Add institution coverage

Support Auth for more US financial institutions and users

Overview

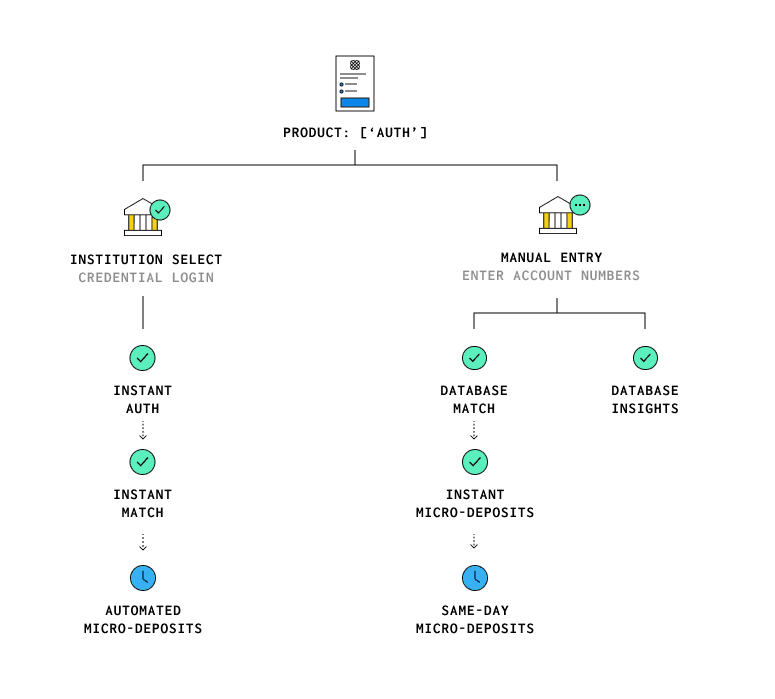

Instant Auth covers approximately 95% of users' eligible bank accounts. For the remaining ~5%, or users who choose not to use instant credential verification, Plaid offers users the ability to verify their accounts through an optimized set of database validation and micro-deposit flows.

The following flows are enabled in your app by default once you have integrated Auth:

- Instant Auth: User enters their credentials and is authenticated immediately. This is the default flow.

- Instant Match (US only): User enters their credentials, account number, and routing number. Plaid matches user input against masked values and authenticates immediately.

To increase conversion, you can implement the following additional Auth flows:

- Instant Micro-deposits (US only): User enters account and routing numbers. Plaid makes a RTP or FedNow micro-deposit and the user manually verifies the code in as little as 5 seconds.

- Automated Micro-deposits (US only): User enters their credentials, account number, and routing number. Plaid makes a micro-deposit and automatically verifies the deposit in as little as one to two business days.

- Same Day Micro-deposits (US only): User enters account and routing numbers. Plaid makes a Same Day ACH micro-deposit and the user manually verifies the code in as little as one business day.

- Database Insights (Beta, US only): User enters account and routing numbers. Plaid verifies the account against the Plaid Network and provides your app with a verification status indicating its viability for ACH.

- Database Match (US only): User enters account and routing numbers and name. Plaid verifies the values against the Plaid Network and if matched, verifies the account. If not matched, can proceed to micro-deposit authentication.

Accounts verified via the manual entry of account numbers (using Database Insights, Database Match, Instant Micro-deposits, or Same-Day Micro-deposits) do not have active data connections with a financial institution. These accounts and their associated Items can only be used with Auth and Transfer, not with any other Plaid products (such as Balance or Transactions), with the partial exception of Identity Match and Signal.

Plaid will attempt to use the flows in the following order of preference: Instant Auth, Instant Match, Automated Micro-deposits, Database Match / Database Insights, Instant Micro-deposits, Same-Day Micro-deposits. For example, the Same Day Micro-deposits flow will only be used if no instant flows are available, Automated Micro-deposits is not available, Database Insights is disabled, and Database Match is either disabled or a match could not be found.

For each of these flows, Plaid will automatically prompt the user for the appropriate information. If a user cannot find their financial institution when searching, Plaid Link will prompt them to link with account numbers, where they can enter the Database Insights, Database Match, Instant Micro-deposits, or Same Day Micro-deposits flow.

To see which Auth flows a given institution supports, you can call /institutions/get with options.include_auth_metadata set to true. The results will be returned in the auth_metadata.supported_methods object in the response. Alternatively, you can see this information on the Institution Status page in the Plaid Dashboard. The Same Day Micro-deposits, Database Insights, and Database Match flows will not appear in these results, as they do not depend on institution capabilities and are available at all institutions.

Next steps

Instant Auth, Instant Match, and Instant Micro-deposits

Support the default Auth flows

View guideAutomated Micro-deposits

Integrate the automated micro-deposit flow

View guideSame Day Micro-deposits and Database Match

Integrate the manual micro-deposit flow

View guideDatabase Insights (beta)

Integrate the Database Insights (beta) flow

View guide