CUSTOMER: WYSH

Simplifying life insurance for the modern consumer

Wysh is reimagining life insurance for consumers—making it simple to understand, affordable to buy, and easy to use. The company’s flagship term life product is designed to meet people where they are, offering protection that feels as intuitive as the financial apps they already employ. With Plaid, Wysh delivers on that promise by enabling fast, secure, and frictionless payments that make buying life insurance as simple as it should be.

Problem: For Wysh, payments were one of the biggest barriers to delivering a modern, digital experience. Legacy systems relied on manual account entry and slow verification processes, which created friction for customers. ACH payments frequently failed due to insufficient funds or incorrect account details, forcing Wysh to maintain coverage while attempting to collect payment—an expensive and time-consuming process. Moreover, without proactive payment risk checks, the company faced greater exposure to fraud and unauthorized transactions.

Solution: By integrating Plaid, Wysh now has a solution that reduces payment failures, keeps recurring payments on track, and increases overall payment conversion. The result is a more reliable and efficient payment experience—helping customers get the coverage they need faster and maintain it when it matters most.

Key results:

Simplified premium payments, allowing users to activate coverage instantly through their payment accounts.

Accelerated Wysh Term onboarding and payment setup, supporting industry-leading acquisition speed and customer satisfaction.

“At Wysh, we’re building life insurance that actually fits people’s lives. Plaid makes that possible by taking one of the most frustrating parts of the process—payments—and making it invisible. It’s a simple, secure connection that lets us focus on what really matters: helping more people protect their families without the friction.”

Edwin EndlichChief Marketing Officer, Wysh

More customer stories

Reimagining big-ticket checkouts

Read story

Certifying rent payments with confidence

Read story

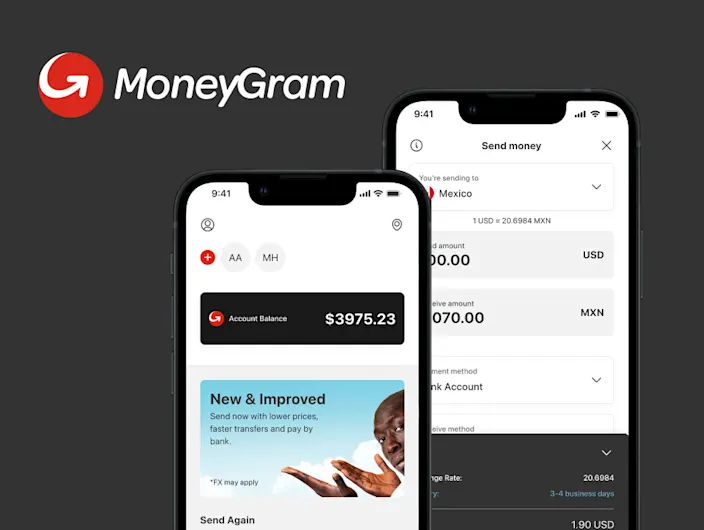

How MoneyGram is reshaping cross-border payments

Read story