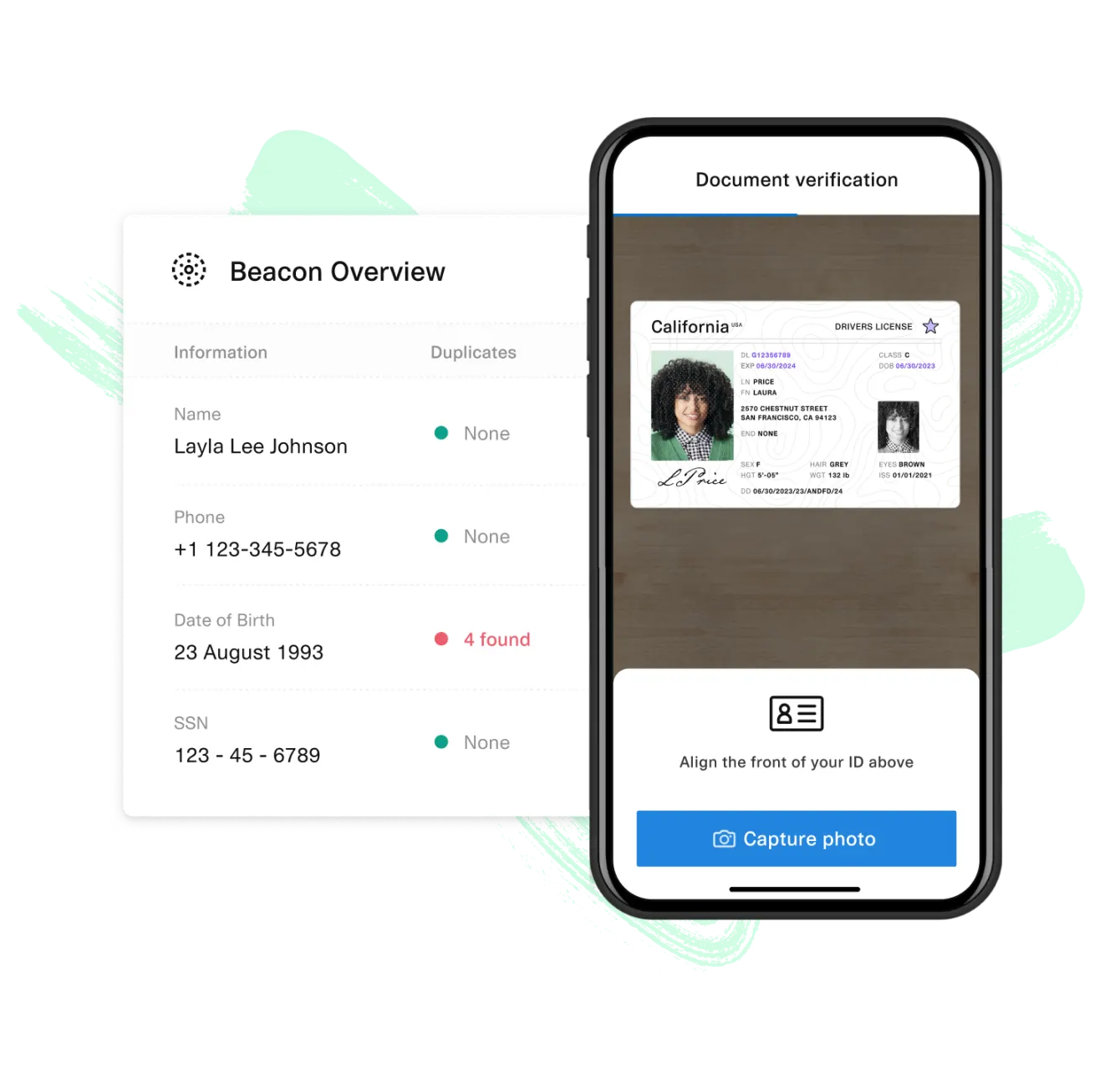

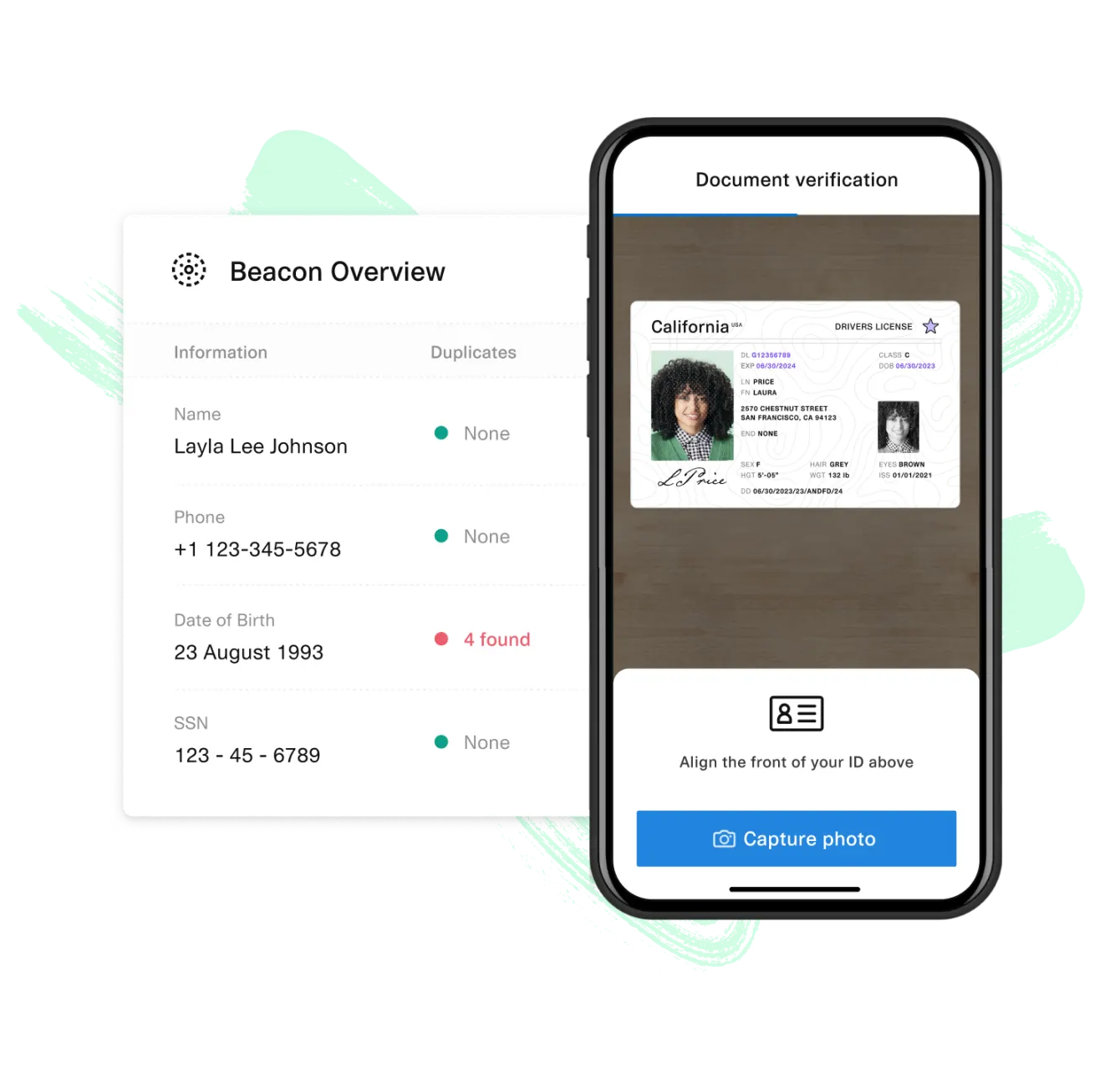

Understand if an identity or account and routing number is associated with stolen ID, synthetic, account takeover fraud, or a data breach.

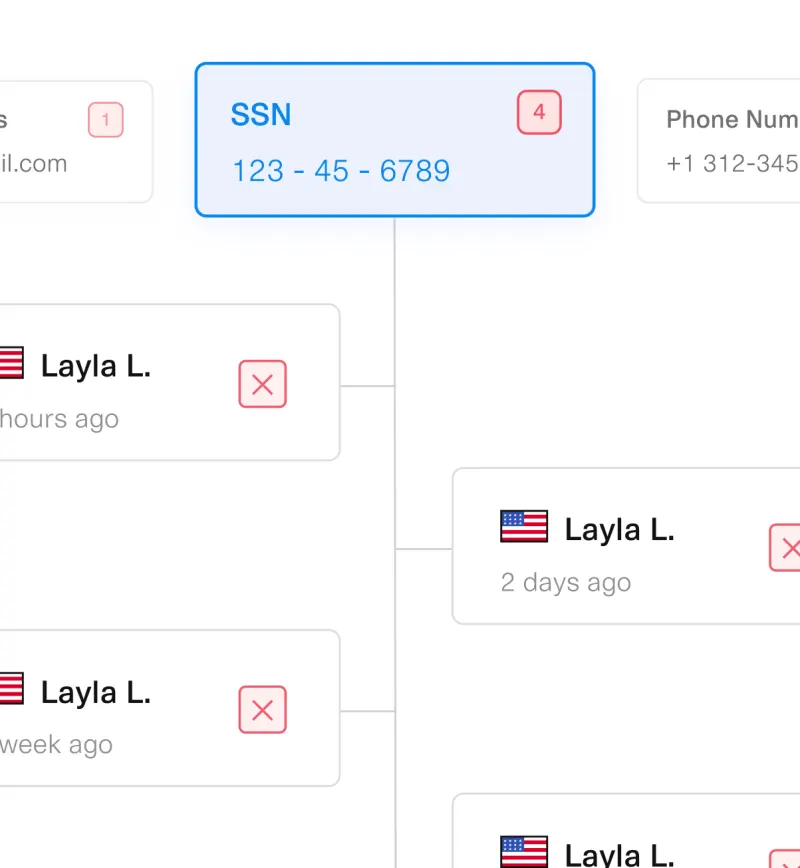

Number of fraud reports

See how many fraud reports are associated with identity data like name, phone number, SSN, and address

Who reported

Review the industry of the organization which made a report and when the report was made

Utilize bank account insights

Beacon provides 40+ attributes about your Plaid-linked accounts, including factors like: account age and status, number of connected apps via Plaid, frequency of account connections and related IP addresses, and identity changes to the account

Breached data reports

Understand if an identity or account and routing number is associated with breached data from the dark web

Secure and encrypted from end-to-end

All data that is reported to Beacon is aggregated and encrypted to protect sensitive identity information. Beacon never shares personally identifiable information (PII) or identity data with customers.

Secure and encrypted from end-to-end

All data that is reported to Beacon is aggregated and encrypted to protect sensitive identity information. Beacon never shares personally identifiable information (PII) or identity data with customers.

Protect identities from abuse and theft

Beacon helps detect data associated with stolen identity, synthetic, account takeover fraud, or a data breach.

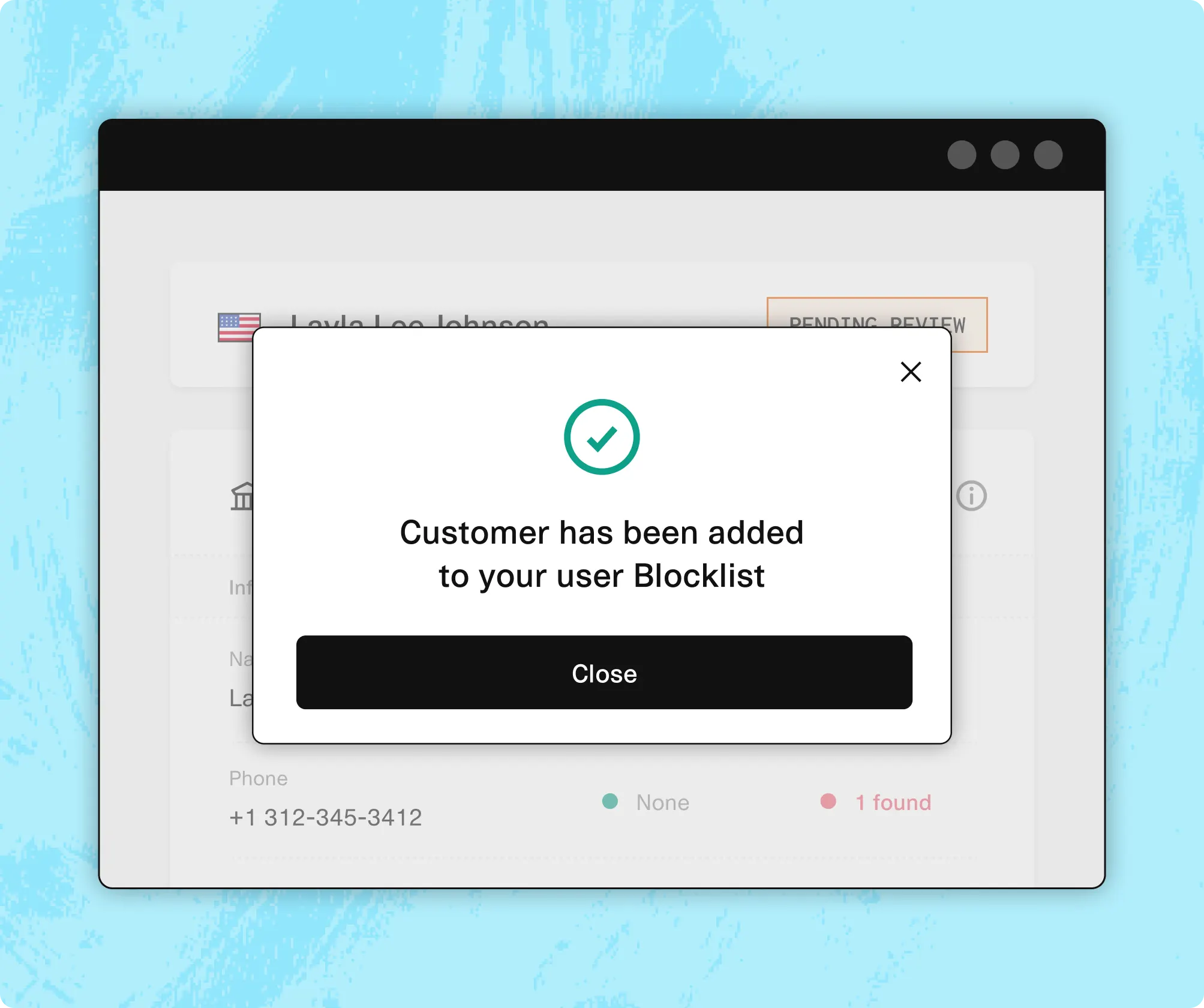

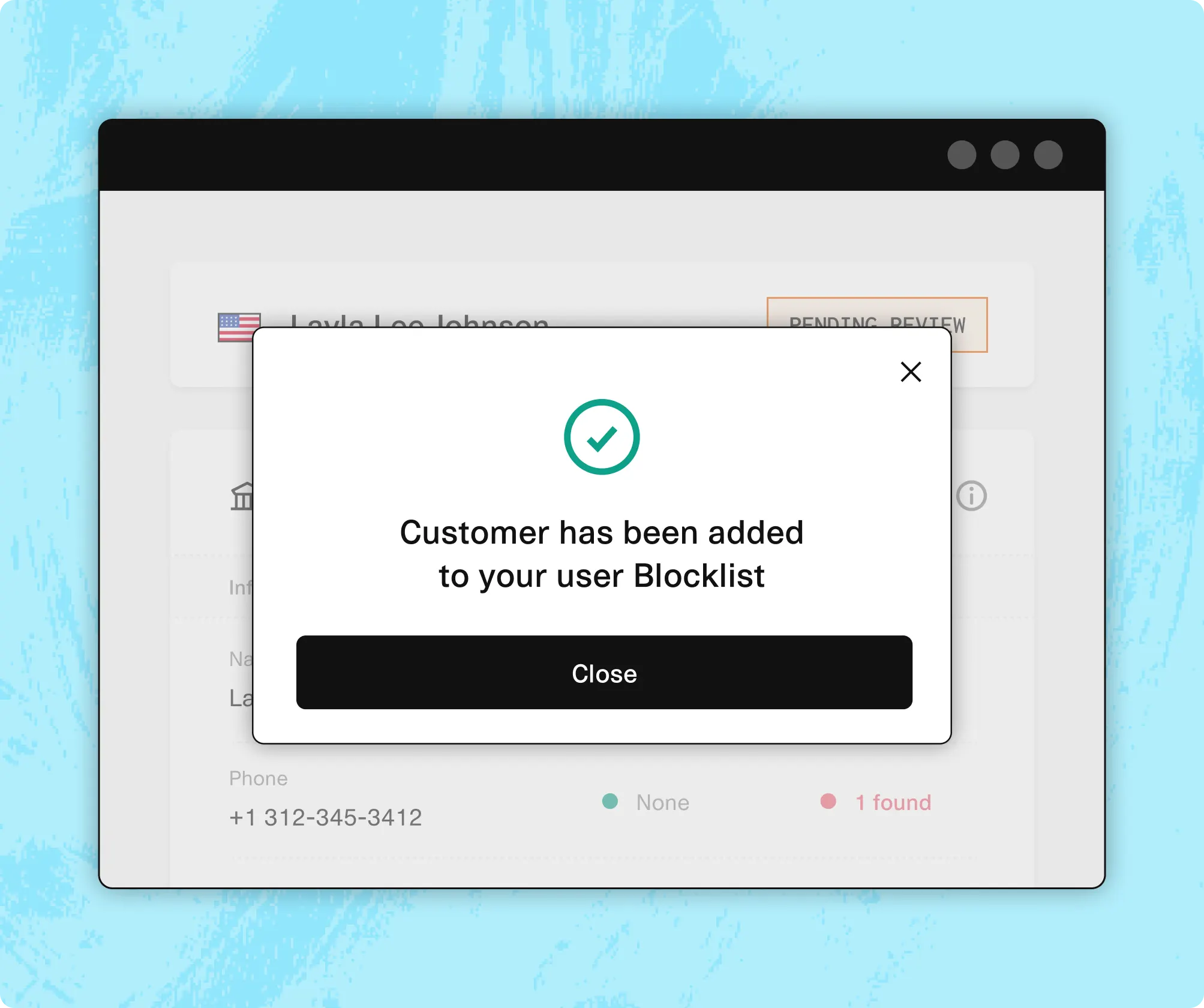

Screen identity data and receive matches based on previous reports shared with Beacon

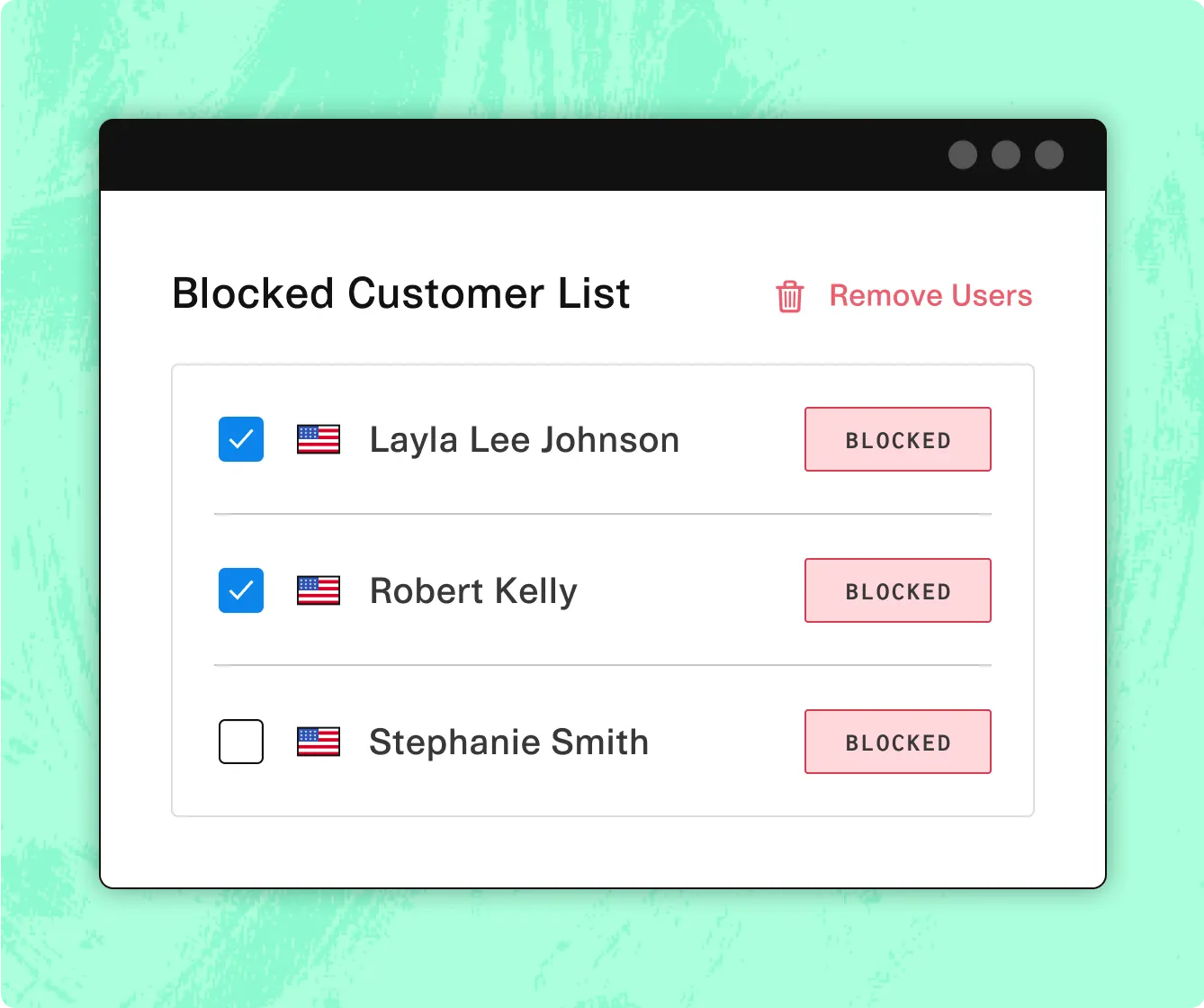

Automatically generate internal blocklists when you report fraud to stop repeat first party fraud and duplicate signup attempts on your platform

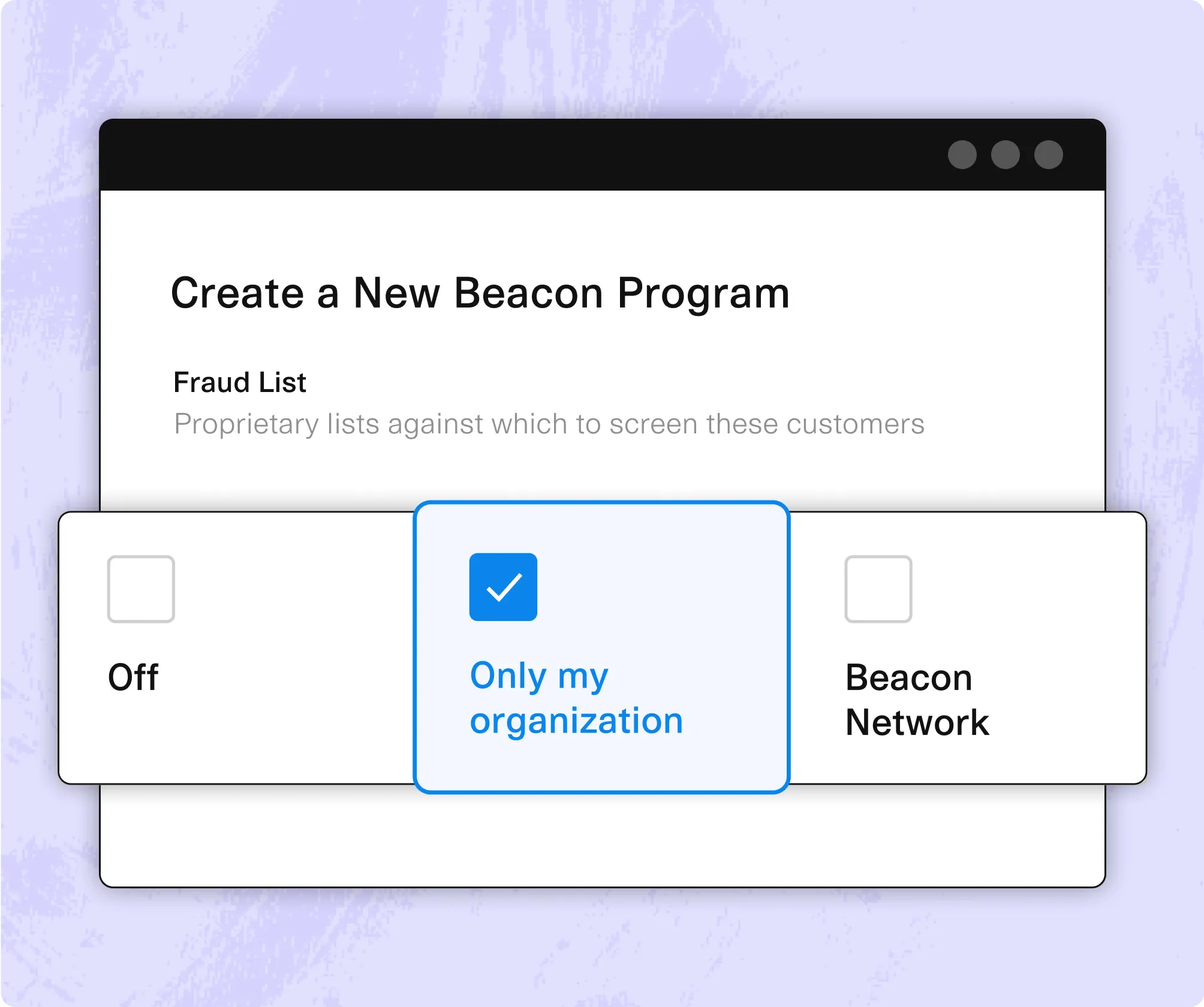

Create custom Beacon programs to screen against internal blocklists or the entire network

Stronger with Plaid Identity Verification

Pair Beacon with Identity Verification to block bad actors from your platform.

Learn moreStronger with Plaid Identity Verification

Pair Beacon with Identity Verification to block bad actors from your platform.

Learn more

Why Plaid Beacon

Unifying the ecosystem

Beacon is available to 8,000+ Plaid-powered fintechs and financial institutions of all sizes. No organization is excluded.

Protect consumers

Beacon helps to curb the abuse of stolen and manipulated identities. Help us create a safer digital finance ecosystem.

Growing and reliable

All members are required to report data on a continuous basis. Ongoing review of reports to increase precision and reliability.

Make reports to Beacon

API

Share fraud data programmatically via the API

Plaid dashboard

Make a fraud report via the Plaid dashboard