AUTO

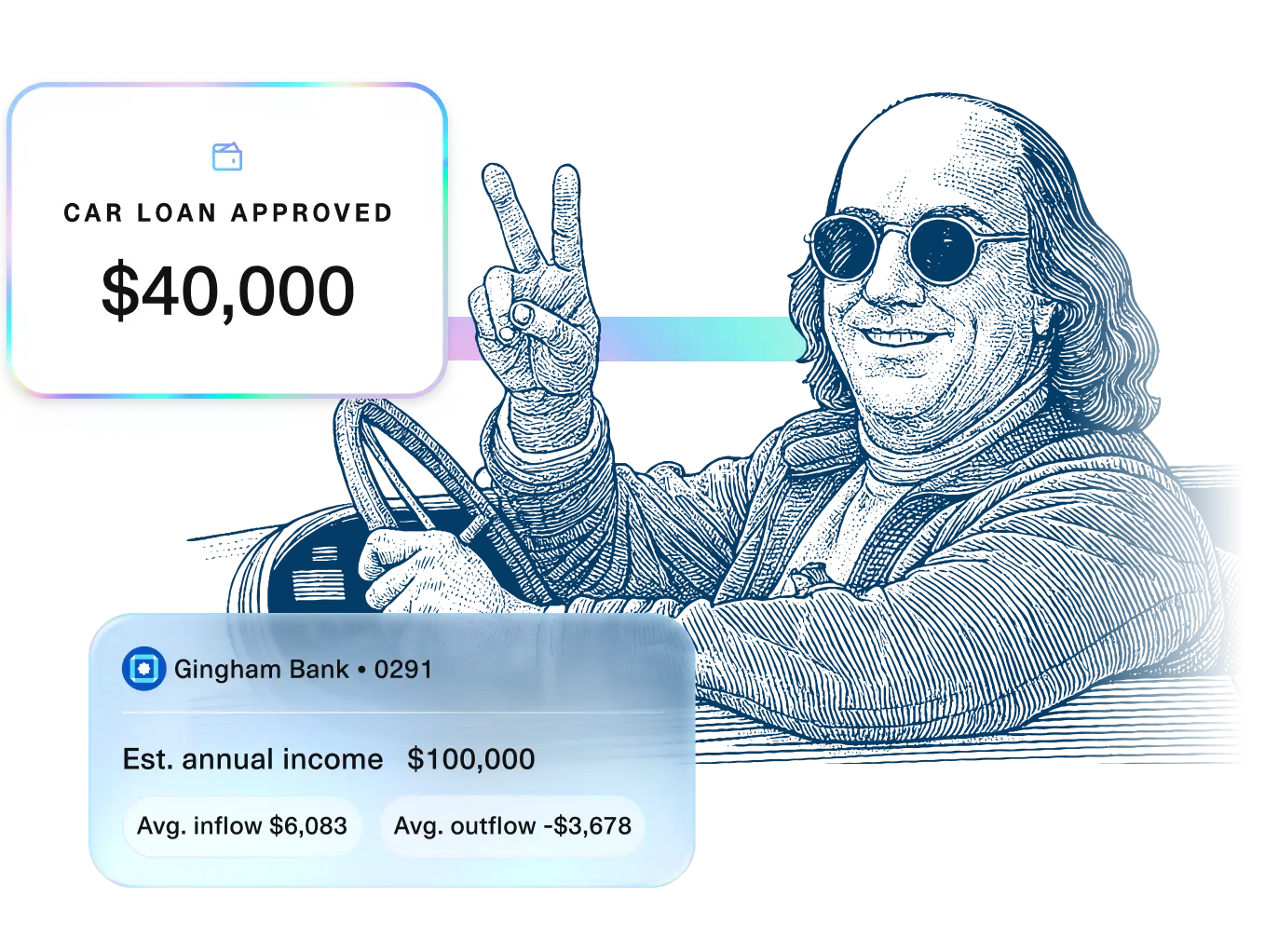

Remove speed bumps from auto financing

Approve more buyers right from the deal desk. Plaid helps you analyze financial stability, stop fraud in its tracks, and process real-time, irrevocable payments.

Instant income verification

Streamline income and employment verification, automating approvals and reducing pay stub fraud.

Visibility that drives approvals

Plaid’s cash flow data gets you under the hood to see a borrower’s true ability to pay, helping you approve more borrowers.

Deposits in seconds—not days

Skip the wait. Set up instant, irrevocable deposits and recurring billing, without compromising on security.

Verify income from the dealership chair

Give buyers a frictionless income and employment verification process—all without leaving the dealership.

Send a secure link via text or email

Applicants connect their bank account in 7 seconds

Get income and employment details instantly

Plaid’s income verification suite covers 100% of the U.S. workforce—including gig and self-employed workers—with insights into two years of transactions, plus net and gross earnings.

Verify income from the dealership chair

Give buyers a frictionless income and employment verification process—all without leaving the dealership.

Send a secure link via text or email

Applicants connect their bank account in 7 seconds

Get income and employment details instantly

Plaid’s income verification suite covers 100% of the U.S. workforce—including gig and self-employed workers—with insights into two years of transactions, plus net and gross earnings.

Plaid income verification suite provides 100% income verification coverage for the U.S. workforce.

Approve Owl saw a 20% reduction in proof-of-income fraud after working with Plaid.

More keys in hands—faster

Plaid helps dealers modernize auto underwriting and payments, increasing approvals while reducing fraud.

Find qualified borrowers with richer insights

Assess credit risk with precision using Plaid’s cash flow and credit data—plus Experian’s analytics—to approve up to 25% more borrowers while reducing losses.

Learn moreLeave bounced checks in the rearview mirror

Onboard buyers instantly by securely connecting their bank accounts, enabling irreversible initial deposits and recurring payments.

Learn moreOur work with Plaid unlocks a faster, more seamless checkout experience by enabling real-time payments at a critical step in the process.

Matt Dundas

Vice President of Finance, CarvanaRead the story