Billing & Recurring payments

Make ACH bill pay faster and more reliable

Making customers dig for checkbooks costs you revenue

Stop payment failures

Plaid pulls account and routing numbers directly from the bank—no more typos.

Keep recurring payments

Easy linking, balance checks, and recovery tools keep bill payments on schedule with less churn.

Boost customer conversion

With coverage across 95% of U.S. banks, more customers know Plaid and complete sign-up.

We needed a partner with the broadest and most trusted network for financial services in the U.S. Plaid has that.

Trevor Nies

SVP & Global Head of StrategyRead the story

Turn every setup into success

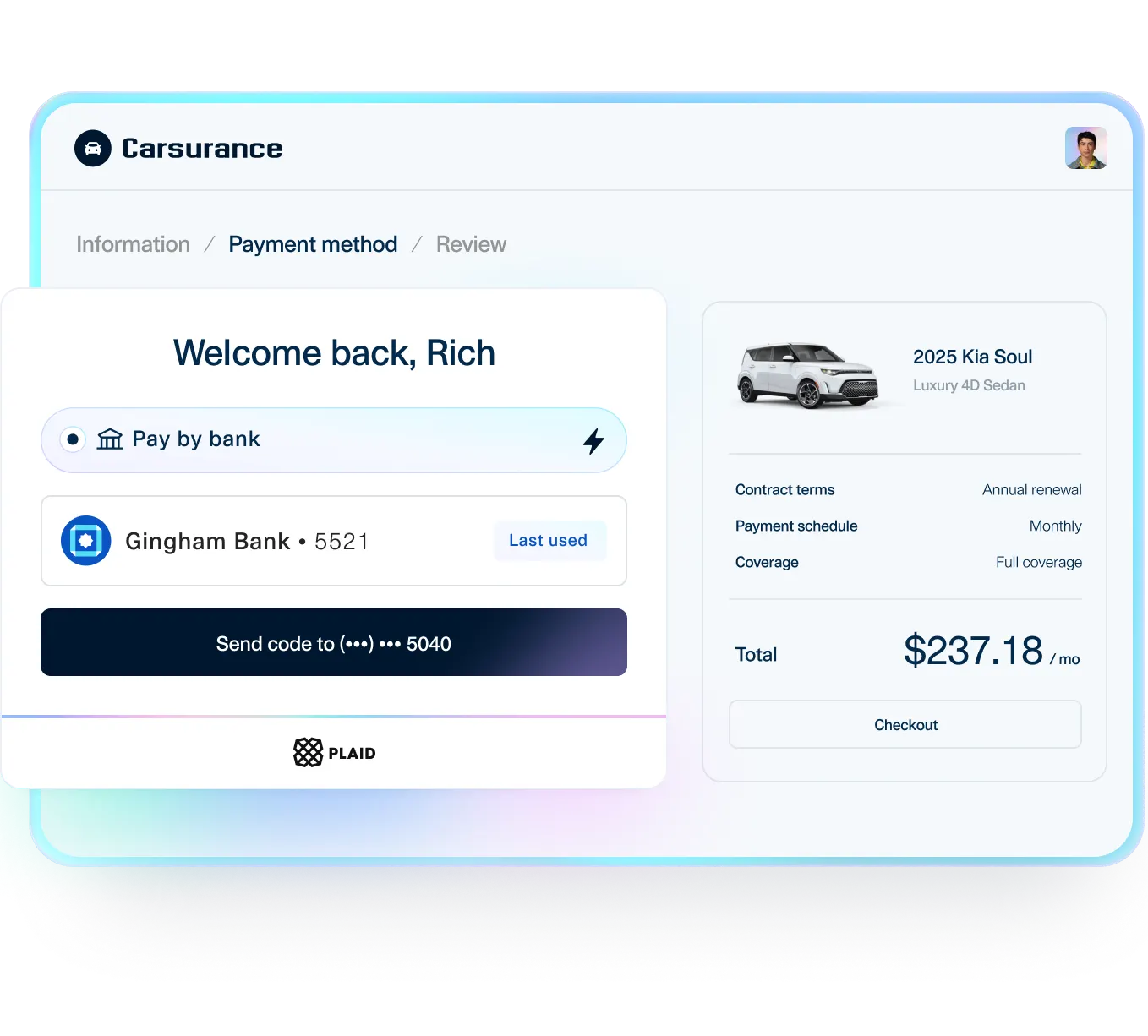

Effortless account linking

No delays or drop-offs. Plaid makes it easy for customers to connect their accounts instantly—so every connection has a chance to become a paying customer.

Instant login or fallback Biometrics, credentials, and manual entry are all validated in real time.

Status checked instantly Accounts are confirmed open and active before bill payments begin.

One-click for returning users Remembered customers can link instantly without re-entering details.

Effortless account linking

No delays or drop-offs. Plaid makes it easy for customers to connect their accounts instantly—so every connection has a chance to become a paying customer.

Instant login or fallback Biometrics, credentials, and manual entry are all validated in real time.

Status checked instantly Accounts are confirmed open and active before bill payments begin.

One-click for returning users Remembered customers can link instantly without re-entering details.

Instant account verification cuts ACH return rates by up to 40%

Link a bank account in an average of 7 seconds

Pay by bank reduces payment costs by an average of 40%

Stop fraud and risk in real time

Network-powered protection

Plaid analyzes 1,000+ data points—from account history, network activity, and balance checks—to stop fraud, flag risky bill payments, and protect your recurring revenue.

Network-powered protection

Plaid analyzes 1,000+ data points—from account history, network activity, and balance checks—to stop fraud, flag risky bill payments, and protect your recurring revenue.

We know that fraudsters are looking for the easiest way to make a buck, and they hit a significant roadblock with Plaid.

Mani Fazeli

Senior Vice President of ProductRead the story

Keep revenue flowing with every payment

Keep autopay on track

Catch low balances or closed accounts early to keep autopay steady.

Retry at the best time

Retry payments when funds are available with real-time insights to reduce failures.

Settle risky payments faster

Re-route through Same Day ACH or Request for Payment (RfP) to keep bill payments on track.

Why ACH wins for bill pay

Known and trusted by millions

Plaid makes ACH feel familiar, trusted, and as fast as cards—so customers actually choose it as their billing method.

Known and trusted by millions

Plaid makes ACH feel familiar, trusted, and as fast as cards—so customers actually choose it as their billing method.

Build the billing stack that fits

Account verification

Verify accounts instantly with login, manual entry, or microdeposits for smooth onboarding.

Start verifying accountsRisk management

Lower ACH returns and fraud with real-time account checks and predictive risk modeling.

Start reducing riskBank payments

Offer secure ACH payments that can reduce costs compared with cards.

Start moving money