Flexible Auth

Let end users to choose between login-based and micro-deposit based flows

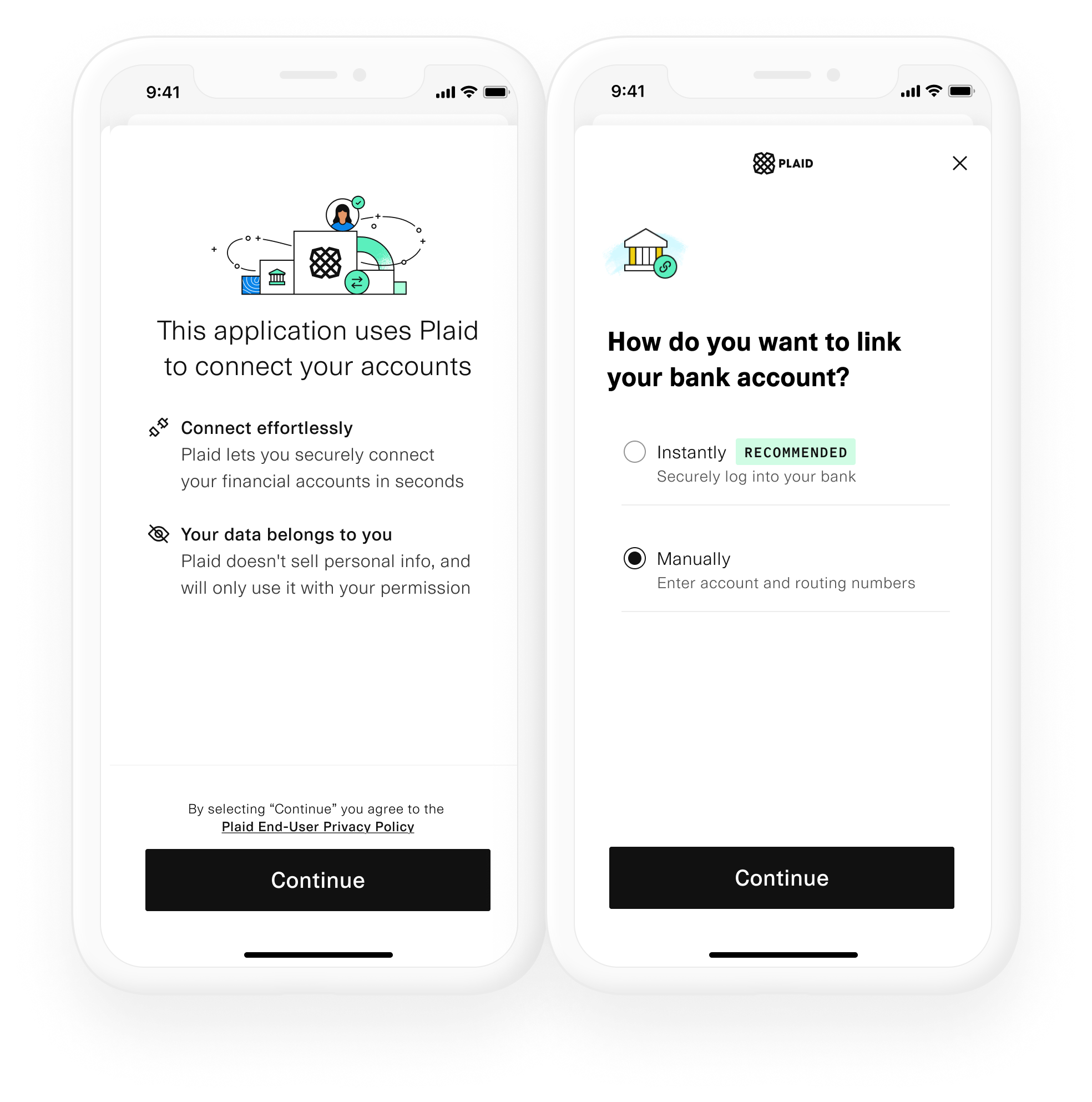

Overview of Flexible Auth

Flexible Auth lets end users choose upfront between instant account authentication and micro-deposits in the Plaid Link flow. By offering this choice, you can better convert users who can't or don't want to use credential-based Instant Auth. Integrations that use Flexible Auth can expect conversion improvements of up to 5-10 percentage points.

Flexible Auth provides an additional entry point into Same Day Micro-deposits.

Requirements

Because Flexible Auth gives your users a choice between Same Day Micro-deposits and Instant Auth, you should only use Flexible Auth if your flow is compatible with the limitations of Same Day Micro-deposits: countries supported must be US only, you must not require the use of any Plaid products other than Auth, and your flow must support a delay of anywhere from several hours to 1-2 days between presenting Link and verifying the user's account.

Access to Flexible Auth is not enabled by default. To enable Flexible Auth, contact your Plaid account manager.

Implementing Flexible Auth

The integration for Flexible Auth is identical to Same Day Micro-deposits, with the addition of the auth object to the request to /link/token/create to create a link_token. This is the only difference between the Same-Day Micro-deposits flow and the Flexible Auth flow.

In order to realize conversion benefits from implementing Flexible Auth, you must prompt your users to verify micro-deposits in Link, as recommended in the Same Day Micro-deposits documentation. Failing to do so may result in a net conversion decrease from implementing Flex Auth.

Configure & Create a link_token

productsarray should include onlyauthas a product when using Same Day Micro-deposit verification. While in most cases additional products can be added to existing Plaid Items, Items created for same-day manual micro-deposit verification are an exception and cannot be used with any Plaid products other than Auth. To use another product with the same bank account, your user will need to re-link their account.country_codesset to['US']– Micro-deposit verification is currently only available in the United States.

1const request: LinkTokenCreateRequest = {2 user: {3 client_user_id: 'user-id',4 },5 client_name: 'Plaid Test App',6 products: ['auth'],7 country_codes: ['US'],8 language: 'en',9 webhook: 'https://sample-web-hook.com',10 redirect_uri: 'https://domainname.com/oauth-page.html',11 auth: {12 flow_type: 'FLEXIBLE_AUTH',13 },14};15try {16 const response = await plaidClient.linkTokenCreate(request);17 const linkToken = response.data.link_token;18} catch (error) {19 // handle error20}Once you’ve acquired the link_token, use it to initialize Link in order to exchange it for a public_token.

When the user successfully logs into their institution or inputs their account and routing numbers, the onSuccess() callback function will return a public_token.

1const linkHandler = Plaid.create({2 // Fetch a link_token configured for 'auth' from your app server3 token: (await $.post('/create_link_token')).link_token,4 onSuccess: (public_token, metadata) => {5 // Send the public_token and connected accounts to your app server6 $.post('/get_access_token', {7 publicToken: public_token,8 accounts: metadata.accounts,9 });10

11 metadata = {12 ...,13 link_session_id: String,14 institution: {15 name: null, // name is always null for Same Day Micro-deposits16 institution_id: null // institution_id is always null for Same Day Micro-deposits17 },18 accounts: [{19 id: 'vzeNDwK7KQIm4yEog683uElbp9GRLEFXGK98D',20 mask: '1234',21 name: null,22 type: 'depository',23 subtype: 'checking',24 verification_status: 'pending_manual_verification'25 }]26 }27 },28 // ...29});30

31// Open Link on user-action32linkHandler.open();Examine the value of metadata.accounts[0].verification_status returned by the onSuccess callback. If it is not returned or null, the user has chosen Instant Auth and you can proceed to call Auth endpoints. If it is pending_manual_verification, the user has chosen Same Day Micro-deposits. Proceed with the instructions for Same Day micro-deposits.