FRAUD AND COMPLIANCE

Tough on fraudsters, easy on customers

Don’t lose good customers to bad anti-fraud tools. Fight fraud while boosting conversion and protecting your bottom line.

Safeguard every stage of the customer journey

Know your customer

Verify a customer’s identity, assess risk factors, and get notified if they’re associated with fraud on other platforms

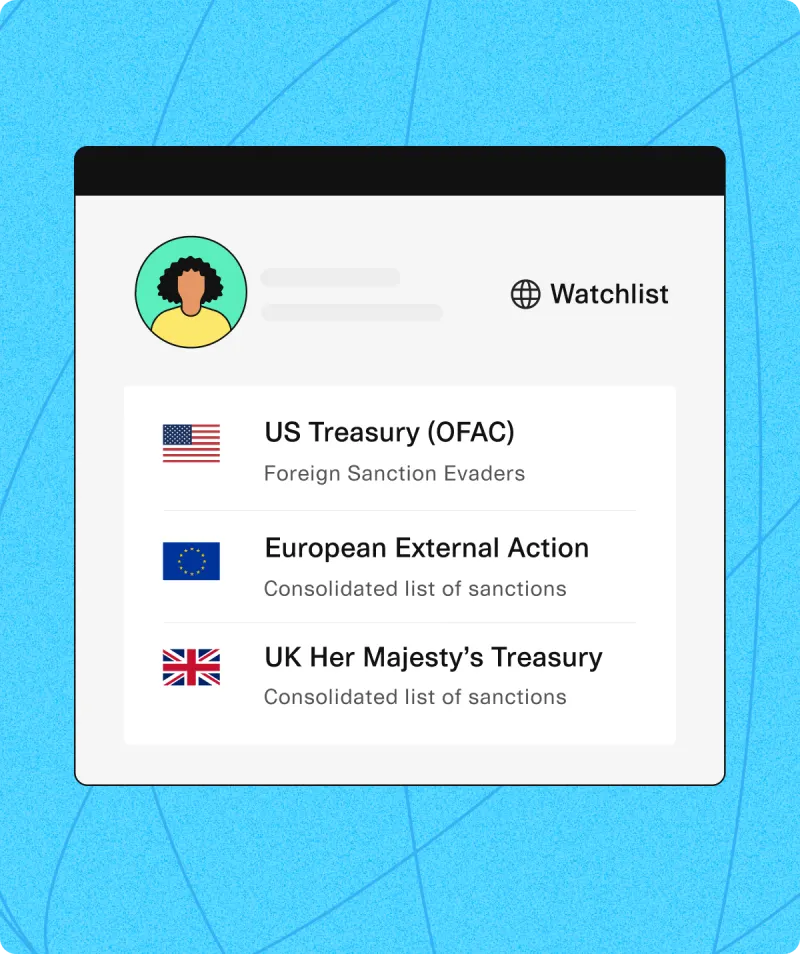

Automate AML compliance

Identify money mules and politically exposed persons with automated global watchlist screening

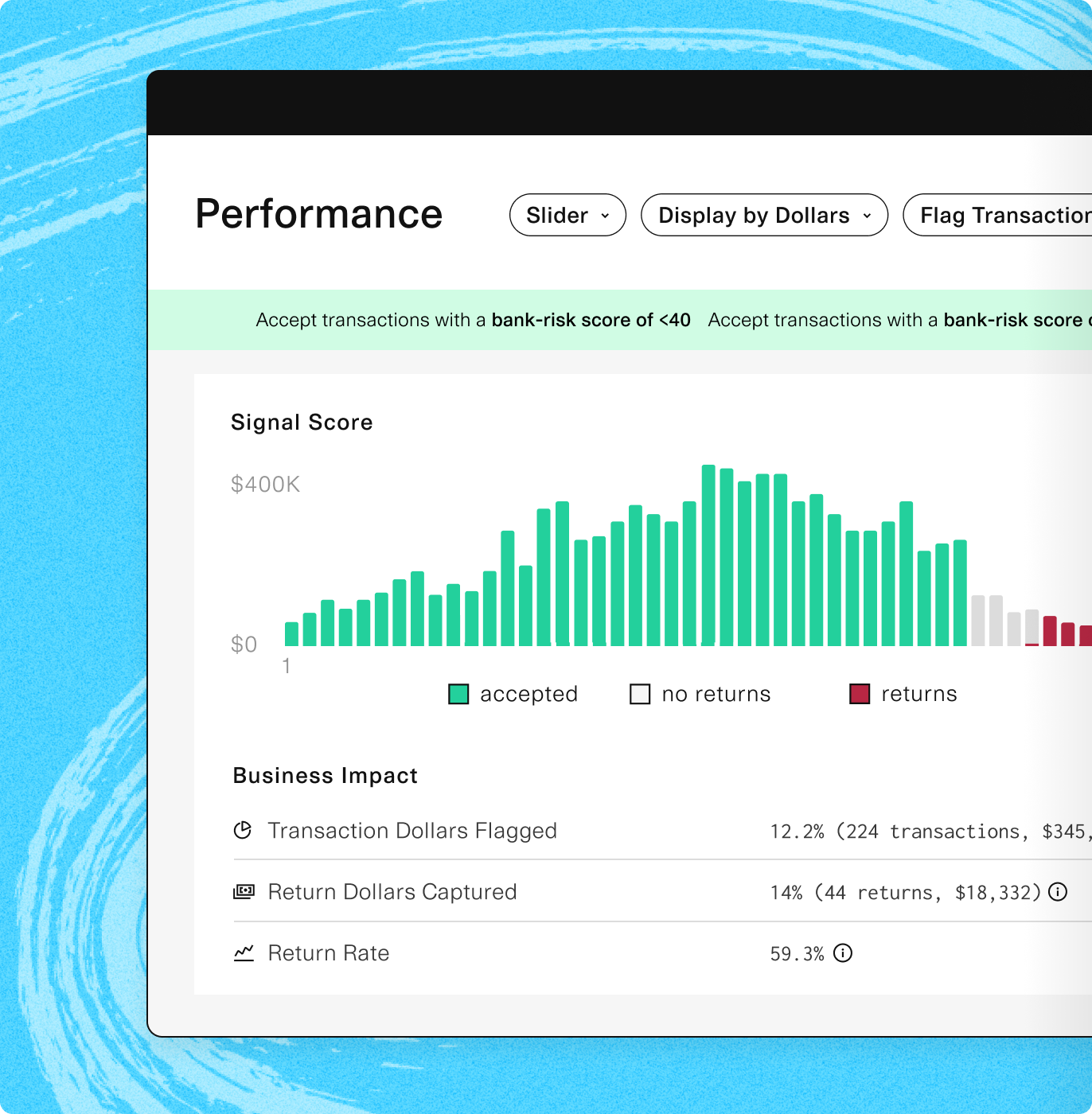

Secure transactions

Enhance your risk program with ML-powered predictive scoring that flags risky ACH transactions and helps prevent costly returns

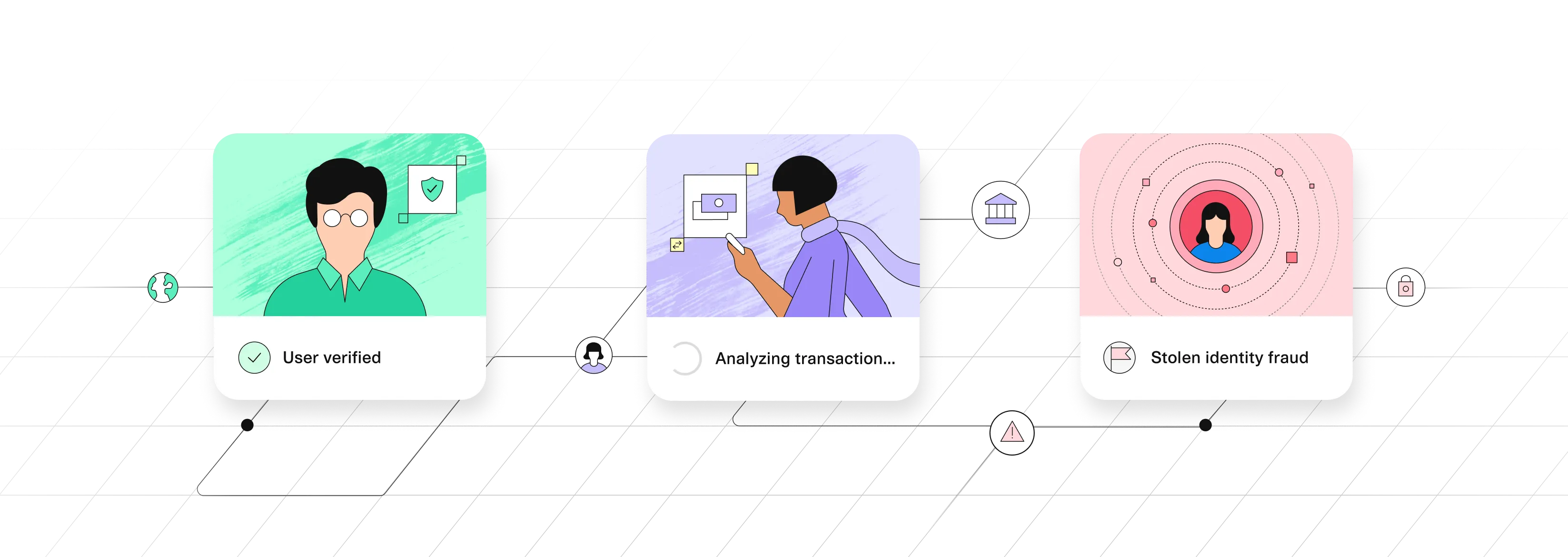

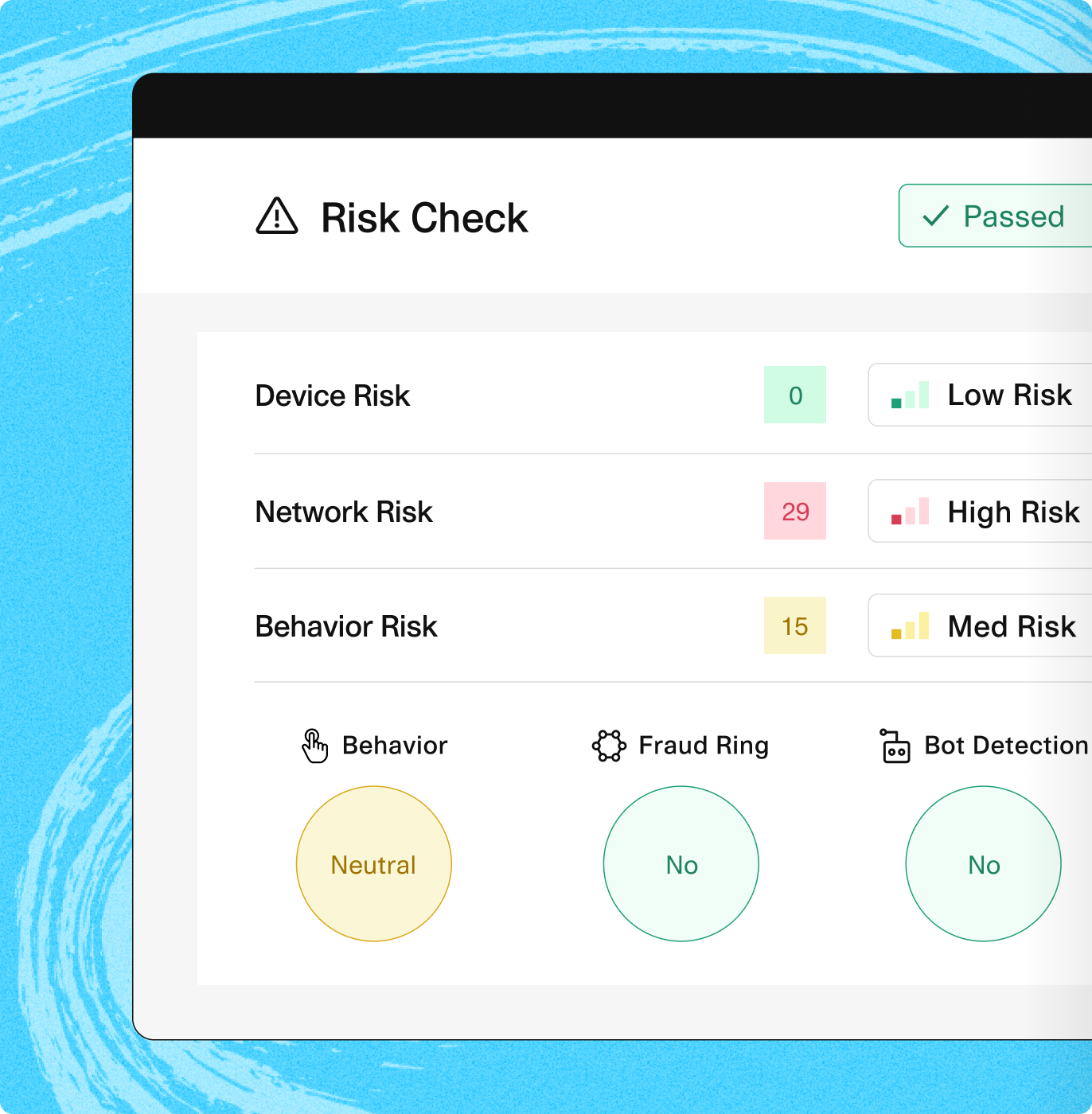

Stop fraud earlier, faster, and in more places

Thanks to our robust fraud detection tools, you’ll have everything you need to flag suspicious activity and stop fraudsters without disrupting the customer experience.

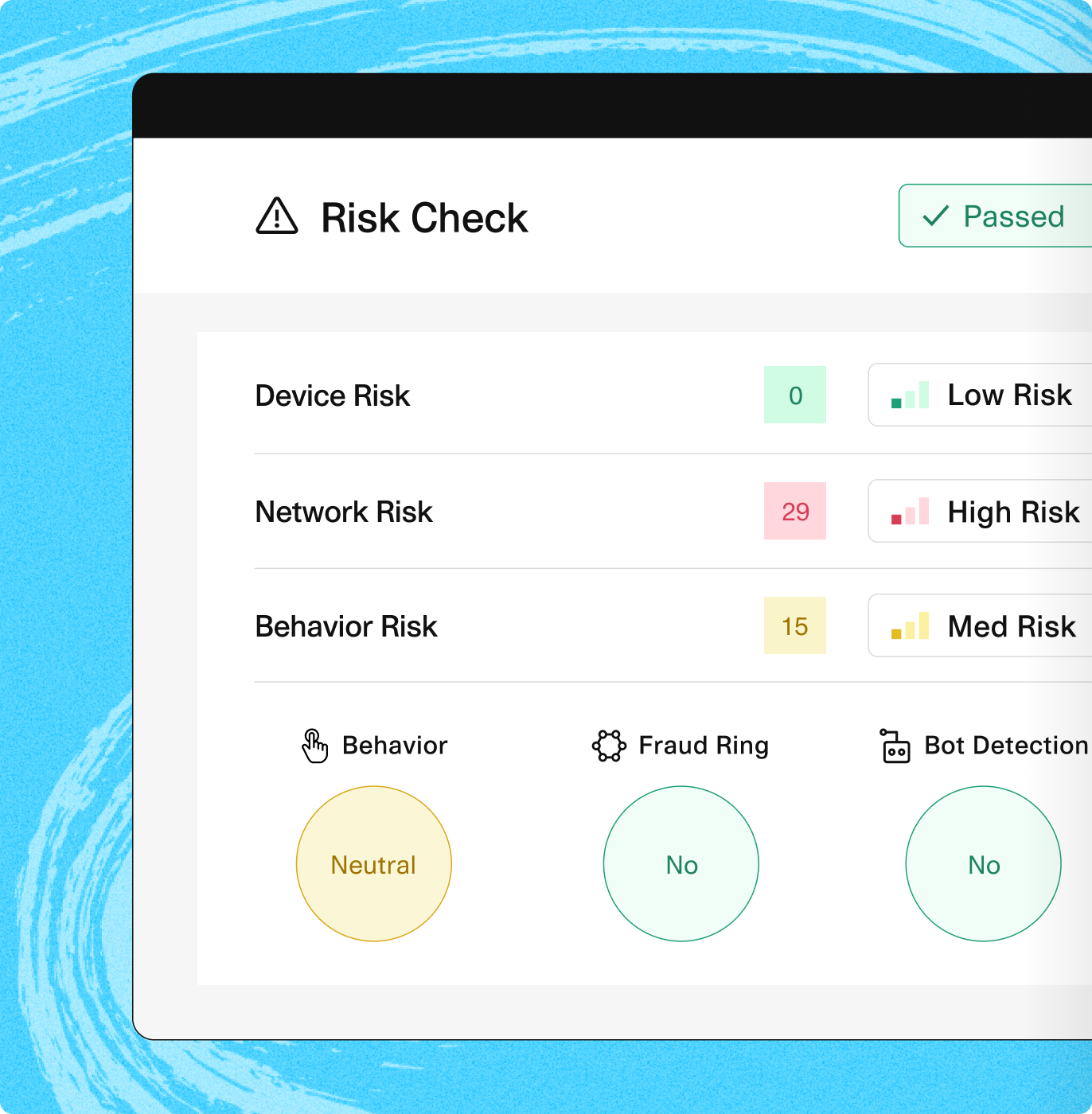

Early detection

Verify good customers and stop bad ones in seconds. Go beyond basic KYC compliance and analyze hundreds of risk signals to prevent identity theft, synthetic ID fraud, and account takeovers with Identity Verification and Monitor.

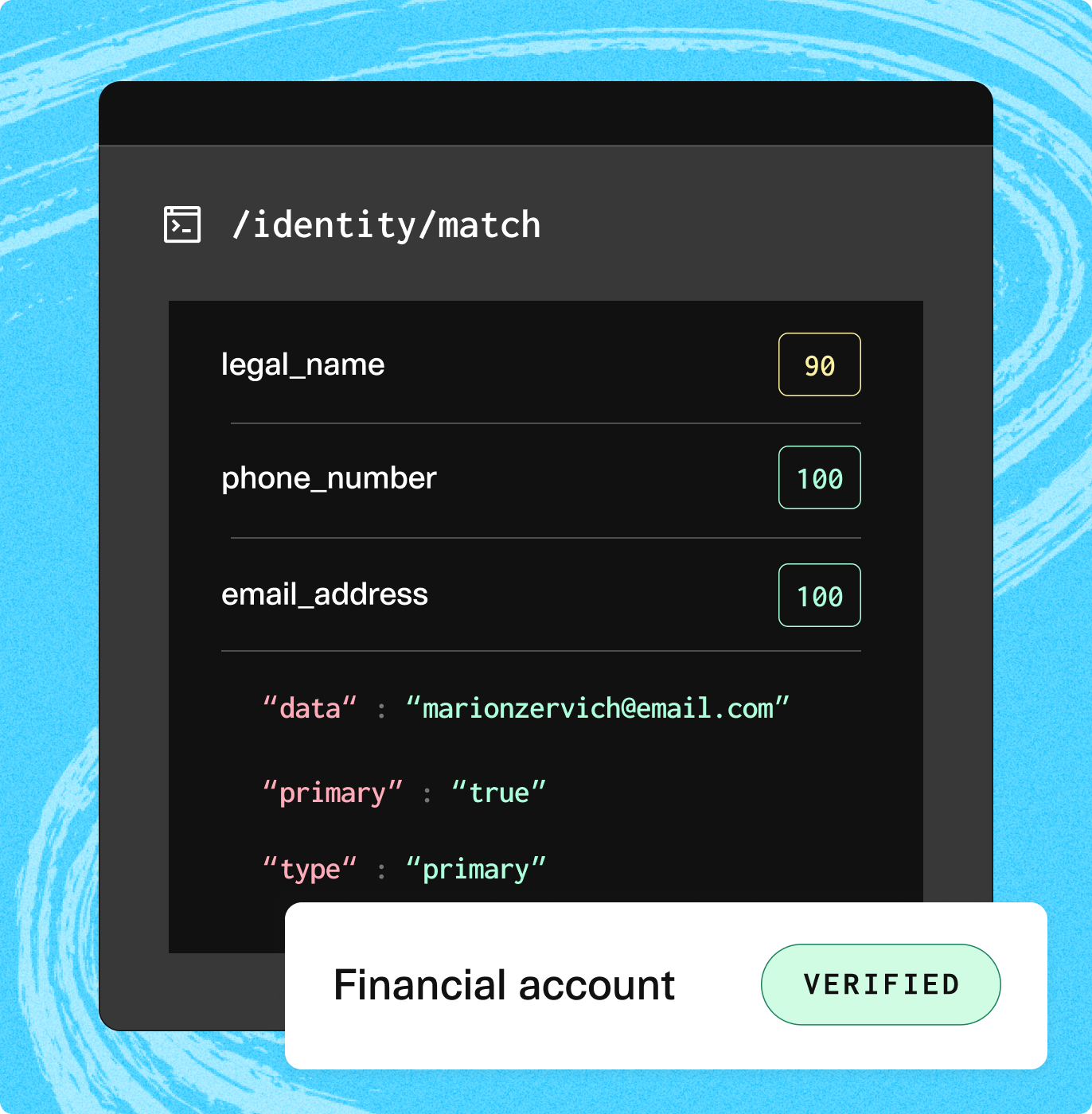

Instant verification

Prevent account takeovers during onboarding or when the source of funds is switched. With Identity, you can verify bank account details to confirm source of funds or understand payer and payee risk.

Ongoing monitoring

Create dynamic payments flows, with less risk. Use Signal’s machine learning to generate real-time, connected insights at scale so you can determine the risk of fraud and prevent returns during each ACH transaction.

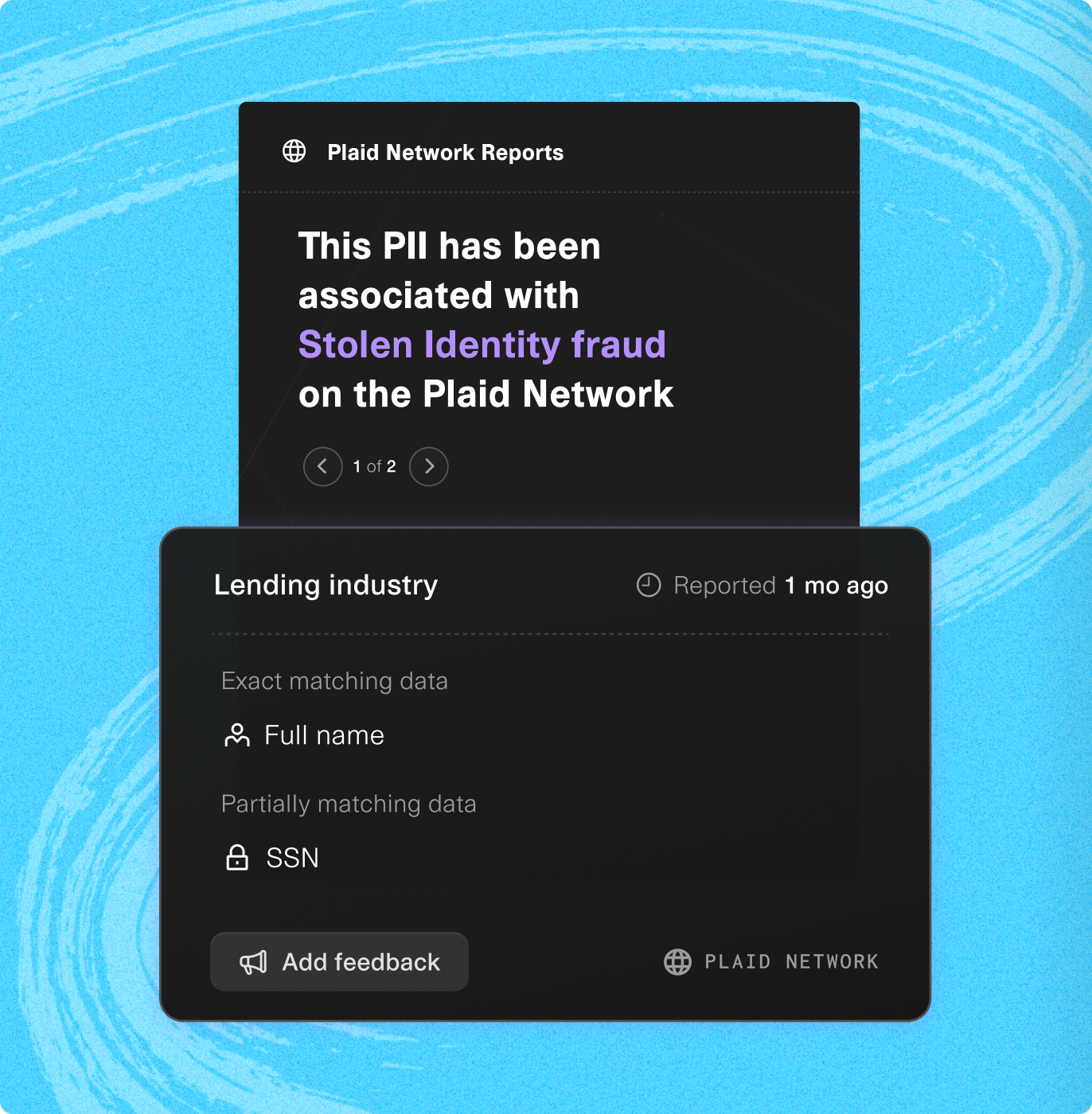

Network insights

Prevent fraud from spreading across the ecosystem. Get notified each time a customer's identity is associated with fraud anywhere in the Plaid Beacon Network.

Why Plaid

Connect to billions of insights for an easier, more secure in-app experience

Get the latest insights you need

to level up your risk program

Learn moreYou'd be in good company

See who’s fighting fraud

with the Plaid Network

Uphold improved the customer experience and reduced return losses by 80%.

Since switching to Plaid, Varo Bank reported a 50% decrease in fraudulent returns.

Zip used Plaid to lower the time spent reviewing alerts by nearly 80%.

Since switching to Plaid, Stash saw a 19% jump in customers funding their accounts.

Build your anti-fraud and

compliance solution today