Customer: Paysend

Powering more transactions with open banking

How Open Banking Helped Paysend Boost Transaction Volume by 125% in One Year

Paysend’s global payment ecosystem simplifies international money transfers, effortlessly connecting users across 170 countries with a simple, fixed-fee service.

But despite a strong mission and growing user base, Paysend had a problem on its hands. "Customers couldn’t use their bank accounts to top up the Paysend app. This was a huge source of frustration, delaying account verification and money transfers”, comments Ronnie Millar, CEO of Paysend.

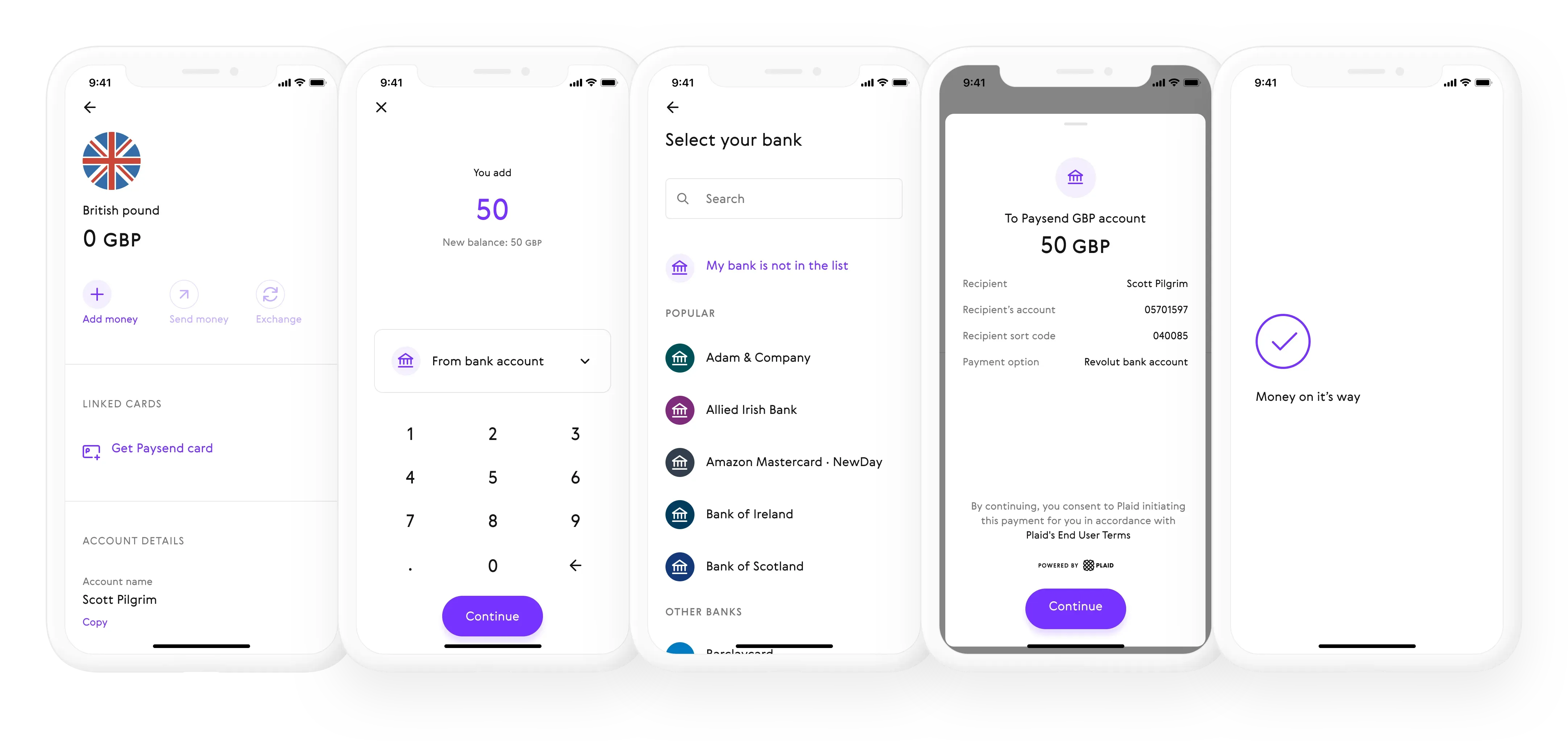

Paysend decided to integrate Payment Initiation through Plaid to make account top-ups quicker and easier for customers. This transformed their customer experience, helping them process 125% more transactions in the UK with up to a 94% success rate.

Here’s how Paysend leveraged open banking to unlock greater transaction volume and customer satisfaction.

Transforming the Customer Experience

Keen to let customers top up from their bank accounts, Paysend partnered with Plaid to allow customers to make instant bank transfers.

“Plaid was the obvious choice. It has extensive coverage with nearly all banks across the UK and EU, a great funding success rate, and a reputation for security”. states James Cresswell, Head of International Schemes and Strategic Partnerships.

Integrating Plaid into Paysend's system was a smooth process from start to finish. Paysend received clear guides, access to forums, and direct help from Plaid's team. This made it easy to handle any issues and ensured a quick, straightforward integration. “We were amazed at how easy it was to get started”, commented Sergey Raskin, Head of Projects.

The Results: A 125% Increase in Transactions (And Happier Customers)

Once Paysend was up and running with Payment Initiation, customers could top up their accounts in just a few clicks. No more having to manually enter bank account details —and no more delays.

Transaction Volume and Growth

Paysend’s decision to integrate with Plaid reduced the friction in setting up and executing international money transfers. In turn, this led to an increase in transaction volume on the Paysend app. By enabling customers to more easily top up accounts, Paysend unlocked a 125% increase in transaction volumes since their launch with Plaid in early 2023.

Customer Satisfaction and Security

Paysend’s transaction acceptance rates averaged around 91 - 94% throughout the year since integrating with Plaid. This transformed customer satisfaction, plummeting customer complaints and queries to Paysend’s support team.

“Our support team has definitely noticed a decrease in complaints”, adds Wanyu Lo, Global Head of Consumer Marketing. “We’re conducting NPS efforts in Q2 of this year and we strongly believe we’ll see drastic improvements compared to last time around.”

EU Expansion is next for Paysend

Post a successful UK launch, Paysend is expanding the integration across the EU. It’s currently testing Plaid for payments in France, Spain, and Ireland.

“We’re delighted to see Paysend’s success with Plaid and open banking. We’re thrilled to be partnering with them on their further EU expansion” Brian Dammier, Head of Europe at Plaid

“We’ve been really impressed by the integration”, comments James Cresswell, Head of International Schemes and Strategic Partnerships. “We couldn’t recommend Plaid highly enough to other companies considering adopting open banking”.

Looking to improve your customers’ payment journeys? Get in touch to begin your journey.