Customer: August

How August drove 25% higher product adoption

Learn how August built a smoother, faster and more intelligent experience for both tenants and landlords.

Transforming landlord finance through real-time rent intelligence

For years, landlords across the UK have managed their lettings with a patchwork of spreadsheets, bank screenshots and late-night reconciliations. Rent status lived across WhatsApp threads and banking apps and a missed payment might go unnoticed until weeks later. August was built to change that. Their mission is to give every landlord the clarity, control and automation that previously only professional agents could access.

As August set out to build an intelligent, end-to-end finance layer for landlords, they needed reliable, real-time financial data they could trust. This meant moving beyond manual uploads and fragmented records toward a connected platform where income, expenses, rent status and payments all flow automatically. So in 2024, August partnered with Plaid.

Turning raw bank data into a live rent ledger to drive 25% higher product adoption

Now that tenants can now securely connect their bank accounts through Plaid, August uses real-time transaction data to detect rent payments automatically. An in-house matching algorithm links payments to the right tenancy and presents landlords with a clean, bank-verified rent status either paid, partial, pre-paid or late.

This improved process has boosted product usage. Customers who connect their bank engage far more deeply with August’s platform. 84% of customers who connect via Plaid use two or more features, compared with just 59% of those who don’t.

But August doesn't just use Plaid for connectivity. August has become a fully automated financial hub for landlords, reshaping how landlords run their portfolios. From income and expense categorisation to Pay by Bank payments, everything now sits in one place, clearly and consistently.

A simpler way for landlords to stay on top of rent

Rent tracking has quickly become August’s flagship feature. It is now the default workflow for landlords and tenants, embedded deeply into tenancy records, reminders and compliance processes. 91% of August’s paid customers connect their accounts via Plaid to manage rent tracking. And adoption grows with portfolio size, reaching 100% among landlords with 5–9 properties. Rent tracking now outperforms every other feature on the platform, from compliance tasks to document storage and AI assistance.

As payments are recognised automatically, there’s no more proving when rent was sent or waiting for confirmation. The whole process becomes smoother, faster, and more transparent for everyone, building trust on both sides of the tenant and landlord relationship.

A single source of truth for landlord finance

By anchoring rent tracking in live bank data, August has eliminated the uncertainty that comes with manual reconciliation. Landlords no longer cross-reference PDFs, spreadsheets, and statements. Instead, they work from a single, up-to-date source of truth.

This clarity powers better decisioning, from monitoring arrears to managing cash flow and preparing for Making Tax Digital requirements. And because Plaid also supports account ownership checks and payments through our auth and identity products, August has been able to extend automation across the entire landlord finance journey.

“Plaid has gone from being an integration on our roadmap to a core part of how August works. Their APIs let us turn raw transaction data into real time rent tracking for landlords using our in-house algorithm. It’s the foundation we’re now using to match transactions to rent payments across portfolios to provide a far better experience for small landlords and their tenants.”

Says Samuel Cope, Founder of August

If you would like to learn more about how Plaid can transform your property business, get in touch today.

More customer stories

How Affirm is creating the future of digital lending

Read story

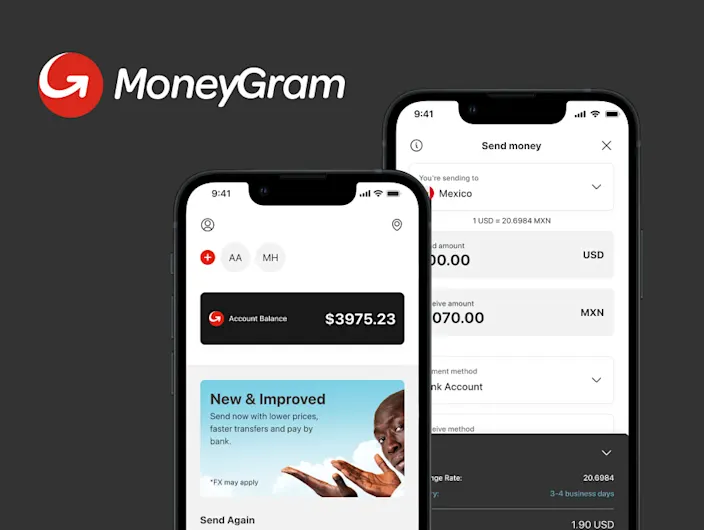

How MoneyGram is reshaping cross-border payments

Read story

Unboxing high-speed, low-fee payments

Read story