CUSTOMER Q&A: Ava Finance

Automating credit access for the underserved

Ava uses Plaid to provide better financial outcomes—accessible to all.

Ava is expanding credit access to the underserved

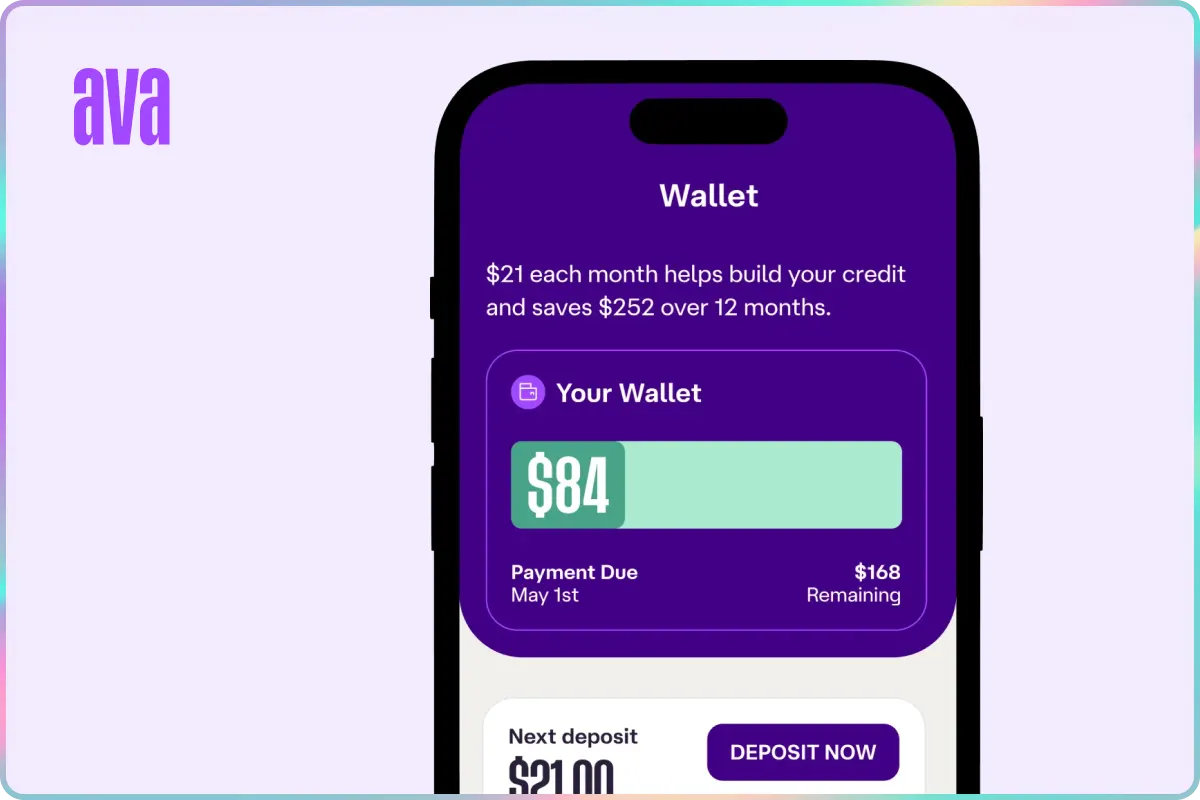

For many Americans, building credit and lowering the cost of debt is riddled with barriers—especially for those with thin or nonexistent credit histories. Ava, a mobile-first financial platform, is working to change that. With products like the Credit Builder Card and Savings Builder, Ava is helping people avoid predatory lending, reduce fees, and showcase their true creditworthiness.

To power these products, Ava relies on consumer-permissioned data from Plaid to underwrite their members without requiring a credit score, reduce fraud, and report everyday expenses that help build members’ credit. In this conversation, Omar Sinno, Co-Founder and CEO at Ava, explains how the company is reshaping the way credit is accessed and understood.

"Most Ava members can get approved for our credit builder card in under two minutes when they use Plaid to connect their bank accounts—and with no hard credit inquiry. That’s a game-changer."

Omar SinnoCo-Founder and Chief Executive Officer, Ava Finance

Plaid: Can you tell us a bit about Ava’s mission and who you serve?

Omar: Ava exists to help every American lower their cost of debt. We do so by giving people better, faster ways to showcase their creditworthiness—especially those underserved by traditional financial systems. These Americans are often overlooked by conventional underwriting—including students, gig workers, and others who might not have an established credit score.

Plaid: What are some of the challenges your customers face with traditional credit products

Omar: Most credit products rely too heavily on traditional credit scores, which don’t always paint the full picture. Our members use Ava to build and demonstrate their true creditworthiness quickly and seamlessly. We want to empower our members to access better financial products with lower interest rates and fewer fees—without relying solely on a score.

Plaid: How does Ava approach underwriting differently?

Omar: We believe cash flow is a more accurate indicator of creditworthiness,especially for those with little or no credit history. That’s why we underwrite members based on real-time cash flow data and behavioral insights from their activity on Ava, rather than relying exclusively on traditional credit reports.

Plaid: What led you to Plaid, and how are you using it today?

Omar: We turned to Plaid because it offered the most advanced and easy-to-implement platform for pulling cash flow data. That’s especially critical for members such as students, who need an alternative way to prove creditworthiness. We use Consumer Report (by Plaid Check) to power our underwriting and credit decisioning, as well as Transactions for rent and utility reporting.

Plaid: What other Plaid products have been helpful in supporting your mission?

Omar: Beyond Consumer Report and Transactions, we use Plaid to match bank account names to reduce fraud and run balance checks to help avoid punitive overdraft fees. These features contribute to a better user experience and smarter decisioning on our end.

Plaid: What impact have you seen since implementing Plaid?

Omar: The results have been exciting. Most Ava members can get approved for our credit builder card in under two minutes when they use Plaid to connect their bank accounts—and with no hard credit inquiry. That’s a game-changer. Plaid enables us to build cash flow profiles for our users, helping us personalize their experiences and continuously adapt as their financial lives evolve.

Plaid: Have you seen any changes in credit outcomes as a result?

Omar: Yes. Plaid has enabled us to offer products we couldn’t before. We can now underwrite users we previously had to turn away, and that’s led to better credit-building outcomes across the board.

Plaid: How has the experience been for your members connecting their accounts via Plaid?

Omar: Plaid is a well-known and trusted name in finance, so our members generally feel confident linking their bank accounts. That trust is priceless.

Plaid: You’re using cash flow data for rent reporting. Where do you see that heading?

Omar: We think cash flow will become foundational to underwriting and credit decisioning. As more institutions begin to recognize rent and utility payments as legitimate credit signals, we’re excited to help lead that shift—especially for people with thin or non-existent credit histories.

Plaid: What’s next for Ava, and how do you see Plaid playing a role?

Omar: Our vision is to make finance seamless and autonomous. Too often, people make poor financial decisions because they lack the right tools or information. Ava wants to be like an agent that acts on your behalf—making smart credit decisions for you, automatically. Plaid’s technology is critical to enabling that kind of autonomous finance.

More customer stories

Unlocking smarter credit decisioning

Read story

A faster way to pre-approve loans

Read story

Rethinking the rental experience

Read story